Brazilian state-owned oil and gas giant Petrobras has wrapped up the sale of its interest in a cluster, encompassing a set of 22 concessions of onshore and shallow water fields. As a result, 3R Petroleum Óleo e Gás’ subsidiary, 3R Potiguar (3R), has taken over the operatorship role for this cluster.

Back in January 2022, it was disclosed that Petrobras’ board of directors had approved the sale of its total stake (100 per cent) in a set of 22 concessions of onshore and shallow water fields with integrated facilities in the Potiguar Basin, in the state of Rio Grande do Norte, to 3R Potiguar, a wholly-owned subsidiary of 3R Petroleum. These assets are jointly called the Potiguar cluster.

The sale includes the cluster’s infrastructure for processing, refining, logistics, storage, transportation and outflow of oil and natural gas. When May 2023 rolled in, IBAMA issued the operational license in favour of 3R Potiguar for the Ubarana, Ubarana Oeste, and Cioba fields, which are part of the Potiguar cluster. This license was a precedent condition for the closing of the transaction.

In an update on Wednesday, 7 June 2023, Petrobras confirmed that the National Agency of Petroleum, Natural Gas and Biofuels (ANP) had approved the transfer of its entire stake in the Potiguar Cluster to 3R Potiguar. This was concluded with the upfront payment of $1.1 billion to Petrobras, with the adjustments foreseen in the contract. The amount received is in addition to the $110.0 million paid to the Brazilian state-owned player when the contract was signed on 31 January 2022.

In addition to this, Petrobras is expected to receive $235.0 million, which will be paid in four annual instalments of $58.75 million, starting in March 2024. With the conclusion of this sale, 3R assumes the operator role of the Potiguar Cluster fields and other production infrastructure.

“The Potiguar Cluster accounts for less than 1 per cent of the total oil production of Petrobras, which will continue in Rio Grande do Norte investing in projects with great potential for future growth, such as the exploration of the Equatorial Margin in the Potiguar Basin (where the company holds stakes in 5 exploration blocks and has the commitment to drill the well to delimit the Pitu discovery) and the evaluation of offshore wind farm projects, such as Colibri, in partnership with Equinor,” explained the Brazilian giant.

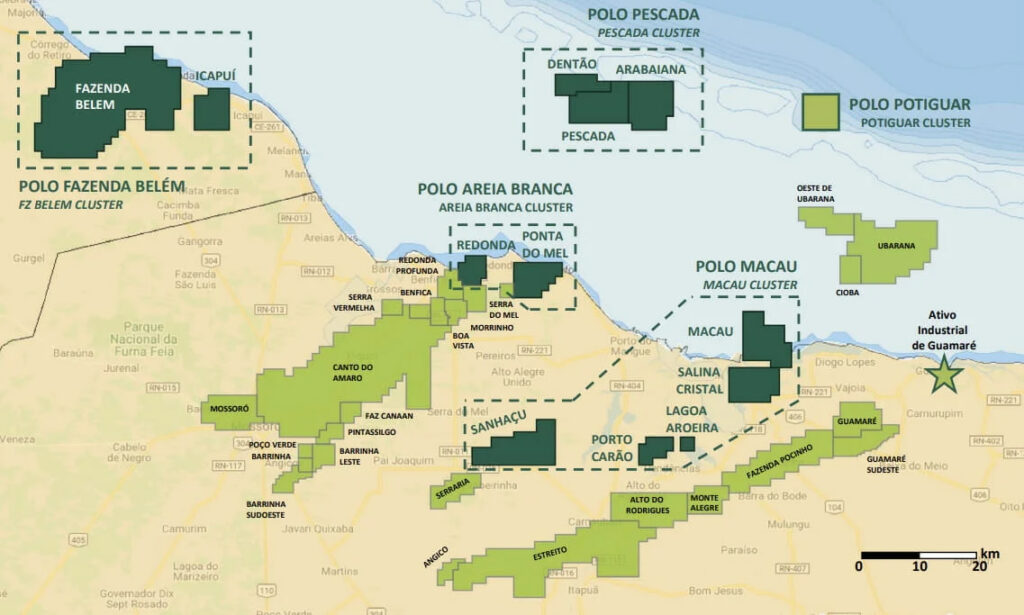

The Potiguar Cluster comprises three subclusters – Canto do Amaro, Alto do Rodrigues, and Ubarana – totalling 20 concessions, of which 3 are offshore concessions and 17 are onshore concessions located in Rio Grande do Norte. The Ubarana subcluster concessions are situated in shallow waters, between 10 and 22 km off the coast of the municipality of Guamaré-RN. The other concessions of the Canto do Amaro and Alto do Rodrigues subclusters are onshore.

Furthermore, the average production of the Potiguar Cluster in 2023 was 16.5 thousand barrels of oil per day (bpd) and 37.3 thousand m³/day of natural gas. Aside from the concessions and their production facilities, the Guamaré Industrial Assets are included in the transaction. This entails the oil treatment plant, natural gas processing units, the jet fuel and diesel unit, and the Guamaré Waterway Terminal.

In a separate statement, c3Ronfirmed that it would take over the operatorship role for the Potiguar Cluster from 8 June 2023. According to the company, the cluster logistics are optimised by integrating the production fields with an extensive network of pipelines that transport the fluids produced to the processing and tanking facilities located at the Industrial Asset of Guamaré (IAG).

3R points out that the IAG brings together all the necessary infrastructure for processing, refining, logistics and the storage of oil and gas from all onshore and offshore fields in the State of Rio Grande do Norte, including those previously acquired by the firm – Macau, Areia Branca and Pescada clusters – and fields operated by other companies in the sector.

Moreover, the Potiguar cluster will bring commercial flexibility to all of 3R’s production from the concessions located in Rio Grande do Norte. Regarding oil, the firm now has independent access to the international market, being able to export it via the Guamaré Waterway Terminal and/or refine it at Clara Camarão Refinery, supplying local distributors. When it comes to gas, the company has access to a new portfolio of customers located on the Brazilian coast, with its own processing and compression capacity.

“This acquisition represents a milestone in the history and construction of 3R’s portfolio. The asset substantially expands the scale of production and capacity to replace and increase reserves in the coming years, positioning the company as one of the main players in the oil and gas industry in Latin America,” highlighted 3R.