Nikola Stojadinovic

Dear readers/followers,

In this article, I will showcase to you a new Swedish company that I haven’t covered on Seeking Alpha before, but that I’ve been “playing” with as far as derivatives and a small equity position are concerned. I’m talking about NIBE Industrier AB (OTCPK:NDRBF). You might not have heard of this company, and the sub-1% yield might scare some of you off – but give me half an hour of your time, and I’ll explain to you in this article while NIBE Industrier is not just solid, but it’s a company you should consider.

At least, at the right price – which is something we don’t necessarily have at this time.

Let’s take a look and see what we got here.

NIBE Industrier – High growth at a high price

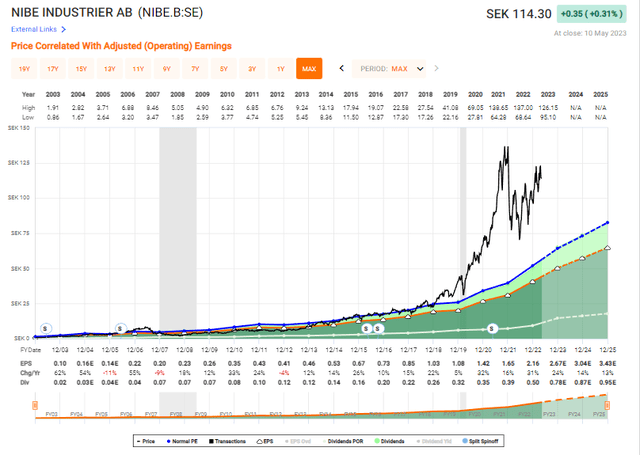

NIBE Industrier is a company in a few very attractive, high-growth segments. This is easily seen by looking at the company’s revenue growth rate, which is at a significant double-digit 15-20%, with a corresponding earnings growth rate. Both historically and going forward, as it happens. Going forward, earnings growth for NIBE is expected, looking at annual EPS growth until 2025-2026E of no less than 11-19%, maintaining the company’s double-digit EPS growth rate. (Source: S&P Global, FactSet).

The company has a market cap of over 230B SEK, an LT debt/cap of less than 16%, interest coverage of 21.57x, high profitability in every single measurement and metric that matters – RoE, ROA, ROIC, and ROCE as well as margins – and solid historical profitability. Out of 10 past years, 10 of them have been profitable. This is a company that’s seen profitability for over 95% of the past 20 years, and the worst years have seen a decline of 11%. In other years, as you can see, the company’s growth has been like clockwork, and things have been going up – higher and higher.

In fact, precariously high.

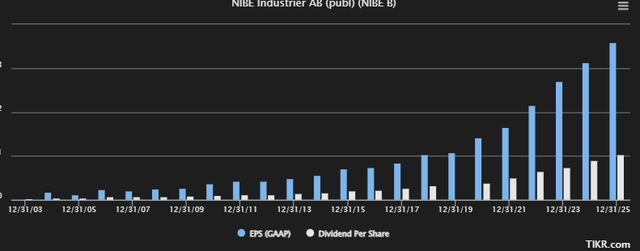

NIBE Earnings growth (F.A.S.T graphs)

So what exactly does NIBE do that is so amazing?

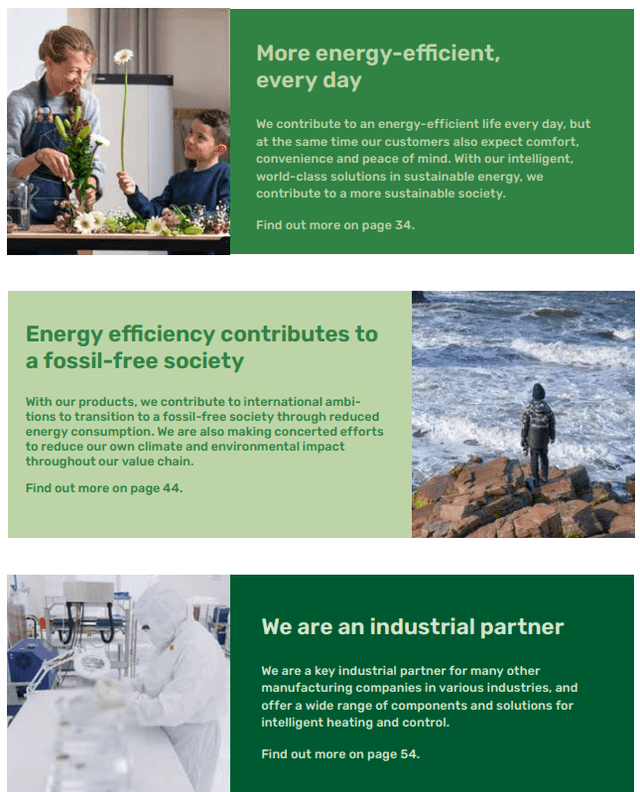

The company is active in the field of climate solutions, Elements, and Stoves.

Nibe IR (Nibe IR)

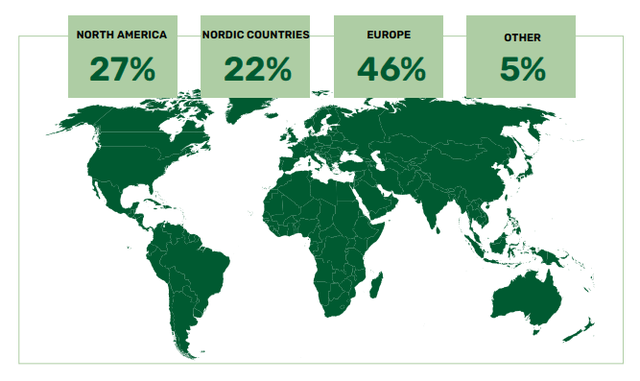

The company researches, develops, and manufactures as well as sells a wide range of modern and energy-efficient of indoor climate solutions, in all types of properties. This is in addition to solutions for intelligent heating and control in industrial and large-scale infrastructure. The company manages a very attractive and diverse sales mix, with a 46% Europe mix, but impressive NA and other exposures as well. Europe does ex the Scandinavian business – Scandinavia alone is 22% of the mix.

Nibe IR (Nibe IR)

The company manages around $4B worth of annual sales at a 14-15% operating margin, a net profit of over 10%, and an equity/asset ratio of over 50%. This highlights some of the comparatively very attractive fundamentals of this business.

Some of the less attractive fundamentals include the company’s sub-par yield. At below 0.5% this is in the 7th percentile of the sector, though its payout ratio is less than 25%.

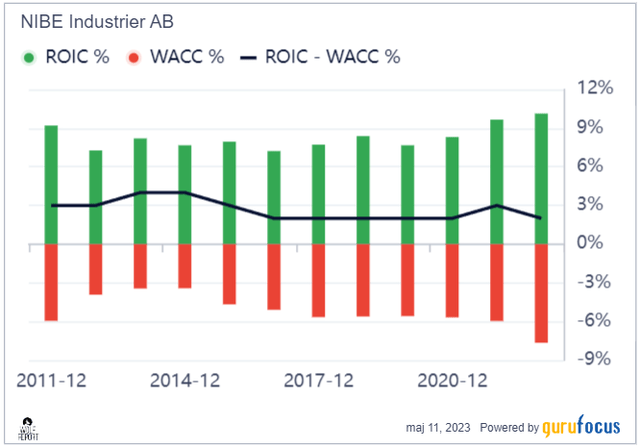

However, I continue to draw your attention to the profitability of the company. Take ROIC net of WACC, for one. You won’t find many companies that increased this last year, given the environment we’re in.

Nibe ROIC/WACC (GuruFocus)

And I also want to draw your attention to the shareholder equity growth rate, and the relation to total assets on the books, which has remained as steady and growing as the step-by-step growth you see in every other part of the company. NIBE Industrier is a well-oiled machine – a machine that’s been able to overcome virtually any business environment and still come out on top. Managing an almost 11% net income margin in this sector is amazing, where COGS usually consumes over 75% but here is below 69%. The only drawback in terms of the mix is perhaps the company’s overreliance on Scandinavia and Europe, which together make up almost 70% of the overall revenues.

NIBE is an institutional darling. The ratio of sales to buys is extremely skewed to the “BUY” side. Over the past few years, only one sell alert from the institutional side has gone out – the rest are all Buys.

This is the sort of growth company that I would be interested in buying. Another example here in the Nordics is Tomra (OTCPK:TMRAY), and I reviewed that one in a different article.

Going forward, and looking at 2022 as a comparison, the expectation from not only me but from other analysts following the company is that the positive trends will continue. EPS on a GAAP basis are expected to continue their climb step-by-step, and year-by-year. The dividend won’t make you rich, and as you can see, sometimes the company will cut it despite the positive result trend, but it usually sticks with it. NIBE is one of the more safely-managed operations in all of Scandinavia, and management does not take risks – beyond calculated ones on the business side.

Nibe EPS/Dividend (TIkr.com)

As a NIBE shareholder, you are most definitely second to the company’s financial safety, as management will do what it needs to do to preserve its capital.

Despite over 200B SEK in market cap and the sort of size you would come to expect credit ratings from, NIBE does not have an institutional credit rating. Instead, we have to do much of the work ourselves – luckily, it doesn’t take much to say that a company with these sorts of fundamentals is indeed very “safe”. it can be argued that a credit rating might even be a waste of time here, given how the company is operated.

That is not to say NIBE is not volatile. Over the past few years, as you can see in the share price graphs for the native, the company has been exploding in terms of multiples. Such volatility brings with it both downturns and growth, and the potential to lose money with NIBE has certainly been around. Investors I know continued to call NIBE a “BUY” at nearly 80x P/E, as we saw some years ago – a level from which the company has obviously dropped.

The company recently reported 1Q23. Results were strong, with continued top-line growth based on strong demand. The underlying reasons for this continued trend are the continued focus on sustainable solutions for heating/indoor climate, as well as the overall volatility of energy prices, especially in Europe. The push for independence from Russian energy has also done its fair share here.

The situation has also improved when looking at the supply chain. The company’s suppliers have increased their output to meet the high demand NIBE’s customers are showing, which in turn is eased by logistics not being as clogged or as troubled as they were half a year back. This is not to say that the efficiency/output situation is solved. NIBE is still bringing new capacities online, and these increases are responsible for significant top-line growth, by which I mean an increase of almost 3B SEK YoY, and a near-doubling of the company’s net result for the quarter, 1.274B compared to 0.68B SEK last year. The EPS for the quarter was 0.63 SEK, which in itself is almost enough to cover the company’s entire dividend.

Significant news, aside from the strong top-line and bottom-line growth is the M&A through 65% of shares acquired in Miles Industries Ltd, a Canadian business in heating.

The company still views the supply chains as somewhat impaired on a global basis, with certain suppliers still not able to meet company demands/quotas – and the company expects this to normalize toward the 2H23 period (Source: NIBE AB).

The reason I believe NIBE will continue to outperform its peers and be one of, if not the growth leader in this segment is its market positioning in markets such as EU, is its-already superior margins on a peer basis – with operating, net, and other return metrics already being above the average in their segment. Continued pressure either on the top or bottom line with this in the back of your mind, puts NIBE in a better situation than most to handle margin compression while still performing well. The company has proven this historically as well – its arguably closest peer with market share is Johnson Controls (JCI), and the company has substantially higher volatility in earnings and returns than NIBE. While JCI has managed perhaps 10-11% CAGR in returns for the past 20 years, NIBE is closer to 30% annually (around 27% per year since 2003). This also reflects the fact that NIBE has managed substantially higher growth on an annual basis in EPS during that time.

NIBE Industrier – The valuation is most certainly stretched here – Either fair value or overvalued

A 5-year average valuation trend puts NIBE at multiple premia of nearly 59x P/E. That’s above what I am willing to pay for any company. While I have been willing to use NIBE’s share price to write attractively-priced cash-secured puts for some months now, trying to “BUY” the company at a double-digit share price, none of those options have gone through.

To give you an idea, a double-digit share price for NIBE at this time would be based on current estimates and actuals indicate a multiple of between 35-40x P/E, which is as I’ve mentioned before, one of the highest valuations that I am willing to accept for any company no matter what sector. For a company to have this I want extremely solid and high-conviction growth.

NIBE has high conviction growth.

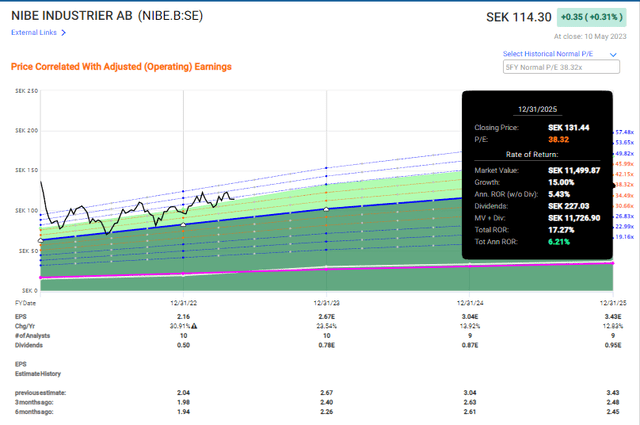

If we forecast on the basis of a 38x P/E however, we’re barely making 6.2% annually here, and with a less than 0.6% yield, that’s a no-go here.

Nibe Upside (F.A.S.T graphs)

There is a clear limit as to what I will pay for growth – and I will not pay over 38-40x P/E to get my upside. This company turns negative if we forecast at 30.6x forward P/E, which is somewhat insane. NIBE is a great company, but we’re talking about a building product company, with a decent amount of exposure to infrastructure and housing development. It’s one of those companies where I believe the market hasn’t yet “normalized” all the way.

NIBE’s analyst targets, aside from my own, are still viewed through rose-colored glasses. Despite trading at almost 40x P/E, the 9 analysts following NIBE give the company an average of 125 SEK, from a range of 88 SEK to 148 SEK. 3 of the 9 analysts have a “BUY”, and 1 is at a “SELL”.

If I owned NIBE today, I would be trimming that position, waiting for an upside as the company declined, and investing in more undervalued potentials in the meantime.

Even a very optimistic EPS DCF with a 17.5% growth rate in the growth stage, followed by a 9% growth rate in the terminal, implies an FV of no more than 70 SEK/share based on a discount rate of 12 and an EPS of 2.16, which is fair given what the company has managed. That means a lack of margin of safety here – almost 62%.

I would pay more than 70 SEK, and I would say DCF misses some of the nuances here due to high growth, but I wouldn’t go above 92 SEK/share, implying a conservative P/E of around 30-31x for this company. This puts me well below the lower averages from other analysts here, but that’s where I am comfortable with this company.

NIBE is one of the most stable, forecastable companies in this entire sector. It’s also one of the largest pure-play climate companies on the planet. The only ones with enough size to measure up aren’t as pure play and are businesses like Compagnie de Saint-Gobain (OTCPK:CODGF), Carrier (CARR), Johnson Controls, and Daikin (OTCPK:DKILF). Johnson Controls would be the one peer I would consider directly relevant here, and its market cap is about 2x the size of NIBE here.

However, I also believe NIBE to be significantly safer than JCI in terms of its earnings and growth trajectory.

To summarize, NIBE is one of the better companies in this segment. It has everything in this segment or in a cyclical industrial, with at least some cyclicality, that you’d be looking for. Good margins, good profit, good safety – except that yield. The company has vastly outperformed its peers in total RoR due to its impressive growth rates. 10-year annualized for NIBE is 32.69%, which is more than 3x the market. Comparable companies in the same sector, even high-quality ones, are less than 1/3rd of that.

However, this has also left NIBE in a position of uninvestability. The reason for saying this is that a company does need to provide a conservative upside for me to even be interested in investing – and that upside here is based on too high multiples, even for a business like NIBE.

Therefore, I give you my introductory thesis for NIBE, which is as follows.

Thesis

- NIBE Industrier is one of the best industries with a climate focus in all of Scandinavia. It’s a high growth, high safety, and low yield, a combination I have become more interested in over the past few years. However, the company is trading at one of the highest valuations we’ve ever seen barring exuberance, and this makes it a tough sell for me.

- I would say that NIBE needs to fall to clear double digits – preferably below 90 SEK, but at the very least to 92 SEK before I would be willing to expose capital here. I have written options on a continued basis here, trying to “catch” the company at a good price, but so far all I have gotten is a few very nice premiums.

- I am at a “HOLD” here – and my PT is 92 SEK/share as an introduction.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company does not fulfill my valuation-related criteria. Because of this, I view it as a no-go and say “HOLD”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.