S847/iStock via Getty Images

Historically, there are few assets more reliable than farmland. It has sat there continuously appreciating for centuries while also generating a current income through the food it produces. The tradeoff to this reliable growth is that farmland trades at low cap rates. Traditional row crop farmland will typically be bought and sold in the 3%-5% range for going-in yield. Specialty crops display similar appreciation over time but are slightly riskier, so they go for closer to 4%-6.5%.

This is fair pricing, as the combination of the going in yield and land appreciation has resulted in a total return beating that of the S&P over the long term. That is the result of buying farmland directly.

Farmland REITs introduce a new dynamic into the equation in which market price influences the going in yield. Unlike farmland itself, which has steady pricing, market prices of the public stocks are all over the place. The mispricing creates an extra layer of opportunity.

One can get the same cashflows and appreciation but get it at discounted prices. Over the years, we have taken advantage of this disparity between public and private markets.

- We shorted LAND when it was trading above net asset value.

- We bought LAND when it was cheap (roughly 40% discount to NAV).

- We bought FPI at less than half of net asset value.

Some of the above trades took years to play out, but there is a sort of inevitability to farmland. I cannot tell you how farmland will be priced tomorrow, and it is even more uncertain how public market securities will price tomorrow, but the value of the land will quite consistently be higher five years down the road.

It really isn’t that hard of a process to understand. Farmland has clearly defined value and for whatever reason the public market gets these wild mood swings which facilitate buying durable assets at 50 cents on the dollar. I’ll take that gift every time it is offered.

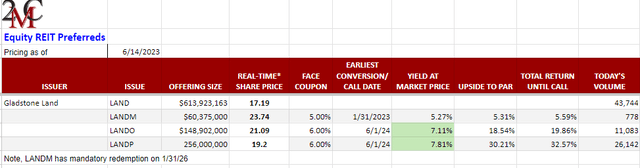

Today, the market is offering another gift, and it comes in the form of a recently listed Gladstone Land (NASDAQ:LAND) preferred offering, the Preferred C (NASDAQ:LANDP). Pictured in the table below are the LAND preferreds and I want to call attention to the disparities in market prices and yields.

Portfolio Income Solutions preferred tracker

LANDM is a bit different than the others as it has mandatory redemption on 1/31/26. As such, it has a defined end date, which defines the yield to maturity.

More interesting to me is the difference between LANDO and LANDP. These two securities are almost identical. They have the same liquidation preference, same rank in the waterfall, and the same claim on dividends as specified in LAND’s SEC filing:

“In the event of our voluntary or involuntary liquidation, dissolution or winding up, the holders of shares of Series C Preferred Stock will be entitled to be paid, out of our assets legally available for distribution to our stockholders, a liquidation preference of $25.00 per share, plus an amount equal to any accumulated and unpaid dividends on such shares to, but excluding, the date of payment, but without interest, before any distribution of assets is made to holders of our common stock or any other class or series of our capital stock that ranks junior to the Series C Preferred Stock as to liquidation rights. If our assets legally available for distribution to stockholders are insufficient to pay in full the liquidation preference on the Series C Preferred Stock and the liquidation preference on any shares of preferred stock equal in rank with the Series C Preferred Stock, all assets distributed to the holders of the Series C Preferred Stock and any other series of preferred stock equal in rank with the Series C Preferred Stock will be distributed ratably so that the amount of assets distributed per share of Series C Preferred Stock and such other series of preferred stock equal in rank with the Series C Preferred Stock will in all cases bear to each other the same ratio that the liquidation preference per share on the Series C Preferred Stock and on such other series of preferred stock bear to each other.”

For clarity, LANDO and LANDP are just their tickers, these are actually the Series B and Series C preferreds, respectively.

LANDO and LANDP also have identical 6% coupons and become callable on 6/1/24. I see absolutely no reason they should not trade at the same price, and yet:

- LANDO – $21.09.

- LANDP – $19.20.

That difference in price represents the opportunity. LANDO has been trading for a while, and that is the price the market thinks is fundamentally correct. In this case I tend to agree as a 6% coupon isn’t quite enough given where interest rates are, but the discount takes LANDO to a 7.11% yield with about 19% upside to liquidation price.

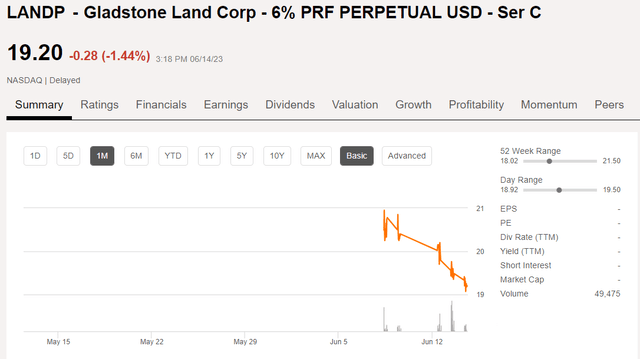

LANDP, however, has not yet stabilized. It was issued by private placement through Gladstone’s broker dealer and was not tradable until it got listed on a public exchange on June 8.

During its time as a non-traded entity, shareholders could not get out per the offering documents:

“Until shares of the Series C Preferred Stock or Series E Preferred Stock are listed on Nasdaq or another national securities exchange, if ever, holders of such shares may be unable to sell them at all or, if they are able to, only at substantial discounts from the liquidation preference.”

The listing represents a liquidity event, allowing those who want their money back to do so by selling. Most have held their shares as it is a stable income vehicle, but in a large statistical sample some will inevitably have liquidity needs. So, LANDP opens up for public trading and some initial holders sell.

SA

This is a small issue of a small REIT that almost none of the market is even aware exists. There is a dearth of buyers and the selling volume overwhelms the tiny number of people aware the issue exists.

So the stock is sold into a void, resulting in a $19.20 price.

I don’t know whether or not the selling is done, but I am confident it is sold down to a point of great opportunity.

LANDP has a nearly identical fundamental value to LANDO yet trades almost $2 per share lower. When the initial selling ends and more of the market becomes aware that LANDP exists, I think it will trade in line with LANDO in the $21s.

So that is the play – It is available in the low $19s and pays a 7.81% dividend yield while one waits for it to normalize pricing around $21.

As with all preferreds, the durability of the income stream relies on the issuer being able to finance the dividend. I find Gladstone Land to be in great shape to do just that.

Fundamental stability

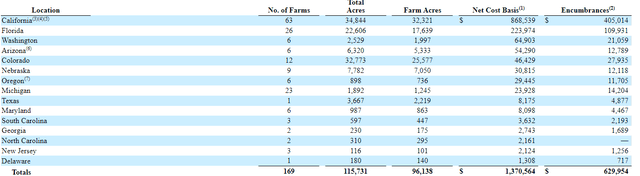

LAND owns a large portfolio of farmland across the U.S.

10-K

It is primarily specialty crops like fruits, vegetables, and nuts. Most are row crops planted seasonally, while others are permanent crops like orchards.

At any given time, there can be problems with a particular crop. For example, almonds have dropped considerably from their previous boom. However, with a diversified batch of agricultural production, the cycles of commodities in favor will tend to equalize those out of favor.

Beyond the crop diversity balancing out, LAND has yet another layer of protection in that it gets most of its revenues from triple net leases rather than the products themselves.

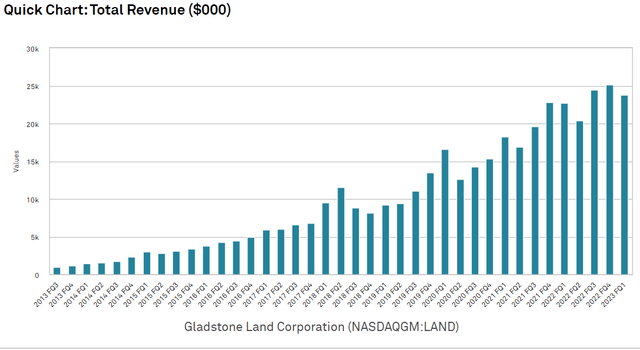

The result is stable revenues that grow over time.

S&P Global Market Intelligence

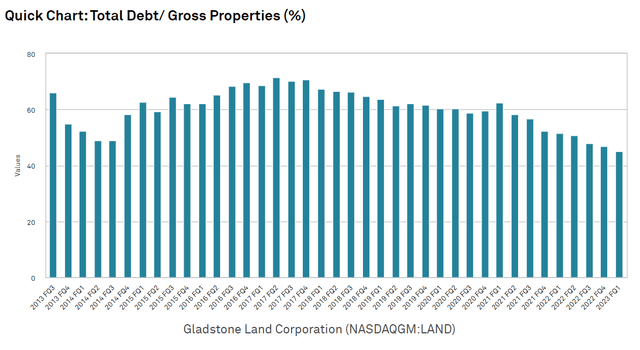

Note that while there has been organic growth, the revenue growth has been accelerated by LAND issuing equity to buy more assets. Over time LAND has increased its equity percentage in acquisitions which has significantly reduced its leverage ratios.

S&P Global Market Intelligence

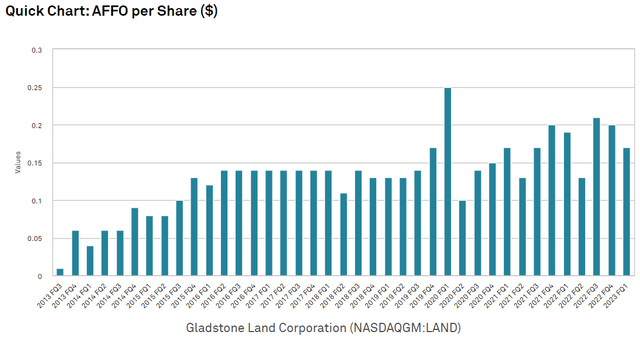

Through much of LAND’s history as a public company, it has traded at a premium to NAV. It had the privilege of issuing equity at anywhere from 110% of NAV to 200% of NAV, which made acquisitions highly accretive and resulted in substantial growth to AFFO/share.

S&P Global Market Intelligence

Based on third party appraisals, LAND’s farms are worth about $1.6B. They produce plenty of cash flow to cover the dividends and I view them as fundamentally long-term stable. As such, I view the preferreds as reasonably low risk.

That said, any investment comes with some risks, and I do want to discuss some of those related to LANDP.

Risks to investment

Due to the bond-like structure of preferreds with regard to the waterfall of distributions and liquidation preference, these securities are inherently indifferent to minor day-to-day risks like the pricing of a particular crop or a specific piece of land temporarily going unleased. Those sorts of things will affect the fundamental value of LAND common shares, but really don’t impact the preferreds.

Instead, preferred holders should worry about the bigger, more calamitous risks. These are much lower likelihood, but the losses are much bigger if they do happen. There are two main tail risks I will be watching as I hold my LANDP shares:

1) Geographical damage to California.

LAND has a substantial portion of its assets in California, which makes it susceptible to things that would destroy the value of California land. Drought, which has previously been an issue, is less of an issue now due to the ample rainfall recently received and LAND’s rather massive water reserves. Every conference call starts with David Gladstone discussing the number of acre feet in reserves LAND has, and it is substantial.

Instead, I would worry more about forest fires, tsunamis, and other events like that which seem to occur with unusual frequency in California. Perhaps there is risk from the San Andreas fault line as well. I am neither a meteorologist nor a geologist, so I have nothing intelligent to say about the likelihood of such a catastrophe. The point I am making is merely that if major damage happens to California’s land, it could hurt the preferreds

2) Long-term trade wars

While fresh fruits and vegetables are often consumed here in the U.S. some of LAND’s other specialty crops are exported around the world. Again, using almonds as an example, California produces the majority of the world’s almonds. Short-term trade wars such as what we have seen in the past are unlikely to affect LAND due to its triple net leases, but if there is a prolonged trade war the specialty crops associated with blocked commodities may have to be replanted to a different crop type which would incur substantial capex and potentially reduce revenues as well.

Tax advantaged dividend

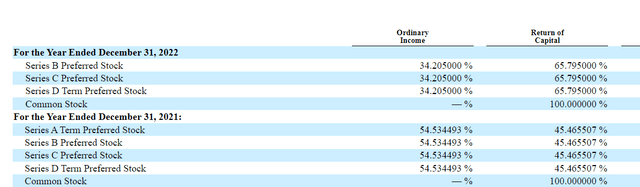

Historically, the LAND preferreds as well as the common have provided their dividends in a tax advantaged manner.

10-K

About 2/3 of the dividends from LANDP have been classified as return of capital, which defers the taxation until the position is sold. Such a distinction raises the functional after-tax yield of the security.

These classifications are subject to change going forward, but we have noticed a stickiness in how Gladstone companies classify their dividends over the years.

The bottom line

Relative to fundamental risk, LANDP provides an outsized 7.8% dividend yield. It also has room for $2 per share (roughly 10%) of near-term capital appreciation as its pricing moves in line with the nearly identical LANDO.