pixelfit

Peapack-Gladstone (NASDAQ:PGC) ended Q1 2023 with revenue of $64.85 million beating Wall Street estimates by $998,000. While the quarterly revenue represented an increase of 15.44% (YoY), the EPS of $1.11 missed estimates by $0.01. Focus on banks and wealth management firms is crucial at this point even as the US President ratified the debt ceiling bill to law averting debt default.

Thesis

Despite dropping 19.79% (YoY) and the share price trading 35.9% below the 52-week high Peapack-Gladstone’s management believes that there will be modest loan growth in 2023. The company has managed to build a formidable middle-market commercial franchise. Total commercial & industrial (C&I) loans and leases as of Q1 2023 stood at $2.3 billion representing 42% of the group’s total loan portfolio. PGC is also advancing its services in treasury management, and corporate advisory together with small business administration (SBA). To top it up, the company is looking at expanding its life insurance premium finance (LIPF) business as a profitable venture in line with its core strategy.

Not so rosy quarter

Data from the Federal Deposit Insurance Corporation (FDIC) revealed that Q1 2023 saw the total loan and lease balances declined by 0.1% (QoQ) or $14.6 billion. As the receiver, the FDIC recorded a seasonal decline in loans transferred and a 2.6% (QoQ) reduction in credit card loan balances translating to $26.6 billion across the US banking industry. The corporation noted that there would have been a 0.4% (QoQ) loan growth in the quarter if the loans had not been transferred from the banking system to the FDIC.

That said, Peapack-Gladstone’s deposits gained 8% (YoY) or by $104 million to $5.3 billion in Q1 2023. The company also marked a rising liquidity level with investments and cash growing to $851 million, representing 13% of its asset base. Cash balances were up by $61 million in the quarter despite the net interest income declining by $4.1 million. PGC’s management is optimistic that it will continue to grow its deposits, loans, and capital throughout the year despite global headwinds. Among its proposals is to approach clients with considerable deposits that are uninsured and integrate them into fully insured FDIC products.

While announcing the Q1 2023 results, Peapack-Gladstone’s CEO Douglas Kennedy stated,

Although we did see minimal outflows associated with clients concerned about deposit insurance, our team actively engaged with many of our deposit customers during the first quarter to discuss any concerns and provide peace of mind regarding the safety and soundness of our institution. Additionally, we migrated $63 million of uninsured deposits into fully-insured FDIC products for those customers that desired that type of protection.”

Of special note is that the company’s demand, savings, and money-market account comprised 92% of its deposits with the non-interest deposits taking up 21% of its total deposit level. I believe this strategy is pragmatic with the decision tied towards active management of the deposit base while lowering the company’s reliance on wholesale funding. In my view, the overall net effect also involves lowering the risks of volatility and market operation. This assertion can also be understood with the fact that PGC is considering expanding into the life insurance premium business in the coming years.

Future expansion

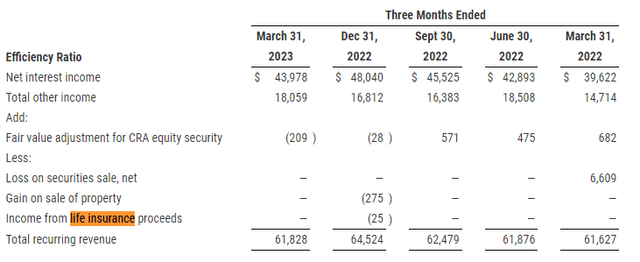

PGC recorded zero income from life insurance proceeds in the three months that ended on March 31, 2023.

Peapack-Gladstone Financial

In the quarter ending on December 31, 2022, PGC realized a loss of $25 million from life insurance and had not recorded any proceeds before. As seen above, the expansion into the Life insurance premium finance business will be a turning point in the company’s profitability level.

This line of business is suitable for PGC since it was established to provide innovative wealth management solutions to clients. This program happens alongside residential lending and other commercial/ retail services both offline and online that has seen PGC’s clientele expand to include private businesses, individuals, families, and not-for-profit organizations among others. The life insurance premium business is run on the premise of integrating a borrowing scheme into a client’s estate plans. This scheme does not only protect a client’s heirs but also the financial position. A liquidity crisis may occur forcing estate executors to pay hefty taxes such as death taxes leading them to sell/ forfeit or part with the inheritance to cover such expenses.

In essence, by offering life insurance premium financing PGC will help clients avoid asset liquidation by covering estate taxes and ensure continuity of the investment or business portfolio. A company such as Wintrust Financial Corporation (WTFC) recorded a 10% (YoY) increase in its life insurance loans (receivables) in Q1 2023 to $8.125 billion. It emerged top among the niche loans in Q1 2023 taking up about 20.5% of the total loans recorded in the quarter.

Peapack-Gladstone is also looking to expand its core wealth management portfolio in line with its commercial banking businesses. In Q1 2023, PGC’s commercial & industrial (C&I) lending balance comprised 42% of the total loan portfolio that stood at $5.4 billion. The company has maintained this proportion since Q4 2022 when total loans stood at $5.3 billion.

Risks to Consider

Fluctuating interest rates may hurt PGC’s life insurance premium business. Market volatility may also increase the company’s operational risk and prevent proper delivery. Additionally, inadequate client awareness may lead to collateral shortfalls that in turn may bring about the possibility of a margin call.

PGC’s 4-year average dividend yield of 0.71% is 76.50% below the industry average of 3.14%. Still, the cash dividend of $0.05 which was payable on May 22, 2023, indicated a 24.88% (TTM) growth in the yield.

Valuation

PGC has a market cap of $501.76 million against a price-to-earnings (TTM) ratio of 6.54X. The forward P/E ratio stands at 7.35X while the company’s earnings have maintained a 5-year average of 26.2%. In my view, PGC is slightly undervalued and has the potential to rise above 200% over the next 5 years.

Bottom Line

Peapack-Gladstone is trading under $30 and presents a unique buying opportunity based on its growth potential. The company intends to expand its wealth management segment and incorporate the life insurance premium business, a segment it is yet to leverage. IN Q1 2023 it recorded an increase in deposits, loans and capital. Still, the company will have to weather the interest rate fluctuation risk that has affected the banking/ insurance industry. We will also wait to see if the company takes up the expansion challenge and the modalities it proposes. I recommend a hold rating for the stock.