Back in March 2016, buoyed after a Lukaku double had disposed of Chelsea in a rousing 6th Round FA Cup game at Goodison, Farhad Moshiri, talking of his new club, Everton, uttered the following words

“For me I bought into a new family and that’s what is special for me. I give them whatever I have.”

No one, least of all Moshiri, ever expected those words to be a literal description of what was to occur over the following seven years. Yet, almost inconceivably, they appear to have come true.

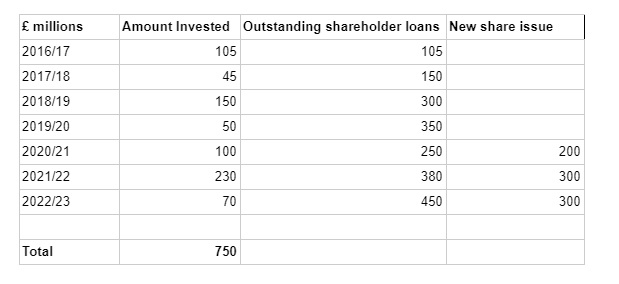

Moshiri has invested £750 million into Everton since acquiring his initial 49.9% stake in February 2016. Massive under-performance on the pitch, failed commercial expansion off the pitch, failure to address the obvious shortcomings of Everton’s board, horrific player and manager recruitment, Covid, the illegal invasion of Ukraine by Putin’s Russia, the loss of USM as principle sponsor and the deterioration of macro economic conditions have all played their part.

Article continues below video content

Moshiri’s investment in Everton through shareholder loans, conversion of loans into equity & new share issue to February 2023 in £millions

The failure to control costs, the failure to grow revenues, the delay in agreeing a design and budget for the new stadium, the reduced, below budget income as a result of failure on the pitch – remember the “project” as it was referred to in the early Koeman days: competing for a Champions League place within three years? – have all added to the amount of funding required by Everton.

Worse, the lack of performance by the board, the apparent poor governance of the club, the failure of Moshiri to address the above, closed off funding from mainstream banks, investors and lenders. Although the club lost the support of the world’s largest commercial bank ICBC, through no fault of their own (ICBC withdrew from UK corporate lending following losses with the House of Fraser) we failed to replace them with a comparable lender, instead relying on the less than prime lender, the mysterious Rights and Media Funding – described internally as “a friend of the club” – yet the provider of debt at higher than standard lending costs from main stream lenders. Significantly, the club failed to convince other lenders, particularly relating to the stadium, to part with their cash, increasing the financial burden on the majority shareholder, Farhad Moshiri.

Farhad Moshiri

By most standards, an incredibly successful and wealthy man. His family fled Iran in February 1979, just before the Iranian Revolution, settling in London. Moshiri studied accounting at the University of London, then worked at Ernst & Young and Pannell Kerr Forster before joining Deloitte & Touche. A mutual friend, Masoud Alikhani, introduced Moshiri to a prominent Russian businessman, Alisher Usmanov when visiting London as part of a “high-level delegation” seeking ways of setting up a political-risk insurance company to encourage foreign investment in the Soviet Union.

They became friends, and in 1993, a UK registered company, Middlesex Holdings, an investment company in which Usmanov was a significant investor, hired Moshiri. Gaining Usmanov’s confidence, Moshiri became a director. The company was, at the time, unique in being London listed but with Russian shareholders. It acquired a significant number of Russian assets including steel mills (the precursor to Metalloinvest). Middlesex was eventually sold, but the Moshiri – Usmanov relationship continued in a company called Gallagher (one time significant shareholder in UK’s Corus Steel).

Moshiri also represented Usmanov’s interests in many other companies, including names familiar to Evertonians such as Megafon.

Their love of football resulted in Red & White Holdings, a company owned by Usmanov and Moshiri, which although eventually acquiring 30.04% of Arsenal failed to win total control, Stan Kroenke becoming the majority (and ultimately outright owner). Red & White Holdings was chaired by former Arsenal Vice Chairman, David Dein, who having had his own falling out with the Arsenal board sought to expand Usmanov’s influence and ultimately failed. Dein was a great friend of Bill Kenwright and played an important part in convincing Moshiri to pursue his own footballing ambitions in acquiring a major stake in Everton.

Away from football, Moshiri carried a 10% stake described as being part of an executive reward programme in Usmanov’s holding companies, resulting in Moshiri becoming chairman and a 10% shareholder in USM, the BVI registered holding company for most of Usmanov’s portfolio companies. It is from this shareholding that most of his net worth is derived. However it should be noted that Moshiri sold his Red & White Holdings stake for £200 million and held other investments beyond his USM stake.

Investing in Everton

Moshiri paid existing Everton shareholders, Kenwright, Woods, Earl and Abercrombie a total sum of £87.5 million to acquire 49.9% of Everton in February 2016. Subsequent purchases including the shares of Lord Grantchester, took his total expenditure on acquiring existing Everton shares to approximately £130 million.

When he bought into Everton the club had a net debt position of approximately £54 million, including the long term Bear Stearns/Prudential loan signed in 2002 – a loan of £30 million repayable over 25 years at a shade over 7%.

In his first three years Moshiri provided loans of £300 million, paying off the existing debt and providing working capital for player purchases and an enormous increase in player wages. As a result of poor recruitment, a failure to build on a single year of European qualification in year 2, Moshiri’s funding after the first three years had a new focus – covering losses. Aside from profitable player sales (Stones, Lukaku, Barkley for example) the business was significantly cash flow negative and required his continued funding. We also had third party debt provision, firstly through ICBC and Santander, then Rights and Media Funding.

In addition, USM had become a major contributor, contributing sponsorship payments which rose to £20 million a year, and of course the single option payment of £30 million for the naming rights on Everton’s future ground at Bramley-Moore dock.

Bramley-Moore Dock

Bramley-Moore Dock became a reality, from the original St Luke’s church presentations by US architect Dan Meis, through an extensive consultation process and finally a successful planning application, Everton acquired a 200 year lease from Peel Holdings and set about the process of converting a 19th century dock into a modern football stadium, all at an estimated cost of £500 million.

The startling issue with Bramley-Moore is that despite literally rising from the docks, the whole stadium project has never been fully funded. Initially there was great excitement over the possibility of a local council engineered loan providing competitively priced funding and an interest margin that would provide the council with additional income of circa £7m a year. Political, practical and legal difficulties put paid to this scheme, and we were left with an initial plan of raising funding from the private placement market (as Tottenham Hotspur had), a capital contribution from the naming rights partner, USM and the remaining costs to be under-written by Farhad Moshiri.

However, raising money from the capital markets has proved elusive and has done so since 2018 – a combination of a poor financial performance and one assumes, a lack of faith in the Everton board and business plan, plus other factors outside Everton’s control, namely Covid, a changing economic picture and then the invasion of Ukraine made this funding impossible. However I would stress that there should have been few reasons for backers not to fund the development in the very early years other than concerns over the management of Everton. It’s not with hindsight that we should consider it a missed opportunity to not find funding before the larger macro events added to our difficulties.

The illegal invasion of Ukraine

The invasion of Ukraine in February 2022, compounded matters hugely for Farhad Moshiri. Prior to the invasion, it is believed Moshiri reduced his stake in USM to 4% (from 8%) increasing his liquidity. The invasion made Russia related individuals, oligarchs and their companies immediately toxic, even before the imposition of sanctions by the UK, EU and US Governments. Everton rightly, before Usmanov (49% shareholder) was sanctioned, suspended their commercial relationships with USM. Furthermore, Moshiri resigned as Chairman of USM and cut links with his benefactor and friend. One of the three legs of the Bramley-Moore funding stool had disappeared for good and seriously damaged the two remaining options

At the same time, in the absence of a naming rights partner, a stadium specific funder, faced with continued losses within the football club, Moshiri had to fund Everton’s working capital requirements and the mounting bills for the stadium – all against a background of a football club failing on the pitch and facing potential relegation.

Where we are now

In the period, June 2021 and February 2022, Moshiri provided another £300 million of funding, bringing his total funding to £750 million.

In addition, Everton sold two players in Richarlison and Gordon for approximately £100 million, the January 2023 sale of Gordon and no subsequent spending is particularly telling. Additionally, third party funding has increased significantly. Rights and Media funding increased their facility to £150 million at the time of the accounts being signed off in February 2023. I have it on very good authority that the facility has been extended further and now sits at £200 million.

The total cost of the Bramley-Moore development is put at £760 million. A figure provided by Farhad Moshiri himself. Based on the last available accounts and the funds provided by Moshiri/Rights and Media Funding it’s reasonable to assume that up to £300 million is yet to be found to complete the stadium development.

In summary, we have a majority investor who has provided £750 million of funding (far in excess of his original estimates). We have £225 million of external debt (including the Covid facility from Metro Bank). We have to find perhaps £300 million to complete the stadium. In the absence of player sales we are still running at a loss (albeit that is improving over time)

It seems that Moshiri has been true to his word – he has given the club whatever he had, hence the need to sell. By selling he crystalises an enormous loss, as no new owner will pay much given its condition, but he relieves himself of the still future funding requirements of the business, a requirement which perhaps he cannot or wishes not to meet himself.

The new owners, be they 777 or others will pick up a club in desperate need of re-capitalisation, a reduction in debt and new working capital for future expenditure. Above all else, it will need to provide management and expertise to enable recovery, take us from the brink, get us moving forwards not backwards, and perhaps eventually make us competitive once more.

The Moshiri years have been an abject lesson in corporate failure by owner and board alike, not helped by external global affairs, but that doesn’t alter the fact that Moshiri has brought this upon himself, and unfortunately upon the club we all love and only wish the best for.

The campaign to remove the owner and board will succeed in the very near future, largely driven by the events described above. We must make sure that a future owner can never put us in this position again.

Reader Comments (6)

Note: the following content is not moderated or vetted by the site owners at the time of submission. Comments are the responsibility of the poster. Disclaimer ()

Chris Leyland

2 Posted

13/05/2023 at

23:00:18

Colin, hopefully youve just smashed your telly after that dirge theyve just played. They infest everything.

Colin Glassar

3 Posted

13/05/2023 at

23:03:58

Chris, it follows you around everywhere like a bad smell.

Brent Stephens

4 Posted

13/05/2023 at

23:08:49

A depressing read, with not a note of optimism in sight.

Mark Murphy

5 Posted

13/05/2023 at

23:35:52

My wife just went loopy cos I muted the sound and threw the batteries out the remote.

Barry Rathbone

6 Posted

14/05/2023 at

00:50:18

Whether it’s puppet master Usmanov slithering further into the shadows or Moshiri simply not wanting to throw any more dough down the shute the money required has dried up. Add in the the financial albatross of the new build and we’re dead in the water (see what I did there?).

If he doesn’t sell to some real money we are well on the way to Leeds under Ridsdale territory. Can’t believe him NOT selling has been considered by anyone.

How to get rid of these ads and support TW

© ToffeeWeb

Colin Glassar

1 Posted

13/05/2023 at

22:56:24

Ill read this after the Eurovision Song Contest finishes. Just want Moshiri gone.