Seiya Tabuchi/iStock via Getty Images

The best positioned sector

Triple net has historically been viewed as a REIT subsector that provides steady, predictable dividend income. That remains true today, but it now has a rather impressive capital gains opportunity layered on top due to the following factors:

- Enhanced forward organic growth

- Enhanced forward external growth

- Advantaged position with regard to insurance and property taxes

- Substantial undervaluation

In this article I will dig into the sector fundamentals to show why I believe it is the best positioned among the 20 distinct REIT property sectors. I will then discuss which triple net REITs are the best positioned within the sector.

Higher forward organic growth

One of the aspects that makes triple net lease REITs so predictable with regard to dividend income is their long lease terms. The typical triple net REIT will sign initial lease terms around 15 to 20 years and ladder their portfolio lease maturities such that at any given point in time the weighted average remaining lease term is roughly in the 7 to 10 year range.

I posit that this is now the key to enhanced forward growth.

Why?

Well, it involves some background information and the concept of market rental rate versus leased rental rate. So when a lease is signed it will generally be at a rent per square foot that approximates market rates at that time. Thus, as a lease ages, the leased rate will stay roughly the same (small escalators) while market rates move around. If market rates drop, the rent payments will be above market and if market rates rise the steady rent payments will be well below market.

The latter has happened to an extreme degree over the past few years. A combination of high inflation, high occupancy, and increased demand for well located properties has caused market rental rates to jump up across the various triple net REIT property types.

- Industrial up 20%-80% depending on location

- Free standing retail up 20%-40%

- Casinos up but amount is harder to determine due to low sample size

- Post office rents up roughly 15% (post offices tend to be double net rather than triple net)

- Medical office rents up 5%-10%

The triple net REITs have largely not been able to capture these gains yet. Organic growth has been anemic as only a very small percentage of leases have been able to be rolled over to the now much higher market rates.

The market has priced in this anemic growth as if it is the actual growth rate as AFFO multiples have dropped across the sector.

I view it more as pent up growth waiting to be unleashed whenever the leases roll. Getting the substantial increase to rental income will not require any special actions and only minimal incremental capex. It merely requires the passage of time. Leases will roll and be renewed or re-tenanted at the current market rate.

Getting big roll-ups will merely require market rates not dropping back down. Perhaps there can be 1 or 2 year drops during a recession, but on a long term basis rental rates generally only go up. There are a few reasons for this:

- Inflation is usually a 1 way train. Even if the Fed manages to get inflation under control and back down to their 2% target it does not reverse previous price increases it merely means prices continue going up but at a 2% pace instead of a 5%-8% pace.

- Development is tied to need for properties and must meet a hurdle rate to get greenlighted. That hurdle rate increases with construction cost, so development will be muted until rental rates go up to justify the development. Thus an equilibrium is formed in which supply growth is contingent on rental rate growth.

- Tighter lending standards: Unlike the previous 2 this factor is unique to the present environment. It has become much harder to get lending for construction which means muted supply growth starting in 2024 and tenants will be more inclined to rent rather than building their own stores/warehouses.

For the above reasons I see a high organic growth rate going forward for the triple net sector.

External growth increased

The zero interest rate environment was stifling growth for triple net REITs as they rely on property acquisitions for external growth. With interest rates so low, cap rates were painfully low which made each purchase less accretive. Since cap rates tend to move with interest rates, albeit with a lag, most sectors have had some cap rate expansion.

I don’t think the enhanced external growth requires all that much explanation. Buying at a 6%-9% cap rate results in significantly more accretion to AFFO/share than buying at a 4%-7% cap rate.

Advantaged position on insurance and property taxes

A while back we wrote about the aggressive increases to property taxes and how significantly the extra cost was affecting certain kinds of real estate. Insurance costs are also increasing rapidly as actuaries take note of an oddly increased prevalence of disasters such as wildfires and hurricanes (or at least the tendency of those disasters to cause property damage).

Triple net, as a sector, is insulated from property taxes. Two of the nets in triple net are property taxes and property insurance. The tenant pays them. The REIT does not.

Ordinarily, this balances out to be no effect. At the time of lease signing the lease payments were set at a level that incorporated the expected insurance/taxes costs. If, for example, those costs were anticipated to be $5 per foot perhaps the rent was signed at $25 per foot instead of $30 per foot.

Historically that works out to be a net neutral, but in this particular cycle both insurance costs and taxes have risen significantly more than anticipated. Thus, the REITs are functionally benefitting the delta between expected which was priced into the lease and the actual.

Deep undervaluation

One of the aspects of finance that I find most interesting is that it is just a big web of qualitative relationships. When one part moves it has reliable implications on each other part. Thus, any piece of news can be distilled into the impacts it should have on market prices. The market adds an extra layer on top of the qualitative web in that there can be deviations between how market prices should move and how they do move.

I believe this deviation has occurred in a massive way in the triple net REIT sector. Specifically, the change in interest rates has been priced in incorrectly.

Moving from near zero Fed Funds rate to around 5% should have the following impacts:

- Higher discount rate (lower multiples)

- Higher interest expense (lower AFFO but no effect on multiples)

- Higher internal growth rate (higher multiples)

- Higher external growth rate (higher multiples)

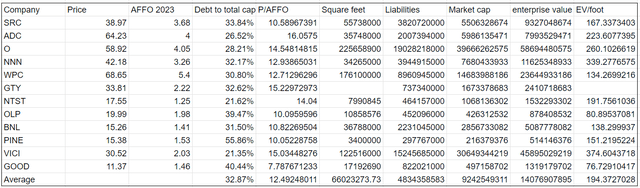

The market seems to have fixated on the first 2 qualitative factors. Multiples have absolutely plummeted across the sector with a now average P/AFFO of 12.49X as measured against expected 2023 AFFO.

2MCAC as of 5/28/23

This is a sector that used to trade at 17X AFFO.

I believe the extreme cheapness is a result of the market simply not accounting for market rental rates and how that impacts future growth.

The market sees the impact of interest rates on interest expense because that hits the income statement immediately.

It is much harder to see the impact of market rents as that will take years to play out. If a given triple net REIT has a 7-10 year weighted average remaining lease term it takes more than a decade for the REIT to fully realize the growth. But it is real and it is a long runway of growth.

It means forward organic growth rates are closer to 4%-7% rather than the 2%-3% they have been in the past. That warrants a higher AFFO multiple, not a lower multiple.

The sector as a whole is far too cheap and I think it will materially outperform both REITs and the S&P.

Best and worst within triple net

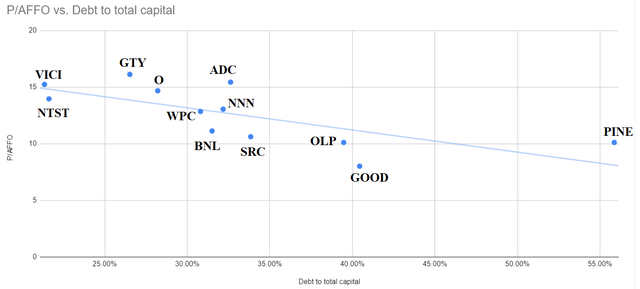

I find plotting multiples against leverage is a great starting point for evaluating the sector. Something like an Alpine Income Property Trust (PINE) might seem cheap at first with a 10X AFFO multiple, but recall that AFFO multiple is not a leverage neutral metric. High debt levels should correspond to lower multiples and indeed they do as per the trendline below.

2MCAC pricing as of 5/28/23

PINE, despite its low multiple is actually a bit overvalued on a relative basis due to having substantially higher leverage than the rest of the sector.

If one wants to play the deep value game, Gladstone Commercial (GOOD) is a better way to go there as it has more moderate leverage and trades at an even lower 7.8X multiple. There is some risk as a portion of its portfolio is office, but that is balanced out by the other roughly 60% being industrial. Within GOOD, I prefer its preferreds as they are deeply discounted to par which results in high current yield as well as substantial capital gains potential.

Among retail focused triple net I like Spirit Realty (SRC) the best. Its properties are almost indistinguishable from those of Realty Income (O) or National Retail (NNN) yet SRC’s multiple is vastly lower. I also think it has superior management as O and NNN seem to just be playing the spread game while SRC is actively creating value through asset selection.

Among the diversified triple nets, I really like both Broadstone Net Lease (BNL) and W. P. Carey (WPC). BNL is strangely cheap at just over 11X given that it has a mostly industrial portfolio. WPC is a bit less cheap at 13X, but it has a phenomenal track record and the ability to originate sale leasebacks which grants it extra basis points of spread over open market buyers. I think each of these 2 stocks is being beaten down by short term tenant issues.

BNL has Carvana (CVNA) exposure which in my opinion will be a bankrupt tenant fairly soon, but I disagree with the market’s assessment that it is a negative. As we have discussed throughout this article, the lease rates are far below market and a default would allow BNL to re-lease the property at the significantly higher market rate. The increased rental revenue more than offsets a temporary interruption. Regardless of whether this is a positive of negative, CVNA is a 1.2% tenant so it bringing the stock down to 11X AFFO is quite the discount for a minor factor.

WPC’s tenant, U-Haul (UHAL), has a purchase option coming up in which they can buy back the properties they lease from WPC. Given the pricing on it UHAL is quite likely to do so and it will result in WPC losing the rental revenue in exchange for a cash infusion. I view this as a minor negative for WPC, but it is negative to the tune of a couple pennies a share in value yet seems to have cratered the stock by dollars per share.

Getty Realty (GTY) is a company I have liked for a long time and used to own, but it is getting a bit overvalued relative to the other triple nets. Convenience stores are an excellent property type as they have corner locations with ample vehicular traffic. As such, I think some sort of premium for GTY is appropriate. I just don’t know that I want to buy it at 15.2X AFFO when the sector average is 12.5X.

Capital appreciation plus dividends = superior total return

As interest rates rose, the market correctly started to demand a higher expected return from equities. The triple net sector felt this correction harder than most because it is incorrectly perceived as a dividend only play and thus the price adjusted to make the dividend yields move in parallel with treasury yields.

In so doing, a rather substantial capital gains potential has formed. These are growth companies, just of the slow and steady nature rather than the exciting type. As such, the total return proposition is not merely the dividend yield, but instead the dividend yield plus the AFFO/share growth rate.

The sector yield is now greater than 5% which along with what I calculate to be a 4%-7% annual growth rate presents a sector level total return of 9% to 12%. The numbers are closer to 10%-15% for some of the more opportunistically priced REITs within the sector.

That level of return is far too high for what is generally viewed as a below average equity risk sector.

I don’t think the risk level has increased. Fundamentals are looking better than in the past. Balance sheets are better and occupancy has remained steady through difficult tests such as the pandemic.

Thus, I think market prices will adjust to bring the sector level expected returns to about 6%-9%. In other words, I think there will be significant near to medium term capital appreciation to get it to that level.

The Catalyst

From a flow of funds perspective, the rising rate environment has really taken a toll on triple net REITs. Those who owned them specifically for income have been flowing out of the sector to lock in 5%+ CDs, or Treasuries with yields almost that high. When the Fed stops hiking, whether that is now, June, or July, that adverse flow will subside.

Even if yields remain high for an extended period of time, the mere cessation of hikes will facilitate price discovery. I think the market will recognize the outsized total return that the sector provides relative to its risk and bid up shares to a more appropriate level. Until then, I have been and will continue to invest more capital into the sector. Triple net has recently become the largest weight in the 2nd Market Capital High Yield Portfolio and I will be opportunistically trading within the sector to optimize the mix of quality and value.