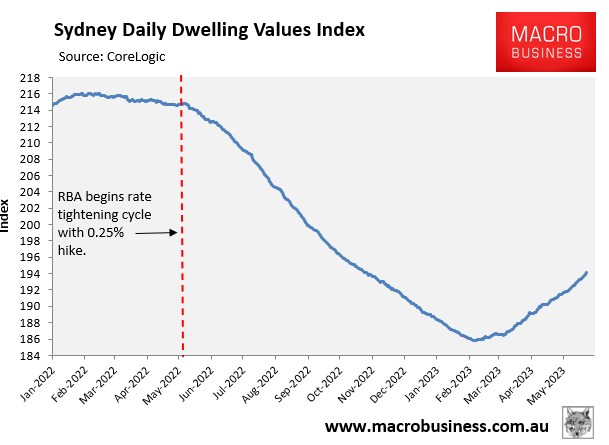

Sydney’s house price rebound continues to gain momentum, with CoreLogic’s daily dwelling values index now up 4.5% from its 7 February low:

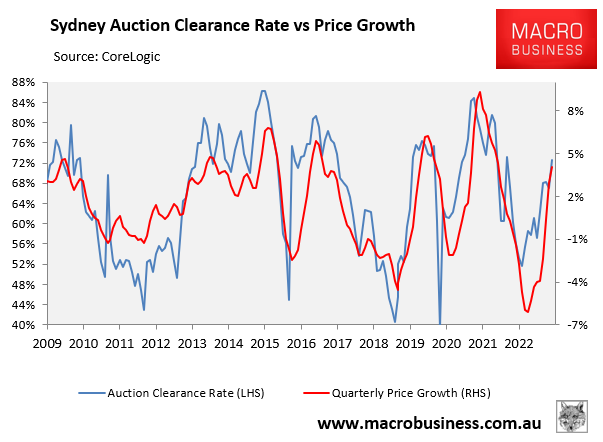

Sydney last week also recorded its highest final auction clearance rate (73%) since February 2022:

Advertisement

Analysts are now warning that Sydney house prices could rise by 10% this calendar year.

“The way things are going, we could end up with a 10% rise in house prices this year”, AMP Capital’s chief economist Shane Oliver said.

“Sydney prices have accelerated this month, so there’s probably an element of FOMO in there, particularly those who are less affected by the rate hikes”.

Advertisement

“The tightness in the for-sale and rental markets, combined with the pickup in house prices seem to be bringing buyers out of the woodwork”.

“The shortage of supply has swamped the negative impact of higher interest rates”, Oliver said.

Oliver’s view was backed-up by Andrew Wilson, the chief economist at My Housing Market.

Wilson also believes Sydney house prices will grow by double-digits this year.

Advertisement

“I think a 10% increase is possible, given that we’re on the verge of an 80% auction clearance right now, which is quite remarkable”, Wilson said.

“I think a lot of it is that buyers are realising home values are still lower than they were a year ago, but are now rising again”.

Meanwhile, selling agent Thomas McGlynn of BresicWhitney believes Sydney value growth was likely stronger than CoreLogic is reporting.

Advertisement

“Most sectors of the market are now actually performing quite strongly, even smaller apartments, so I think the price increases are not being reflected in the data yet”, McGlynn said.

“I think once the recent strong sales have flowed through, they’d show even stronger results”.

The unprecedented surge in net overseas migration has lifted housing demand at a time when rental vacancies are at an all-time low and overall for sale listings levels are subdued.

Advertisement

Meanwhile, Chinese buyers are back in force which, given the dearth in listings, is having a larger-than-usual impact on Sydney prices.

The only thing keeping prices in check is the substantial drop in borrowing capacity caused by the RBA’s 3.75% of interest rate hikes.

When the RBA begins its rate-cutting cycle, borrowing capacity will increase, and Sydney house prices will skyrocket.

Advertisement