statu-nascendi

Welcome to the nickel miners news for May.

The past month saw some impact of lower nickel prices on the producers. Meanwhile the nickel juniors are progressing very well with plenty of good news.

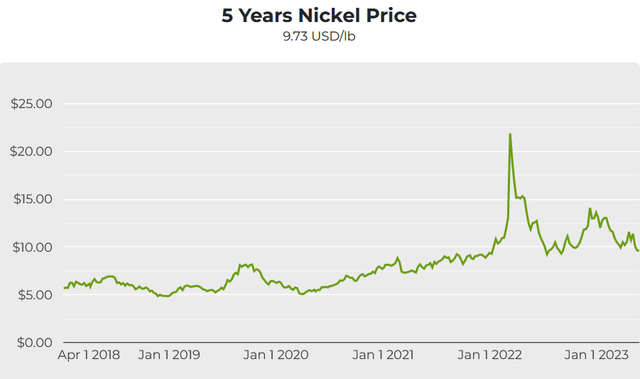

Nickel price news

As of May 31, the nickel spot price was USD 9.73, significantly lower than USD 10.73 last month. LME shows the price at USD 21,215/tonne. Nickel inventory at the London Metals Exchange [LME] was lower the past month at 38,172 tonnes (39,918 tonnes last month).

Nickel spot price 5 year chart – Current price = USD 9.73/lb

Mining.com

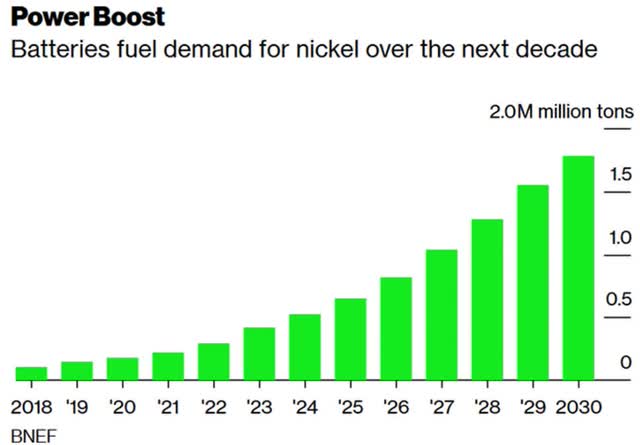

Nickel demand v supply chart

BloombergNEF forecasts ‘battery’ nickel demand set to surge over ten fold this decade as the EV boom takes off (2020 chart)

BloombergNEF

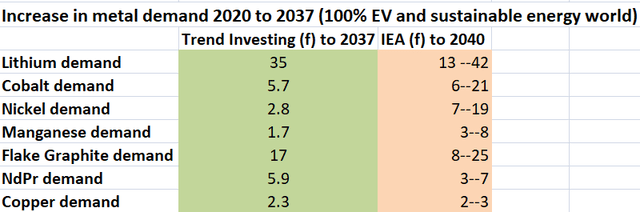

Trend Investing v IEA demand forecast for EV metals (Trend Investing) (IEA)

Trend Investing and the IEA

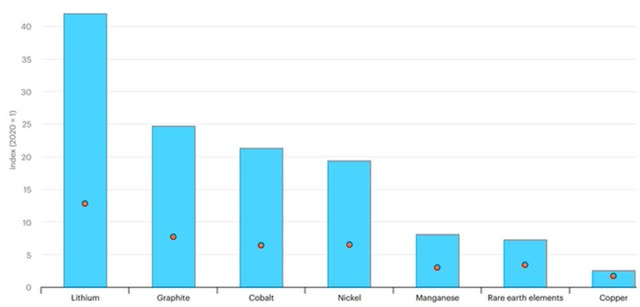

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, and Copper 2x to 3x (source)

IEA

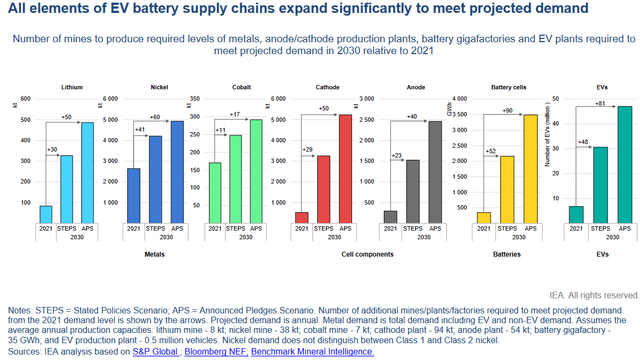

2022 – IEA forecasts 60 new nickel mines needed by 2030

IEA

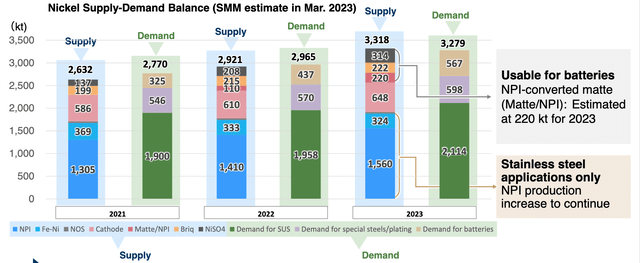

BMI forecasts we need 330+ new EV metal mines from 2022 to 2035 to meet surging demand – 72 new 45,500tpa nickel mines needed by 2035

BMI

Nickel Market News

On April 25 Investing News reported:

Nickel Price Update: Q1 2023 in Review……Increasing supply from Indonesia and a slower-than-forecast demand rebound from China hit the market in Q1…… “The nickel market will remain in surplus over the medium term on the back of strong supply growth in Indonesia,” Manthey said……Looking ahead, FocusEconomics analysts believe nickel prices should decline this year, but remain well above their 10 year average. Panelists at the firm see the metal averaging US$22,973 in Q4 of this year, and US$22,131 in the same quarter in 2024. Meanwhile, ING expects nickel to gradually move higher over the course of 2023, averaging US$25,250 in for the year…….Wood Mackenzie is forecasting an average Q2 price of US$22,900. “We really need to see Chinese and European stainless steel demand pick up,” Gardner said. “Everyone talks about batteries, but stainless steel still accounts for 65 to 70 percent of primary nickel demand.”

On April 28 Reuters reported:

Column (Andy Home): Nickel faces huge supply glut as Indonesian output booms……The International Nickel Study Group [INSG] is forecasting a supply-demand surplus of 239,000 tonnes, the largest in at least a decade and a significant increase from last year’s excess of 105,000 tonnes…….Demand expectations have been tempered, although nickel usage is on track to register healthy 6.1% growth in 2023. It still won’t be enough to absorb the wave of new production coming out of Indonesia. The supply surge, though, is not coming in the form of the Class I refined metal traded on both the London Metal Exchange [LME] and the Shanghai Futures Exchange. That may complicate the pricing impact…….Despite weak Chinese sales after the removal of subsidies and the shift towards non-nickel chemistries, the speed and scale of the global switch to EVs means that batteries are the core driver of growing nickel demand. A total 17,137 tonnes of nickel were deployed onto roads globally in EV batteries in February, according to research house Adamas Intelligence. That was up 19% month-on-month and 47% up on February last year…….LME stocks of Class I nickel continue to slide even as surplus builds in other parts of the supply chain.

On May 5 Fastmarkets reported:

LME nickel stocks at multi-year low. London Metal Exchange [LME] warehouse nickel stocks have reached their lowest point since 2007 on Wednesday May 3, following gradual withdrawals in recent weeks.

Nickel Company News

Producers

Vale S.A. (NYSE:VALE)

Vale Voisey’s Bay Mine is a key Canadian and global source of nickel. Vale plans a refinery at Bécancour in Québec to supply GM with battery grade nickel sulfate with deliveries targeted to commence in H2 2026.

On May 19 Mining.com reported:

Vale said to decide on base metals sale worth billions next week: Brazilian paper….. [Vale] to be deciding next week on the sale of a minority stake of its base metals business to automakers, pension funds and sovereign wealth funds, according to Brazilian news outlet Valor. The board of directors of Rio de Janeiro-based Vale is to analyze binding offers on May 25 for a 10% stake that could be valued at $2.5 billion, Valor said.

On May 23 Finance News Network reported:

Details imminent regarding Vale Metals sale. Big global investors may find out this week how Vale, the giant Brazilian miner, will handle the much-awaited sale of 10% of its base metals business. According to Wall Street analysts the possible sale could put a value of more than $US20 billion on the business, with top forecasts around $US25 billion.

Norilsk Nickel [LSX: MNOD] (OTCPK:NILSY)

No news for the month.

BHP Group [ASX:BHP] (NYSE:BHP)

BHP’s Nickel West (includes the Mt Keith nickel mine in Australia) has a Measured and Indicated Resource of 4.1Mt contained nickel with a Total Resource contained nickel of 6.3Mt, with an average grade of 0.58% Ni in sulphide ore. Nickel West produced 80 kt of nickel in FY 2020. Stage 1 production of the Kwinana Nickel Refinery is aimed to be 100ktpa nickel sulphate.

On May 2 BHP Group announced: “Completion of OZ Minerals acquisition.”

BHP’s Nickel West operations

BHP

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

On May 9 Glencore announced: “Glencore and Li-Cycle announce joint study to develop a European recycling hub, repurposing an existing Glencore metallurgical facility to be the largest source of recycled battery grade lithium as well as recycled nickel and cobalt in Europe.” Highlights include:

- “Expected to create the first European fully closed-loop solution from lithium-ion battery material inputs to battery-grade products; would be the largest source of recycled battery grade lithium as well as recycled nickel and cobalt in Europe.

- “Expected new Hub processing capacity of 50,000 to 70,000 tonnes of black mass input per year.

- Definitive Feasibility Study to commence in mid-2023 and will leverage Li-Cycle’s leading technology and extend first-mover advantage to Europe.

-

Fast tracked timeline enabled through repurposing part of Glencore’s existing asset base in Portovesme, Italy.”

On May 22 Glencore announced: “Glencore publishes 2022 Sustainability Report.”

Jinchuan Group [HK:2362]

No nickel related news for the month.

Sumitomo Metal Mining Co. (OTCPK:SMMYY)

On May 10 Sumitomo Metal Mining Co. announced:

FY2023 Capital Expenditure and Total Investment Plans…..Sumitomo Metal Mining Co., Ltd. (SMM) plans a total 198.0billion yen of capital expenditures on a consolidated basis during the fiscal year 2023 (April 1, 2023 — March 31, 2024). The total investment represents a 41% increase from that of FY2022.

On May 10 Sumitomo Metal Mining Co. announced: “Consolidated financial results for the year ended March 31, 2023…..”

On May 17 Sumitomo Metal Mining Co. announced: “FY2022 progress of Business Strategy……”

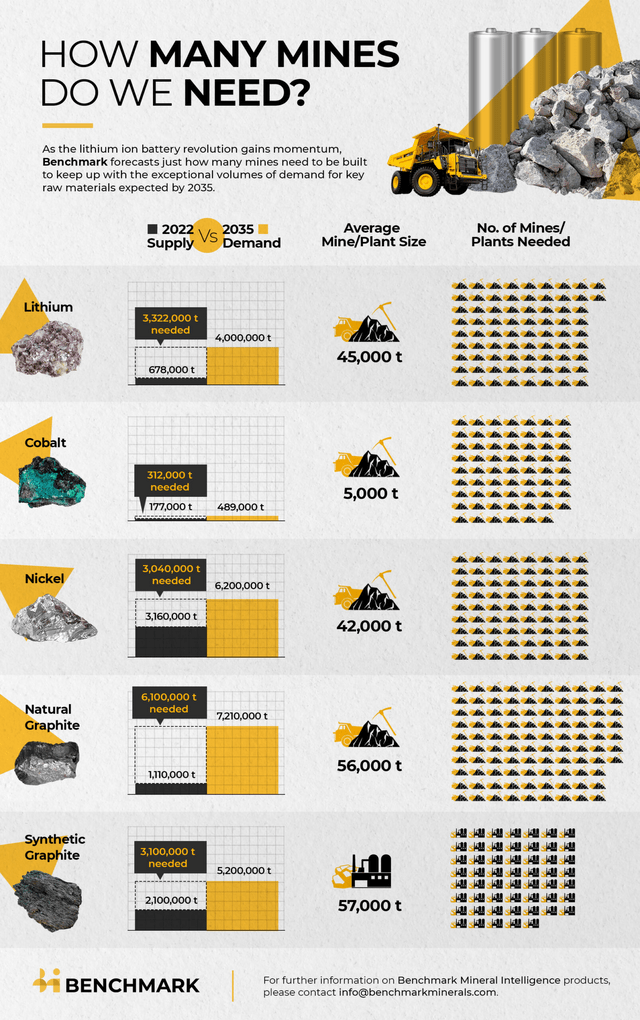

“Metal Supply and Demand Outlook

《Nickel》Continued growth is anticipated.

- “Demand for nickel–based lithium–ion batteries for EVs will continue to grow.

- Increased NPI production is expected to continue in Indonesia; production volume of Class I from intermediate products is expected to increase further.

- Both demand and supply have respective growth risks, but the Ni market is expected to continue growing even after factoring in the risks.”

Nickel Business Environment: Supply-Demand Balance (source)

Sumitomo Metal Mining Co.

Metal Price Estimation for FY2

“《Nickel》$10.00/lb(FY2022 ave.:$11.63/lb Apr. 2023 ave.:$10.78/lb)

- “Supply–demand balance of nickel in 2023 is expected to be in over–supply.

- While there are expectations of an economic recovery in China on the demand side, there is a strong impact from the increase in nickel supply from nickel sources in Indonesia, and we expect it to be primarily in the $10/lb range.”

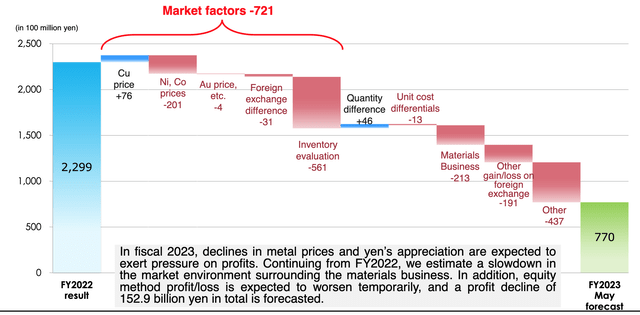

Profit before Tax Analysis: FY2023 Forecast vs. FY2022 Results (source)

Sumitomo Metal Mining Co.

Anglo American [LSX:AAL] (OTCPK:AAUKF)

On May 2 Anglo American announced:

Publication of Offering Memorandum….relating to the issue of US$900,000,000 5.500% Senior Notes due 2033 (the “Notes”) guaranteed by the Company, has been approved by the UK Financial Conduct Authority and is available for viewing.

Eramet [FRA:ERA] (OTCPK:ERMAY)

On April 27 Eramet announced: “Eramet: Q1 2023 turnover of €775m.” Highlights include:

- “Closing of the sale of A&D at end-April confirming the Group’s strategic repositioning.

- Adjusted turnover (including the proportional contribution of Weda Bay) of €949m (-24%), strongly penalised by the expected decrease in our selling prices (-24%) compared to the very high levels of Q1 2022.

- Contrasting operational performance across activities, given the incidents,= now resolved, that impacted Q1: -18% in volumes of manganese ore sold externally in Gabon, following the landslide at end-2022 that halted activity over January. +89% in volumes of nickel ore sold externally in Indonesia.

- Significant decline in selling prices compared to Q1 2022 particularly for manganese alloys, of which prices were exceptionally at that time, but also for Class II nickel (NPI and ferronickel).

- Input costs remain high, albeit with a trend reversal in freight and reducing agent prices.

- Strength of Eramet’s financial profile: first financial ratings obtained from Fitch (BB+) and Moody’s (Ba2).

- Liquidity remains at a high level contributing to secure the Group’s financing plan.

- The outlook for 2023 is, as expected, set against the background of a less buoyant macroeconomic context.

- Adjusted EBITDA is revised slightly downwards to around €1.1bn in 2023….

- The Group continues to focus on cost control, productivity actions and cash generation, while preparing its growth projects in the energy transition.“

On May 11 Eramet announced: “Eramet: Successful inaugural issue of €500 million sustainability-linked bonds.”

On May 17 Eramet announced: “Eramet: Results of the tender offer to repurchase its bonds due February 2024.”

Sherritt International (OTCPK:SHERF)[TSX:S]

On May 10 Sherritt International announced: “Sherritt reports Q1 results and successful implementation of the cobalt swap.” Highlights include:

Selected Q1 2023 Developments

- “Net earnings from continuing operations was $13.6 million, or $0.03 per share in Q1 2023, compared to net earnings from continuing operation of $16.4 million, or $0.04 per share, in Q1 2022.

- Adjusted EBITDA(1) in the quarter was $40 million compared to $59 million in Q1 2022……

- Sherritt’s share of finished nickel and cobalt production at the Moa Joint Venture (Moa JV) was 3,483 tonnes and 367 tonnes, 10% and 18% lower, respectively, than the prior year quarter.

- Net direct cash cost (NDCC)(1) was US$6.46/lb in Q1 2023 compared to US$3.42/lb in Q1 2022 primarily due to materially lower realized cobalt prices, placing Sherritt in the second cost quartile for HPAL nickel producers.

- Power production increased 15% to 158 GWh compared to Q1 2022 as a result of additional gas supply……”

IGO Limited [ASX:IGO] (OTC:IIDDY)

On May 2 IGO Limited announced: “IGO Limited farm-in and JV agreement Henderson Nickel – Lithium Project.” Highlights include:

- “Farm-in and Joint venture in which IGO Subsidiary can progressively acquire up to a 70% interest in the Project by incurring A$4,000,000 of exploration expenditure on the Project and reimbursing VMC A$1,000,000…..”

On May 4 IGO Limited announced: “Metal Hawk secures 100% of JV projects from IGO.”

Panoramic Resources [ASX:PAN] (OTCPK:PANRF)

Panoramic’s Savannah mine and mill has a forecast life of mine average annual production rate of 10,800t of nickel, 6,100t of copper and 800t of cobalt metal contained in concentrate.

On May 8 Panoramic Resources announced: “Savannah drilling and DHEM Program update.” Highlights include:

- “Significant nickel-copper-cobalt mineralisation intersected in a three-hole drill program to establish new DHEM survey platforms testing both below and above the 900 Fault at Savannah.

- Massive sulphide intersections returned on both the northern and southern contacts of the Savannah intrusion with results from drill hole KUD2050 including: 3.6m @ 1.39% Ni, 0.17% Cu and 0.07% Co from 628m (northern contact). 43.0m @ 0.79% Ni, 0.60% Cu and 0.04% Co from 652m (Savannah)…..

- DHEM surveying to commence late May and include several surface exploration holes completed in 2022.”

On May 25 Panoramic Resources announced: “Savannah regional exploration update.”

Nickel Industries Limited [ASX:NIC] (OTCPK:NICMF)

On May 24 Nickel Industries Limited announced:

Breach of ASX Listing Rule 10.17A. Nickel Industries Limited (‘the Company’) advises of a breach of ASX Listing Rule 10.17A which states that: “The total amount of directors’ fees paid to the directors of an entity by the entity or any of its child entities must not exceed the total amount of directors’ fees approved by the holders of its securities under rule 10.17”. Under Article 15.13 of the Company’s constitution the aggregate amount of fees available to be paid to Non-Executive Directors is currently set at A$750,000 per annum (‘Fee Pool Threshold’). The Fee Pool Threshold was set prior to the Company listing on ASX and has not been subsequently increased. As detailed in the Company’s Notice of Annual General Meeting, released on 28 April 2023, the Company is seeking shareholder approval to increase the Fee Pool Threshold by A$300,000 to an aggregate amount of A$1,050,000 per annum.

Nickel 28 Capital Corp. [TSXV:NKL] [GR:3JC]

On May 3 Nickel 28 announced: “Nickel 28 releases Ramu Q1 2023 operating performance and provides update on Shareholder Engagement.” Highlights include:

- “Nickel 28 confirms receipt of largest ever cash distribution from Ramu joint venture of US$9.7 million.

- Concurrent with cash distribution, Nickel 28’s Ramu construction debt reduced by US$18.1 million leaving a balance of approximately US$55.8 million as of January 2, 2023.

- Nickel 28 provides update on shareholder engagement efforts.”

On May 9 Nickel 28 announced:

Nickel 28 rejects Pelham’s latest zero premium take-over attempt. Pelham’s purported “settlement offer” would leave Nickel 28 without vital expertise or a credible plan to drive shareholder value. Nickel 28’s Board and management team has positioned the Company to become a leading cash generating battery metals investment vehicle…

On May 17 Nickel 28 announced: “Nickel 28 announces fiscal 2023 financial results.” Highlights include:

The Company’s principal asset, an 8.56% joint-venture interest in the Ramu Nickel-Cobalt (“Ramu”) integrated operation in Papua New Guinea, had another outstanding year in terms of production, sales and cash flow. Highlights from Ramu and the Company during the year include:

- “Full year debt repayment of US$21.3 million, with a remaining construction debt balance of US$55.8 million as at January 31st, 2023.

- Production of 34,302 tonnes of contained nickel and 2,987 tonnes of contained cobalt in mixed hydroxide precipitate (MHP) placing Ramu as one of the top producers of MHP globally.

- Total Ramu project revenue of over US$820 million.

- Average cash costs for the year, net of by-product sales, of US$3.37/lb. of contained nickel.

- Total net and comprehensive income of US$6.1 million or US$0.07 per share.”

On May 24 Nickel 28 announced: “Nickel 28 Responds to Pelham’s distraction tactics and misleading claims…..”

Mincor Resources [ASX:MCR] (OTCPK:MCRZF) – Wyloo Metals Pty Ltd takeover offer extended to 5 June 2023

On May 12 Mincor Resources announced:

Wyloo Consolidated increases its shareholding in Mincor to 69.32% and extends Offer period to close of trading on ASX on 5 June 2023…..

On May 16 Mincor Resources announced: “Mincor awards Haulage contract.”

On May 29 Mincor Resources announced:

Mincor business and Wyloo offer update. Kambalda Nickel Operations on track to achieve nameplate mining rates in May 2023, while continuing to optimise forward mine plans; Mincor Shareholders are recommended to ACCEPT Wyloo’s Offer…..Wyloo holds 72.77%1 of the shares in Mincor and therefore it is unlikely that a competing proposal for Mincor will be made or announced. Wyloo intends to seek a delisting from the ASX following the close of the Offer if requirements for delisting can be satisfied……

Other nickel producers

First Quantum Minerals [TSX:FM] (OTCPK:FQVLF), Franco/Nevada [TSX:FNV], MMG [HK:1208], South32 [ASX:S32], Lundin Mining [TSX:LUN], Nickel Asia Corporation [PSE:NIKL] (OTC:NIKAY), Platinum Group Metals’ [TSX:PTM] (PLG).

Nickel juniors

Horizonte Minerals Plc [TSX:HZM] [AIM:HZM]

Horizonte is developing its 100% owned Araguaia Nickel Project (Araguaia) as Brazil’s next major ferronickel mine.

On May 24 Horizonte Minerals Plc announced: “Horizonte Minerals Plc 2022 sustainability report…..”

You can read a recent Trend Investing article here that discusses Horizonte Minerals.

Poseidon Nickel [ASX:POS] (OTC:PSDNF)

On May 26 Poseidon Nickel announced: “Black Swan restart & company update.” Highlights include:

Black Swan Smelter grade concentrate project

- “Resource update – all assays received, update due late May/early June 2023.

- Offtake & Debt Financing – short list reduced to two parties, with final negotiations of offtake and debt financing agreements underway.

- Timetable – targeting Final Investment Decision on the Black Swan restart late June/early July 2023.”

Other projects

- “Black Swan Expansion Project – metallurgical testwork continues, concentrate samples supplied to potential customers for testing.

- Proposed Kalgoorlie pCAM Hub – MMI conditional grant no longer being negotiated.

- Lake Johnston – stage 1 drill program of ~6,600m completed, assay results expected late June 2023.”

Talon Metals [TSX:TLO] (OTCPK:TLOFF) Tamarack – (JV with Rio Tinto)

Tamarack is a high grade nickel-copper-cobalt project located in Minnesota, USA, with considerable exploration upside. Talon Metals owns a 51% project share, with potential to further earn-in to a 60% share by 2026.

On May 12 Talon Metals announced: “Talon Metals reports results for the quarter ended March 31, 2023. Talon Metals Corp.”

Garibaldi Resources [TSXV:GGI] [GR:RQM] [LN:OUX6] (OTCPK:GGIFF)

No news for the month.

OZ Minerals [ASX:OZL] (OTCPK:OZMLF)

Owns the West Musgrave nickel-copper project in Western Australia as well as several other mines.

On May 2 OZ Minerals announced:

Implementation of Scheme. OZ Minerals is pleased to advise that the scheme of arrangement pursuant to which it was proposed that BHP Lonsdale Investments Pty Ltd (“BHP”), a wholly owned subsidiary of BHP Group Limited (ASX:BHP), would acquire 100% of the shares in OZ Minerals (“Scheme”) has today been implemented. OZ Minerals Shareholders (“OZ Minerals Shareholders”) will today be paid: $1.75 for each OZ Minerals share they held on the Special Dividend Record Date (being 7.00pm (Melbourne time) on Friday, 21 April 2023); and $26.50 for each OZ Minerals share they held on the Scheme Record Date (being 7.00pm (Melbourne time) on Monday, 24 April 2023).

St George Mining Ltd. [ASX:SGQ] [GR:SOG]

The Cathedrals, Stricklands and Investigators nickel-copper discoveries (at Mt Alexander) are located on E29/638, which is held in joint venture by Western Areas Limited (25%) and St George (75%). St George is the Manager of the Project with Western Areas retaining a 25% non-contributing interest in the Project (in regard to E29/638 only) until there is a decision to mine.

No nickel news for the month.

Queensland Pacific Metals [ASX:QPM] (OTCPK:QPMLF)

On May 18 Queensland Pacific Metals announced: “$5 million awarded in Government Grant.” Highlights include:

- “QPM has been awarded a $5m grant from the Australian Federal Government under the Critical Minerals Development Program.

- The grant funding will be used to accelerate Front End Engineering Design (detailed engineering) for the TECH Project.”

You can read a recent Trend Investing article here that discusses QPM.

Premium Nickel Resources [TSXV:PNRL](OTCQX:PNRLF)

No news for the month.

Canada Nickel Company [TSXV:CNC](OTCQX:CNIKF)

On May 24 Canada Nickel Company announced: “Canada Nickel announces new discovery at Mann Northwest Property, provides update on Regional Drilling at Midlothian and Sothman.” Highlights include:

- “First four holes at Mann Northwest intersected multi–hundred metre intervals of mineralized peridotite and dunite.

- Long, shallow mineralized intervals reported at both Sothman and Midlothian: Midlothian returned 343 metres of 0.28% nickel starting at 2 metres. Sothman returned 319 metres of 0.29% nickel starting at 15 metres in East Zone.

- High–grade mineralization confirmed at Sothman within larger mineralized intervals: 1.28% nickel over core length of 5.3 metres from 58.7 metres, within 192 metres of 0.31% nickel in West Zone.”

Investors can view a CEO video here, or a CEO interview here on Trend Investing.

Ardea Resources [ASX:ARL] (OTCPK:ARRRF)

On April 27 Ardea Resources announced:

Quarterly operations report for the quarter ended 31 March 2023. $14.5M cash-at-bank, supportive share register seeking development of the Kalgoorlie Nickel Project (KNP)…..

On May 2 Ardea Resources announced: “Nickel sulphide anomalism from aircore drilling at Kalpini Project.” Highlights include:

- “Twenty-four exploration aircore drill holes for 1,077m were completed in October 2022 at Emu Lake with one drill line to the north of the Binti Prospect and two drill lines to the south.

- Drill hole AELA0022 intersected significant nickel sulphide anomalism: 14m @ 0.52% Ni, 231ppm Cu and 129ppb Pt+Pd from 24m……

- Textures including presence of distinctive pits in the drill chips indicate weathered nickel sulphide mineralisation in saprock ultramafic.

- AELA0022 is located 1km south-southeast of the Binti South Prospect (Ardea discovery hole AELD0003: 2.72m at 5.42% Ni and 0.85% Cu from 391.04m1) in an area with no previous surface electromagnetic [EM] surveys.”

Centaurus Metals Limited [ASX:CTM] (OTCQX:CTTZF)

Centaurus Metals is an Australian-based minerals exploration company focused on the near-term development of the Jaguar Nickel Sulphide Project, in Northern Brazil.

On May 4 Centaurus Metals Limited announced: “First nickel sulphate produced from Jaguar Ore as pilot plant program successfully concludes. Pilot Program confirms Jaguar’s ability to produce a high-quality nickel sulphate product for the fast-growing EV market.” Highlights include:

- “……Nickel sulphate successfully produced from Jaguar for the first time. Very efficient cobalt recovery in the solvent extraction (SX) circuit. Over 99% of cobalt extracted from the Phase 2 raffinate with minimal loss of nickel (0.3-0.7% nickel). A high-purity cobalt hydroxide by-product has been produced, to benefit overall project economics.

- These key results build on the previous positive results from Phase 1 & 2 of the refinery pilot plant program.

- The pilot testwork program has been very successful in either meeting or exceeding the pre-testwork goals and delivering a robust data package for use in the DFS refinery process design, which is currently underway with the Company’s engineering partner Ausenco.

- Samples of Jaguar nickel sulphate product are now available for marketing and strategic off-take discussions.

- Work to date confirms the quality of the Jaguar Project and its potential to produce a battery-grade nickel sulphate product for the rapidly growing EV market.

- Centaurus remains well-funded with approximately $23 million in cash at the end of the March Quarter.“

You can read a Trend Investing article here that discusses Centaurus Metals.

Alliance Nickel [ASX:AXN] (formerly GME Resources)

On May 1 Alliance Nickel announced:

Alliance Nickel executes Binding Offtake Agreement and Cornerstone Equity Investment with Stellantis N.V……Share Subscription Agreement for A$15 million giving Stellantis an 11.5% shareholding in Alliance….. The Binding Offtake Agreement for battery grade materials is for the first five years of operations for the NiWest Project and Alliance will supply approximately 170,000t of nickel sulphate and 12,000t of cobalt sulphate in total over this initial five year period.

On May 3 Alliance Nickel Limited announced: “Alliance Nickel receives $12.7 million from first Tranche of Strategic Placement to Stellantis N.V.”

On May 30 Alliance Nickel Limited announced: “NiWest Nickel-Cobalt Project update.” Highlights include:

- “As part of the offtake customer qualification process, six tonnes of NiWest ore shipped to SGS in Canada for pilot plant processing into premium battery grade product.

- Contractor pricing for determining DFS mining costs progressing well and follows recent site visits by shortlisted mining contractors.

- Discussions advancing with rail logistics providers Qube and Aurizon, for the import and transport of sulphur through the Port of Esperance.

- DFS work programs progressing to plan and budget with study manager Ausenco expected to deliver DFS in Q4 2023.

- Geotechnical assessment drilling completed for the Mt Kilkenny mine pit as well as planned infrastructure construction sites around the refinery, heap leach pads and evaporation ponds.

- Infill drilling at Mt Kilkenny completed with results being used to define final mine pit designs as well as adding additional Ore Reserve tonnage.

- Calcrete drilling completed at Sturt Meadows and will result in an update to previous calcrete JORC Resource.”

Widgie Nickel [ASX:WIN]

On May 8 Widgie Nickel announced: “Nickel discovery South of Gillett Resource underpins growth potential.” Highlights include:

- “Discovery hole 23MERCD017 returns significant results; proving that mineralisation continues to the south of Gillett, an area previously considered “closed off”.

- Potential to unlock significant Nickel resources to the south in an area that remains untested.

- Significant nickel intercepts include: 23MERCD017 30m @ 1.17% Ni, 0.14% Cu, 0.03% Co, 0.04 g/t Au, 0.11 g/t Pd, 0.09 g/t Pt from 214.0m…..and 11m @ 1.57% Ni, 0.18% Cu, 0.05% Co, 0.03g/t Au, 0.10g/t Pd, 0.11g/t Pt from 232.0m……

- Gillett forms part of the “Widgie South” project area that is a key component of the Mt Edwards project pipeline, currently containing combined Resources of 71,800t of Nickel with further upside potential as mineralisation remains open to the north and south of Gillett, in addition to a largely untested 1km corridor between Gillett and Widgie Townsite further to the north.

- Follow-up drill testing of the fertile basal contact has commenced.”

Sama Resources [TSXV: SME] [GR;8RS] (OTCPK:SAMMF)

On May 25 Sama Resources announced: “Sama Resources announces arrangement for the spinout of SRQ Resources, its Quebec Nickel Subsidiary.” Highlights include:

The Spin-Out will be completed by way of a court approved plan of arrangement under the Canada Business Corporations Act (the “PoA”). Upon completion of the PoA, holders of common shares of Sama (“Sama Shares”) are to receive:

- “One new share in the reorganized capital of Sama (“New Sama Share”) for every one Sama Share held at the effective time of the PoA (the “Effective Time”).”

- One SRQ Share for every ten Sama Shares held at the Effective Time.”

Murchison Minerals [TSXV:MUR] (OTCQB:MURMF)

On May 24 Murchison Minerals announced:

Murchison Minerals identifies nickel-bearing sulphide mineralization along a 5 km trend and significantly expands the HPM Project Area……Company has expanded the HPM claim block to cover an additional 313.7 km2 of prospective geology. The HPM Project area now totals 971.8 km2….

Power Nickel [TSXV:PNPN] (CMETF)

On May 30 Power Nickel announced: “Power Nickel announces latest drill results that expands central high-grade Zone at Nisk.” Highlights include:

- “1.01% Ni, 0.27% Cu, 0.07% Co, 0.88 g/t Palladium, 0.13 g/t Platinum, 0.03 g/t Gold over 14.4m in Hole PN-23-028, including:

- 1.69% Ni, 0.37% Cu, 0.12% Co, 1.59 g/t Palladium, 0.22 g/t Platinum, 0.04 g/t Gold over 7.8m.”

Investors can view the company presentation here and a Trend Investing CEO interview here.

The Metals Company (TMC)

On May 11 The Metals Company announced: “The Metals Company provides Q1 2023 corporate update.” Highlights include:

- “Net income and per share amount of $nil for the quarter ended March 31, 2023, after recording a gain on disposition of asset of approximately $14 million.

- Total cash of approximately $28.4 million at March 31, 2023.

- The Company believes that existing cash and liquidity will be sufficient to fund operations for at least the next twelve months.”

Other juniors

Artemis Resources [ASV:ARV], Australian Mines [ASX:AUZ], Azure Minerals [ASX:AZS] (OTCPK:AZRMF), Blackstone Minerals [ASX:BSX], Cassini Resources [ASX: CZI] (OTC:CSSQF), Class 1 Nickel and Technologies Ltd. [CSE:NICO] (OTCQB:NICLF), Electra Battery Materials [TSXV:ELBM] (ELBMF), Electric Royalties [TSXV:ELEC], Flying Nickel Mining Corp. [TSXV:FLYN], FPX Nickel [TSXV:FPX], Grid Metals Corp [TSXV:GRDM], Go Metals [CSE:GOCO] (OTCPK:GOCOF), Huntsman Exploration [TSXV:HMAN] (OTCPK:BBBMF), Inomin Mines [TSXV:MINE], Jervois Global Limited [ASX:JRV] (OTCQX:JRVMF), New Age Metals [TXV:NAM], Nickel Creek Platinum [TSX:NCP] (OTCQX:NCPCF), Nordic Nickel Limited [ASX:NNL], Pancontinental Resources Corporation [TSXV:PUC], Polymet Mining [TSX:POM], Renforth Resources [CSE:RFR] (OTCQB:RFHRF), Rox Resources [ASX:RXL], S2 Resources (ASX:S2R), Stillwater Critical Minerals [TSXV:PGE] (OTCQB:PGEZF), Sunrise Energy Metals [ASX:SRL] (OTCQX:SREMF), Surge Battery Metals Inc. [TSXV:NILI] [FRA:DJ5C] (OTCPK:NILIF), Talisman Mining Ltd. [ASX:TLM], Tartisan Nickel Corp. [CSE:TN] (OTCQX:TTSRF), Transition Metals [TSXV:XTM], URU Metals Ltd. [LSE:URU] [GR:NVRA], Wall Bridge Mining [TSX:WM], and Zeb Nickel Corp. [TSXV:ZBNI] (OTCQB:ZBNIF).

Note: Some of the above companies are covered in the Cobalt monthly news.

Nickel miners ETF

Below is the newly listed Sprott Nickel Miners ETF. You can view the top holdings here.

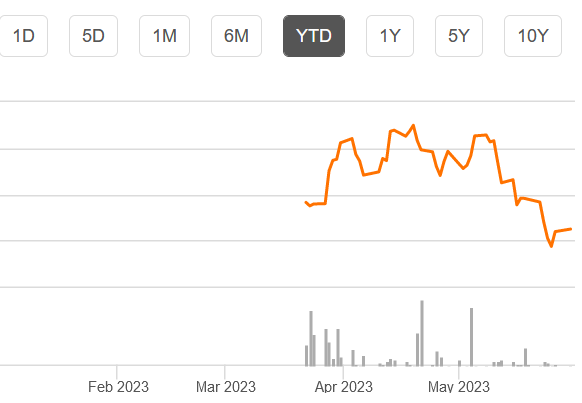

Sprott Nickel Miners ETF (NIKL) – Price = US$20.25

Seeking Alpha

Conclusion

Nickel spot prices were significantly lower the last month.

Highlights for the month were:

- Increasing supply from Indonesia and a slower-than-forecast demand rebound from China hit the market in Q1. FocusEconomics analysts believe nickel prices should decline this year, but remain well above their 10 year average.

- Nickel faces huge supply glut as Indonesian output booms.

- LME nickel stocks at multi-year low.

- Vale – Details imminent regarding sale of 10% of its base metals business, reported to be worth $US20-25 billion.

- BHP Group completes takeover of OZ Minerals.

- Glencore and Li-Cycle announce joint study to develop a European recycling hub, to be the largest source of recycled battery grade lithium, nickel & cobalt in Europe.

- Sumitomo Metal Mining – Supply–demand balance of nickel in 2023 is expected to be in over–supply, we expect the nickel price to be primarily in the $10/lb range.

- IGO Limited farm-in and JV agreement of up to a 70% interest in the Henderson Nickel-Lithium Project.

- Panoramic Resources drills 43.0m @ 0.79% Ni, 0.60% Cu and 0.04% Co from 652m at Savannah.

- Nickel 28 confirms receipt of largest ever cash distribution from Ramu JV of US$9.7 million. Rejects Pelham’s latest zero premium take-over attempt.

- Wyloo Consolidated increases its shareholding in Mincor and extends Offer period to close of trading on ASX on 5 June 2023,

- Poseidon Nickel targeting Final Investment Decision on the Black Swan restart late June/early July 2023.

- Canada Nickel announces new discovery at Mann Northwest Property.

- Centaurus Metals – Nickel sulphate successfully produced from Jaguar for the first time. Very efficient cobalt recovery.

- Alliance Nickel executes Binding Offtake Agreement and cornerstone equity investment with Stellantis N.V.

- Widgie Nickel – Nickel discovery South of Gillett Resource underpins growth potential. Drills 30m @ 1.17% Ni, 0.14% Cu, 0.03% Co, 0.04 g/t Au, 0.11 g/t Pd, 0.09 g/t Pt from 214.0m.

- Sama Resources announces arrangement for the spinout of SRQ Resources, its Quebec Nickel Subsidiary.

- Power Nickel drills 1.01% Ni, 0.27% Cu, 0.07% Co, 0.88 g/t Palladium, 0.13 g/t Platinum, 0.03 g/t Gold over 14.4m.

As usual all comments are welcome.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.