WARWICK – With the Federal Reserve scheduled to next meet on June 14 to set the short-term interest rate, Sen. Sheldon Whitehouse, D-R.I., on Monday warned additional rate hikes could put the economy in “jeopardy” during The Greater Providence Chamber of Commerce 2023 Congressional Breakfast at the Crowne Plaza Providence-Warwick.

“There is a significant downside to these interest rates hikes” putting pressure on commercial enterprises, said Whitehouse.

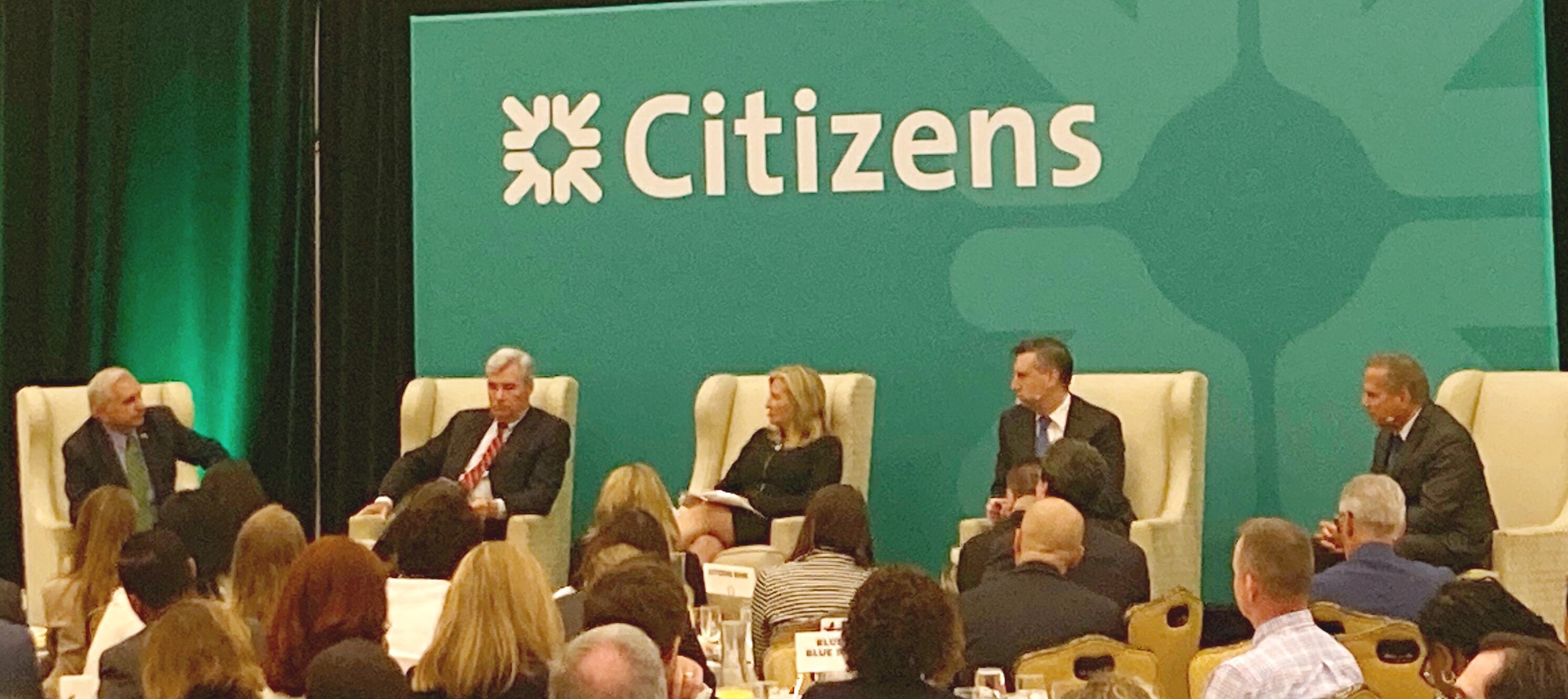

Other panelists, who included U.S. Sen. Jack Reed, D-R.I., U.S. Rep. Seth Magaziner, D-R.I., and former U.S. Rep. David Cicilline and Whitehouse, remained hopeful the Federal Reserve would not raise interest rates for the first time in more than a year.

Magaziner said he has supported past rate hikes but hoped an easing was in store. The consumer price index exceeded 5% over the past twelve months.

“It’s hard for people living on the margins,” he said, adding that Congress needs to find the “root causes,” such as the sticky labor shortage. The first-term representative suggested increasing immigration to supplement labor for struggling industries.

“We have a shortage of workers in this country now. And that has [hampered] the ability of industry to supply goods … and contributing to cost increases,” Magaziner said. “Every industry that we talk to is looking for workers.”

Moderated by Chamber President Laurie White and sponsored by Citizens Bank, Monday’s wide-ranging conversation also touched on hot button issues such as inflation, the war in Ukraine, banking oversight, and the effects of social media and artificial intelligence on local and national business and politics.

The delegation reiterated American support for Ukraine in its war with Russia while acknowledging the blow the geopolitical conflict has had on international supply chains.

Reed asserted that much of the supply-chain bottlenecks have been “healed,” but with the 500-day anniversary of the war about a month away, Reed said Ukraine remains in “a very difficult fight” against a “poorly trained” Russian army.

On the health of the banking sector, Magaziner said one of the “fixes” is to diminish the concentration of risk, while Reed suggested more “stress tests” by the central bank on financial institutions.

The failure of three regional banks back in March – most notably the collapse of Silicon Valley Bank – was not only a result of mismanagement, but of digital contagion via social media platforms, the panelists said.

“[SVB] only had three branches,” said Reed. “The subsequent bank run was partly a result of misinformation being shared widely online without correction.”

The panel all agreed more governmental oversight may be needed in the banking sector, as well as over information sharing that exploits rifts in the populace.

Magaziner worried “a foreign actor could engineer a [future] panic on social media.”

But more traditional oversight may also be needed, such as increasing capital requirements. “There is a conversation to be had about how we manage the risk profiles of deposits at banks,” he said.

Reed said he is confident in the soundness of the banking system but warned of the massive refinancing on deck for commercial real estate. According to the Mortgage Bankers’ Association, close to 25% of mortgages on office buildings will need to be refinanced this year.

“That is going to be a challenge,” said Reed.

In Rhode Island, a “bellwether” test for the commercial sector and that will be the fate of the Industrial Trust Building in downtown Providence and the fledgling soccer stadium project in Pawtucket, said Whitehouse.

If these projects fail, he said, “it’s also a signal of where other projects might go when the financing and supply chain issues make what had been a viable project no longer viable.”

However, commercial vacancy rates in Providence remain strong, said Magaziner, who said he remains “bullish on downtowns in the long run.”

No political discussion would be complete without mentioning the exponential growth of artificial intelligence capabilities. Magaziner said AI “could be a positive power for good in our society,” but “in the wrong hands, it can be used to do incredibly dangerous things.”

Reed said Congress will be ramping up its AI discussions, focusing on whether the technology needs to be reined in.

“We have been shocked into action,” he said. “But this has to be a worldwide endeavor.”

Cicilline joined his former congressional colleagues on stage toward the conclusion of the forum. He spoke about the importance of environmental protection and the state’s effort to shore up the Blue Economy, saying the Rhode Island Foundation, the nonprofit he now heads, will be playing an increased role.

“We are the Ocean State for a reason,” he said.

But the historic investments being made in renewable energy will cause proportional “blowback” from fossil fuel industry groups and dark money elements fearful of hits to their wallets, said Whitehouse.

The pushback has already begun, he said, and it “has all the earmarks of a Broadway play.”

Christopher Allen is a PBN staff writer. You may contact him at [email protected].