Kruck20

Real Estate Weekly Outlook

This is an abridged version of the full report and rankings published on Hoya Capital Income Builder Marketplace on May 12th.

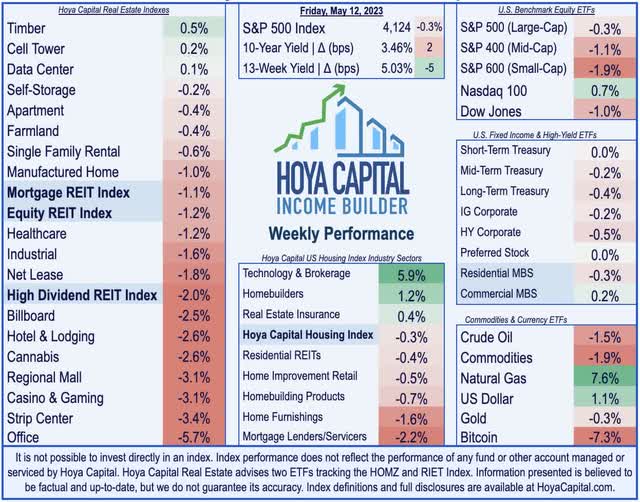

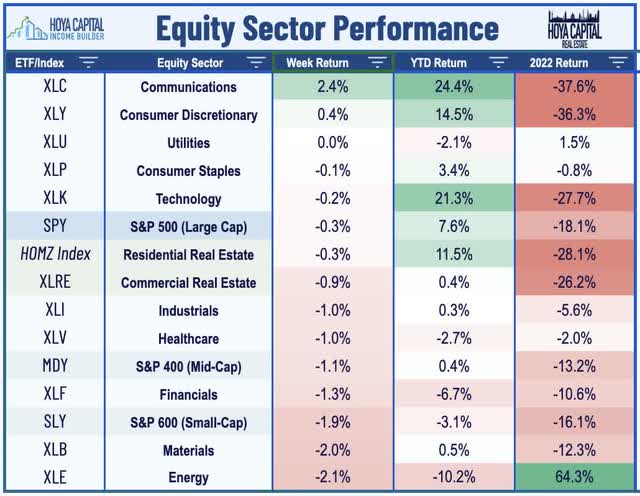

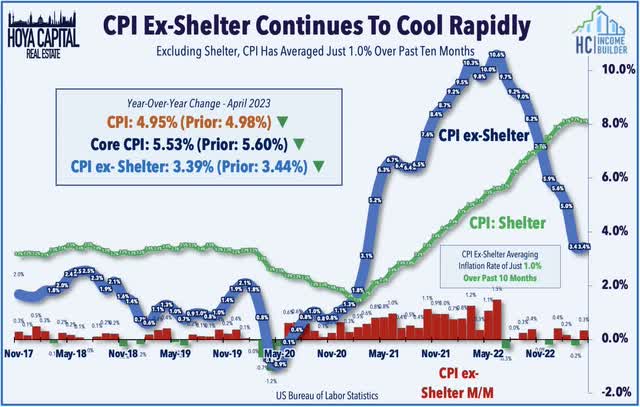

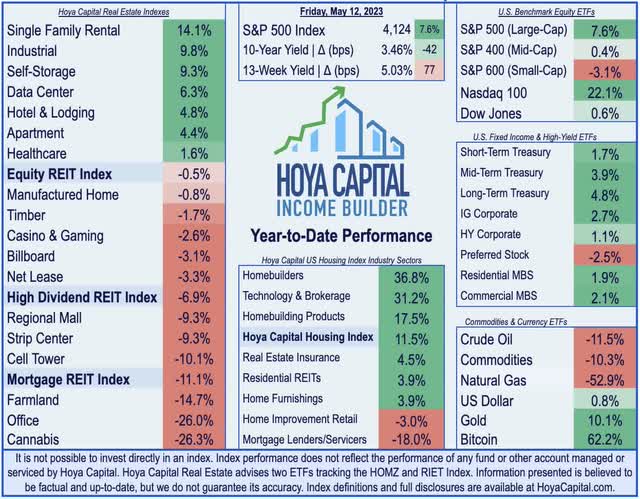

U.S. equity markets finished lower for a second-straight week as data showing an encouraging cooldown of inflationary pressures was offset by ongoing regional bank instability and an unresolved debt ceiling standoff. Hawkish rhetoric from Federal Reserve officials added to the angst as several FOMC voting members doubled-down on their view that further tightening may be necessary to contain inflation, even as the closely-watched CPI ex-Shelter Index – the metric that showed the surge in inflation nearly a year before the initial Fed rate hike – now shows inflation averaging just 1% since last July.

Hoya Capital

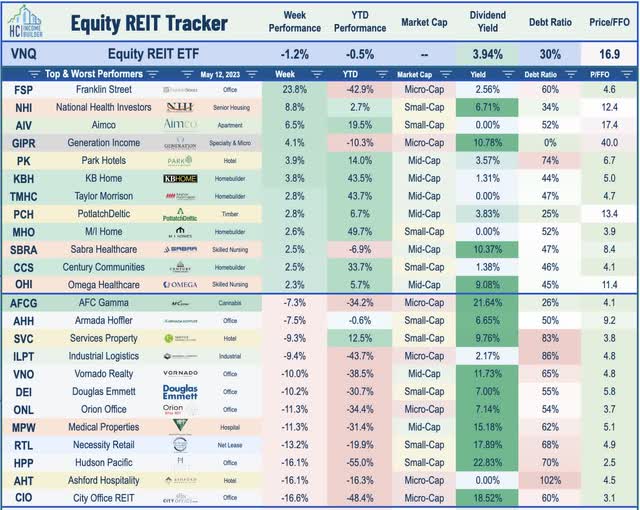

Declining for a second week after ending April at its highest levels of the year, the S&P 500 slipped 0.3% on the week, but the tech-heavy Nasdaq 100 gained nearly 1%. Smaller-cap companies lagged for a second week, however, with the Mid-Cap 400 declining 1.1% and the Small-Cap 600 dipping nearly 2%. Real estate equities were among the laggards this week as earnings season wrapped up with a mix of positive and negative reports. The Equity REIT Index declined 1.2% on the week, with 15-of-18 property sectors in negative territory, while the Mortgage REIT Index declined 1.1%. The Hoya Capital Housing Index continued to exhibit strength on data showing surprising buoyancy in both rent growth and homebuying demand.

Hoya Capital

Despite a slate of cooler-than-expected inflation reports and a surprisingly weak jobless claims print, benchmark interest rates ticked higher this week, with the 2-Year Treasury Yield climbing nine basis points to 4.0% while the 10-Year Treasury Yield rose two basis points to 3.46%. Swaps-implied probabilities of another Fed rate hike next month rose from near-zero last week to a roughly 1-in-6 chance after Fed governor Bowman commented that she has not seen “consistent evidence that inflation is on a downward path” while Chicago Fed President Goolsbee commented that “inflation is too high.” The historically swift tightening course – which has already resulted in three of the four largest bank collapses in history – has another lender firmly in its grips with PacWest (PACW) dipping another 20% this week – extending its YTD declines to 80%. The WTI Oil benchmark declined back towards its lows of the year around $70/barrel – down nearly 40% from last year – one of several major commodities that have seen historic annual price declines.

Hoya Capital

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

Hoya Capital

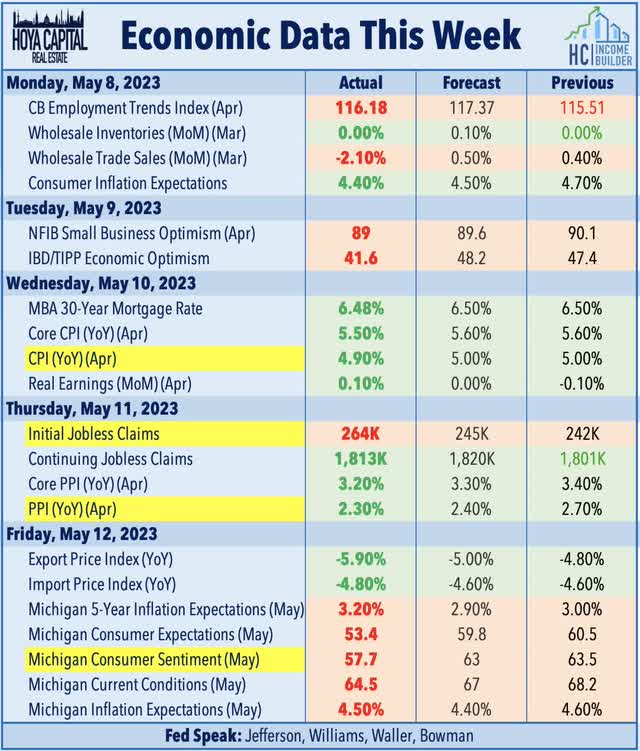

All eyes were on the Consumer Price Index report this week, which showed a continued moderation in inflationary pressures from the four-decade-high levels seen last summer. The headline CPI inflation rate moderated to 4.9% in April – below consensus estimates of a 5.0% print – as lower heating and food prices offset increases in gas prices, used vehicle prices, and rent costs. The delayed recognition of shelter inflation continues to heavily distort the headline and core metrics, however, resulting in a significant understatement of inflation from mid-2021-2022 and an overstatement of inflation since mid-2022. The metric that we watch most closely – CPI-ex-Shelter Index – showed a tenth straight month of cooling in the year-over-year rate. Since July, this CPI ex-Shelter Index showed an annual inflation rate of just over 1%.

Hoya Capital

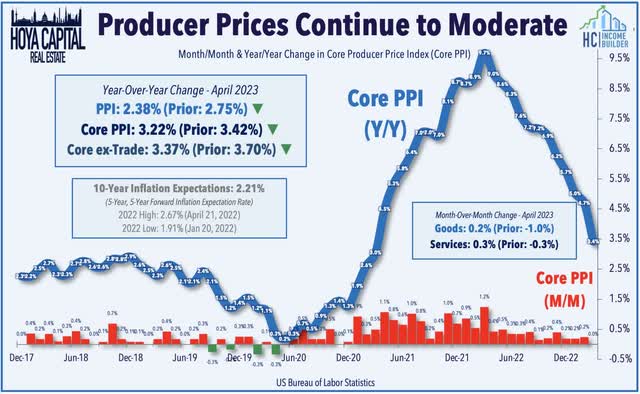

Later in the week, Producer Price Index data was also cooler-than-expected, showing that wholesale prices rose by just 2.3% year-over-year, the slowest annual increase since January 2021. The headline PPI posted a 0.2% month-over-month increase in April – below the 0.3% expected – while the 0.2% increase in Core PPI was also below estimates. Higher gasoline prices in April – resulting from the brief surge in oil prices following the surprise OPEC production cut buoyed both the CPI and PPI metrics – but retail gas prices are again on the retreat in May with prices now about 5% below their peaks in late April. Notably, the index for Final Demand Goods is now higher by just 0.8% on a year-over-year basis, down from the peak of 17.3% ten months prior.

Hoya Capital

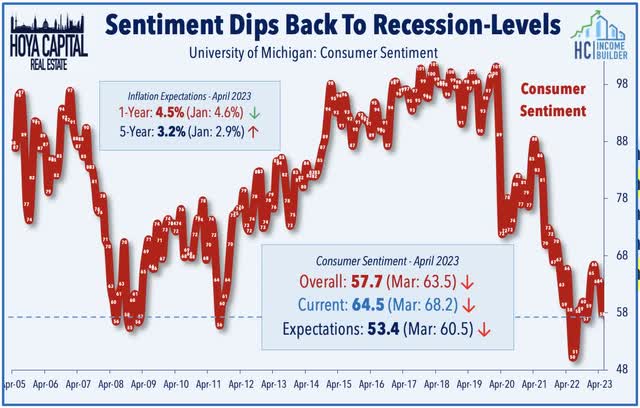

Interestingly, neither the Fed – nor consumers or small businesses- appear willing to believe that inflation is as contained as the recent evidence suggests. Data this week from the University of Michigan showed that consumers’ five-year inflation outlook climbed to 3.2%, the highest reading since 2011, up from 3.0% last month. The survey’s reading of one-year inflation expectations declined to 4.5% in May after jumping to 4.6% in April. Overall Consumer Sentiment slumped to a six-month low in May, meanwhile, which surveyors attributed to a “proliferation of negative news about the economy, including the debt crisis standoff.” Earlier in the week, the NFIB reported that its measure of Small Business Optimism declined to the lowest level in since January 2013. The IBD/TIPP Economic Optimism Index, meanwhile, also recorded a sharp decline in consumer confidence in May as confidence in federal economic policies fell to its lowest levels in nearly a year.

Hoya Capital

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

Hoya Capital

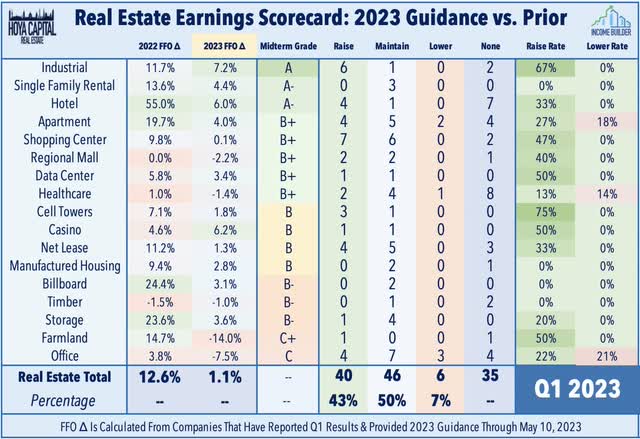

REIT earnings season wrapped up this week with the final two dozen reports, which we discussed in our two-part Earnings Recap series – Winners of REIT Earnings Season and Losers of REIT Earnings Season. Obscured by continued office pain, REITs delivered surprisingly strong first-quarter results. Of the 92 equity REITs that provide full-year Funds from Operations (“FFO”) guidance, 40 (43%) raised their full-year earnings outlook, while 6 (7%) lowered guidance – an FFO beat rate that exceeded the historical REIT average of 40% for the first quarter. The “beat rate” for the critical property-level metric – same-store Net Operating Income (“NOI”) – was actually slightly better, with over 50% of REITs providing upward revisions. Surprisingly buoyant rent growth – particularly across the residential, industrial, hospitality, technology, and retail sectors – was the prevailing theme of these upward revisions.

Hoya Capital

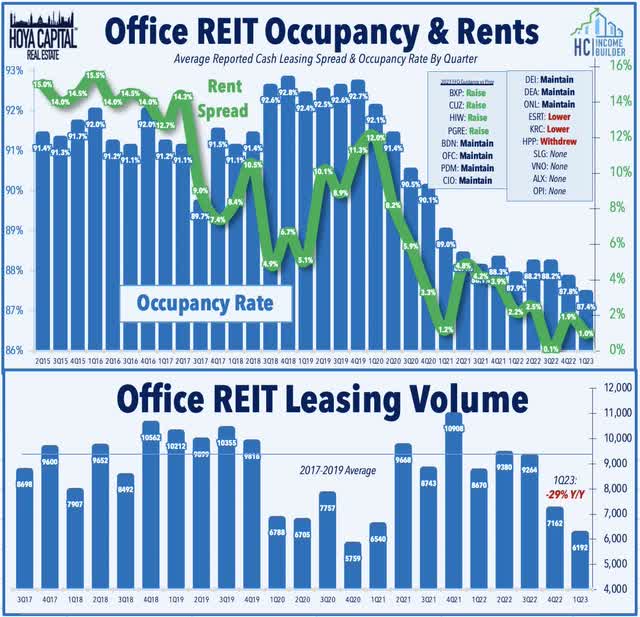

Office: Among the losers of earnings season, office REITs dipped another 6% this week after another soft slate of reports. West Coast-focused Hudson Pacific (HPP) dipped 15% this week after it withdrew its guidance and reduced its dividend by 50%, becoming the seventh office REIT and 15th overall to reduce its dividend this year. HPP noted that it signed 344k SF of space in Q1 – down about 30% from a year earlier – at rental rates that were 4.9% below prior rates. HPP – which owns a portfolio consisting primarily of traditional office properties in San Francisco and Los Angeles, markets that were among the strongest before the pandemic driven by robust tech hiring – cited the impact of the Hollywood writer’s strike in its guidance withdrawal, which impacts its studio segment, which represents about 10% of its portfolio. Data from Kastle Systems – which tracks office utilization rates – shows that San Francisco remains the hardest-hit market by the pandemic-driven WFH era. At the same time, many Sunbelt and secondary markets are seeing mid-week utilization rates at around 75% of pre-pandemic levels, San Francisco has yet to crack 50%. Orion Office (ONL) dipped 11% after reporting in-line results and reiterating its guidance calling for a 12% decline in FFO this year.

Hoya Capital

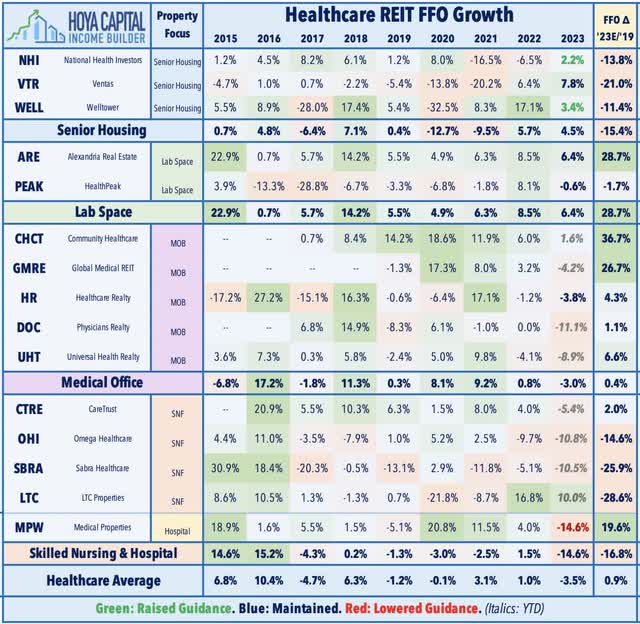

Healthcare: Hospital owner Medical Properties Trust (MPW) – one of the most heavily shorted REITs – dipped 9% after the Wall Street Journal reported that two of its largest hospital tenants – Steward Health and Prospect Medical – have hired financial advisors for debt refinancing. Steward accounts for roughly 27% of MPW’s revenues, while Prospect accounts for 10% of revenues. Steward reportedly hired Guggenheim Securities to refinance asset-based loans due at the end of this year, and commented to the WSJ that it is “customary to refinance any asset-based credit line well before the maturity date, and is doing so from a position of strength.” This year, Steward repaid $100M of a $150M loan from MPT using proceeds from the sale of a portfolio of hospitals in Utah. Prospect is being advised by Houlihan Lokey on a refinancing effort. Missed rental payments from Prospect is the driver of an expected 15% decline in FFO this year, per MPW’s most recent guidance.

Hoya Capital

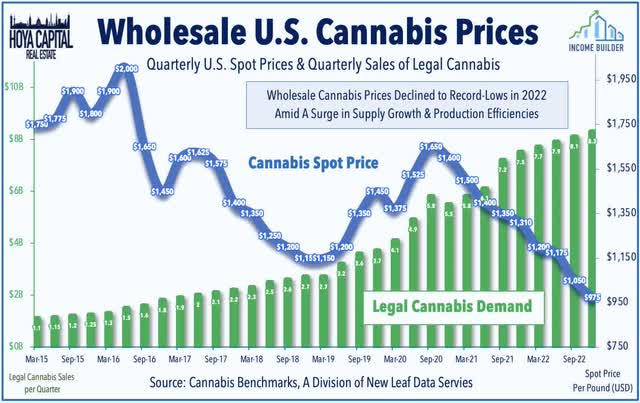

Cannabis: As noted in our earnings recap, commodities disinflation was a major theme for the agriculture-focused REIT sectors – including cannabis REITs – as tenant operators have been smoked by plunging wholesale cannabis prices, tightening credit availability, and setbacks on federal legalization. Innovative Industrial (IIPR) – the largest of five cannabis REITs – was among the better performers this week after reporting that its rent collection rate improved to 98% in Q1 – up from 94% in Q4 – with no additional tenants named as non-payers. The improved collection rate in Q1 was driven primarily by applying security deposits on leases of Green Peak, Parallel, and Holistic and through the sale of its properties leased to Vertical. NewLake Capital (OTCQX:NLCP) dipped 6% on the week, however, after noting that its rent collection dipped to 90% in Q1, noting that Revolutionary Clinics (10% of its rental income) has not paid rent in 2023, citing “two unfortunate harvest related issues in 2022 and delays in opening adult use dispensaries.” AFC Gamma (AFCG) also declined 7% this week after downgrading the risk rating on its largest loan, which is currently paying a portion of the interest in kind, citing “difficulty raising additional equity capital.” Chicago Atlantic (REFI) traded flat after reporting in-line results and affirming its full-year outlook.

Hoya Capital

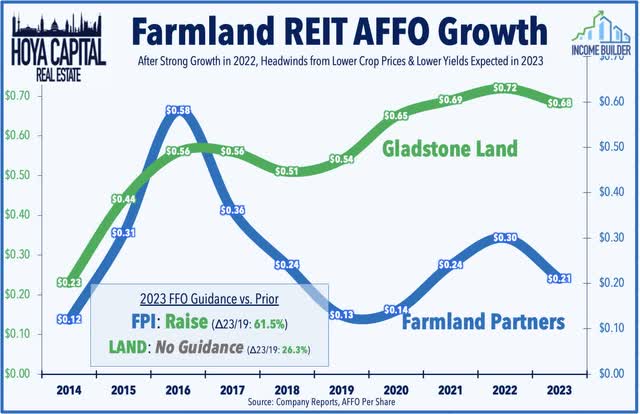

Farmland: Sticking in the agriculture space, Gladstone Land (LAND) dipped 2% this week after reporting mixed results, noting that its tenant rent collection issues have persisted amid headwinds from lower crop prices and the impacts of flooding in California. LAND reported rent collection issues from 3 of its 90 tenants – one of which was evicted – while the other two are late in their rent payments. One of the hottest inflation hedges, farmland REITs have been slammed over the past six months amid a substantial pull-back in commodities prices from their peaks last May. The Bloomberg Grains Index is now lower by about 40% from last year and is now slightly below the average from 2015-2020. Earlier this earnings season, Farmland Partners (FPI) reported mixed results, noting that it still expects its FFO to decline 30% this year driven by a “triple-whammy” of headwinds: lower crop yield due to drought conditions, low crop price due to normalization effects after a sharp spike early in the Ukraine-Russia war (with particularly sharp price declines on specialty crops), and significantly higher interest rate expense due to FPI’s elevated level of variable rate debt exposure.

Hoya Capital

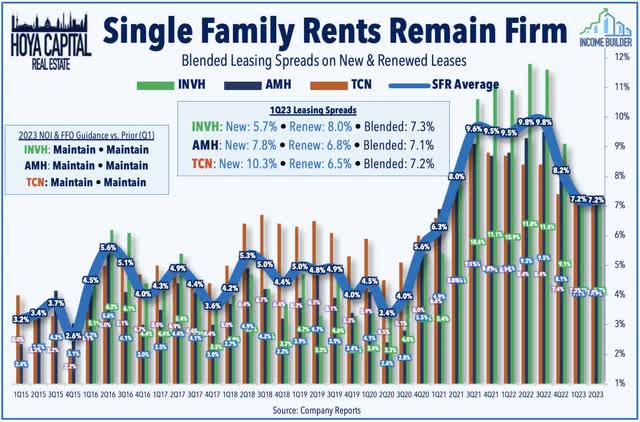

Single-Family Rental: There were some notable upside standouts this week. Tricon Residential (TCN) – the third largest SFR REIT – gained 1% this week after reporting solid results highlighted by buoyant leasing spreads, consistent with the theme we’ve observed across residential REIT earnings reports over the past month. TCN noted that it achieved blended rent growth of 7.2% in Q1 comprised of new lease rent growth of 10.3% and renewal rent growth of 6.5%. Rent growth actually accelerated in early Q2 as TCN reported blended spreads of 7.6% in April, comprised of 11.9% growth on new leases and 6.5% growth on renewals, while same home occupancy was stable at 97.2%. TCN commented, “Housing in America has a math problem – demographics are driving demand for single-family homes from both buyers and renters; meanwhile the supply of new homes is not keeping pace.”

Hoya Capital

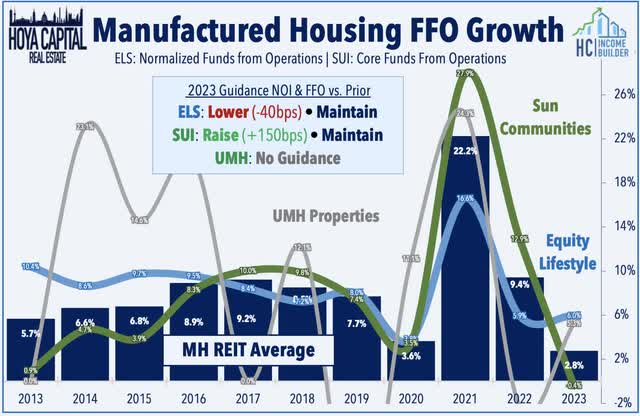

Manufactured Housing: UMH Properties (UMH) – the smallest of three MH REITs – advanced 2% this week after reporting solid results, noting that its AFFO per share rose about 5% from last year. UMH – which does not provide full-year guidance – reported same-store NOI growth of 5.6% in Q1 as a 6.1% increase in revenues was partially offset by a 6.8% increase in expenses. UMH commented, “One year ago, our results were impacted by a lack of inventory for sale and rent which resulted in limited revenue growth. We now have new home inventory in place that will allow us to drive significant earnings growth this year.” Earlier this year, UMH raised its dividend by 2.5%, marking a third-straight year of dividend growth after going 13 years without a dividend raise. Speaking of residential REIT dividend hikes, apartment Independence Realty (IRT) gained 1% this week after hiking its dividend by 14%.

Hoya Capital

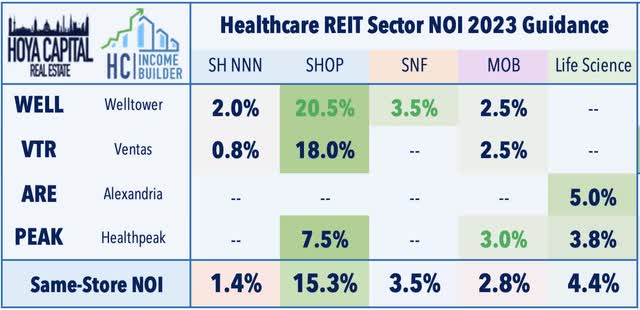

Healthcare: Back in the healthcare space, small-cap healthcare REIT National Health Investors (NHI) rallied 9% this week after reporting strong results and raising its full-year guidance. Driven by improved rent collection, lower executive compensation, and an expected recovery in its Senior Housing Operating Portfolio (“SHOP”), NHI now expects full-year FFO growth of 2.2%, up from its prior outlook calling for a 0.7% decline. NHI reported that total occupancy improved year-over-year by 400 basis points to 81.3% on a 440 basis point increase in senior housing and a 350 basis point increase in skilled nursing. Senior housing REIT Ventas (VTR) slipped 3% after reporting in-line results and maintaining its full-year outlook calling for FFO growth of 7.8%. Despite occupancy rates that remain about ten percentage points below pre-pandemic norms, senior housing operators have wielded significant pricing power in recent quarters as rental rates “catch up” with rents of comparable non-age-restricted multifamily units. VTR reported that its Revenue Per Occupied Room (“RevPOR”) increased by nearly 7% in Q1 – its strongest in a decade. Importantly, labor expenses moderated as well following a period of crisis-level staffing issues in 2022. VTR noted that the more-costly third-party contract labor component has been reduced by 59% year-over-year. VTR affirmed its same-store NOI outlook for its Senior Housing Operating portfolio (“SHOP”) of 15% to 21% NOI growth, driven by “a significant occupancy ramp throughout the year and muted new supply.”

Hoya Capital

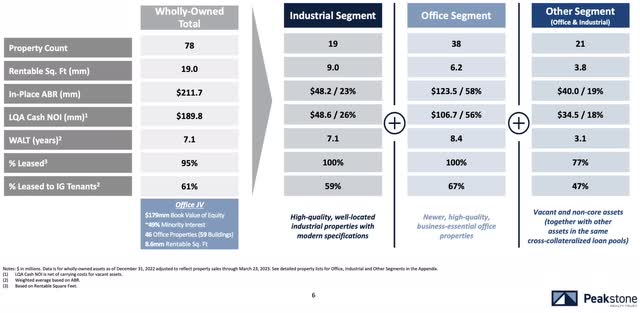

Net Lease: Peakstone Realty Trust (PKST) – formerly known as Griffin Realty Trust – gained more than 10% this week after reporting its first earnings results as a public-listed company following its direct listing last month, a process that was marred by uncertainty over its share count resulting from a reverse stock split and preferred share redemption concurrent with its listing. PKST traded below $20 in its first week after the listing, but climbed to as high as $43/share in mid-April before retreating back below $20 this week. Peakstone is a net lease office and industrial REIT that owns 78 properties across 24 states. Roughly 70% of PKST’s Net Operating Income (“NOI”) is derived from its portfolio of 55 office properties, while 30% of NOI comes from its portfolio of 23 industrial properties. PKST reported that its FFO was $0.37/share – $1.48 annualized – which implies a Price-to-FFO of roughly 13x based on its $20 current share price.

Hoya Capital

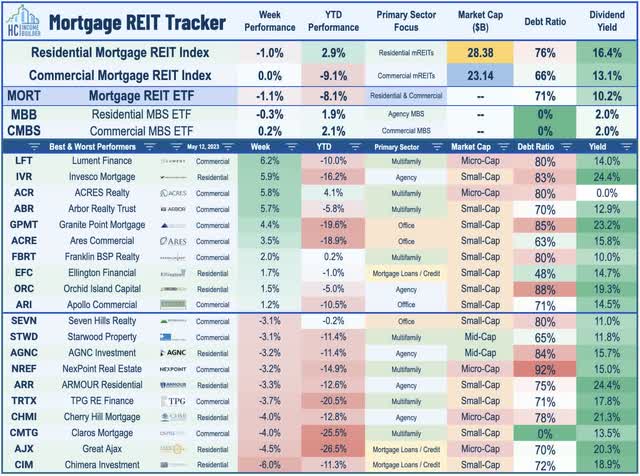

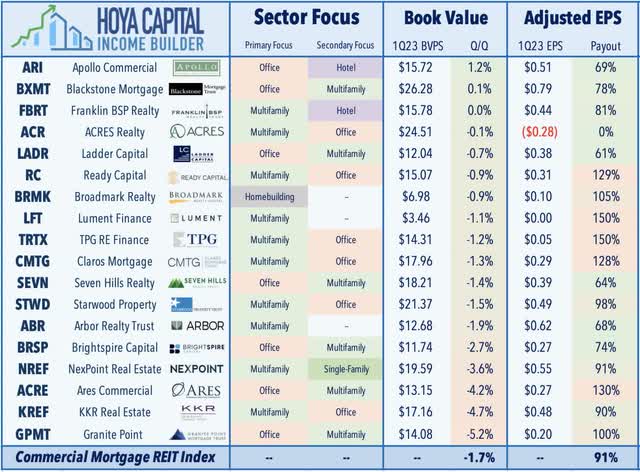

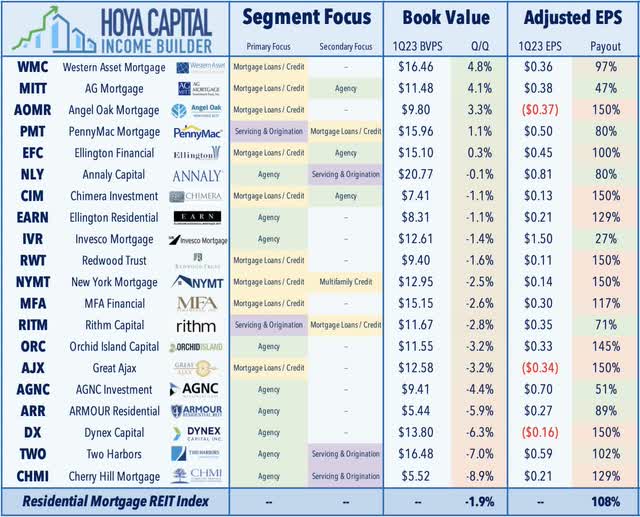

Mortgage REIT Week In Review

Mortgage REITs finished mixed on the week as we heard first-quarter earnings results from the final dozen mREITs. As noted in our Earnings Recap, residential mREITs reported an average decline in BVPS of 1.9% in Q1, while commercial mREITs reported a 1.8% average decline. Within the residential mREIT sector, credit-focused mREITs fared better in Q1 – reporting a slight increase in their Book Value Per Share (“BVPS”) while agency-focused REITs reported an average decline in their BVPS of about 5% in Q1. Dividend coverage was stronger for commercial mREITs with about 75% of commercial mREITs covering their dividend with Q1 adjusted EPS while just 50% of residential mREITs covered their dividend, leading to dividend reductions from Redwood Trust (RWT), Great Ajax (AJX), and Cherry Hill (CHMI). Based on earnings commentary, other REITs that were over 100% payout were more confident in their ability to maintain their dividends.

Hoya Capital

Beginning with the commercial mREITs – small-cap Lument Finance (LFT) – which focuses primarily on multifamily lending – rallied 6% this week after reporting decent results, noting that 99% of its loans – including all of its residential loans – are performing and noted that its BVPS was roughly flat in Q1. Granite Point (GPMT) – which has roughly a third of its loan book backed by office properties – gained 4% after reporting adjusted EPS of $0.20/share – covering its $0.20/share dividend – and noted that four of its five non-performing loans are office properties. Also among the leaders, Arbor Realty (ABR) rallied another 6% this week after reporting strong results the prior week and raising its dividend by 5% to $0.42/share (15.4% dividend yield), the fourth mortgage REIT to raise its dividend this year. Ready Capital (RC) gained 0.2% after reporting distributable EPS of $0.31/share – shy of its $0.40/share dividend – but noted that its BVPS was roughly flat in Q1 at $15.07. Broadmark (BRMK) reported adjusted EPS of $0.10/share – and noted that its May dividend of $0.035/share would be its final dividend paid, assuming the completion of the merger with Ready Capital by June 1.

Hoya Capital

On the residential side – Invesco (IVR) advanced 6% after it reported adjusted EPS of $1.50/share – covering its $0.40/share dividend (which was reduced from $0.65 in March) – while noting that its Book Value Per Share (“BVPS”) declined about 1% in Q1 to $12.61. Ellington Financial (EFC) gained 2% after it noted that its BVPS increased 0.3% in Q1 and reported distributable EPS of $0.45/share – covering its $0.45/share dividend. On the downside this week, Cherry Hill (CHMI) dipped 4% after it reported that its BVPS dipped nearly 9% in Q1 to $5.52 – the worst decline in the mREIT sector – and commented that it expects to reduce its dividend to “a yield of 13% to 15% of our current book value.” Using its end-of-quarter book value, this guidance would imply only a slight reduction to $0.25/share from its current rate of $0.27/share. Ellington Residential (EARN) slipped 2% after reporting adjusted EPS of $0.21/share – shy of its $0.24/share dividend – while noting that its BVPS declined 1% in Q1 to $8.31.

Hoya Capital

2023 Performance Recap & 2022 Review

Through nineteen weeks of 2023, the Equity REIT Index is now lower by 0.5% on a price return basis for the year, while the Mortgage REIT Index is lower by 11.1%. This compares with the 7.6% gain on the S&P 500 and the 0.4% advance for the S&P Mid-Cap 400. Within the real estate sector, 7-of-18 property sectors are in positive territory on the year, led by Single-Family Rental, Industrial, and Self-Storage REITs, while Office REITs have lagged on the downside. At 3.46%, the 10-Year Treasury Yield has declined by 42 basis points since the start of the year – well below its 2022 closing highs of 4.30%. The US bond market has stabilized following its worst year in history as the Bloomberg US Aggregate Bond Index has gained 3.3% this year.

Hoya Capital

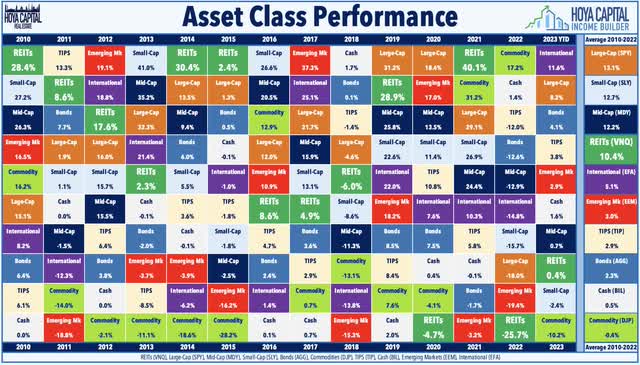

There were few places to hide across financial markets in a historically brutal year for investors in 2022 that wiped out nearly a fifth of global financial wealth. The typically-steady US bond market delivered its worst year in history in 2022 with a loss of 13.01% on the Bloomberg US Aggregate Bond Index, which is over 4x larger than the previous worst year back in 1994 (-2.9%). Closing at 3.88%, the 10-Year Treasury Yield surged 237 basis points from the start of the year. Among the ten major asset classes, Commodities (DJP) was the only segment to see positive inflation-adjusted returns for the year. After leading the charge in the prior year, REITs finished in the basement of the performance tables among the ten major asset classes on a total return basis with declines of roughly 25%. Performance trends have largely reversed this year, with Commodities now in the basement in 2023.

Hoya Capital

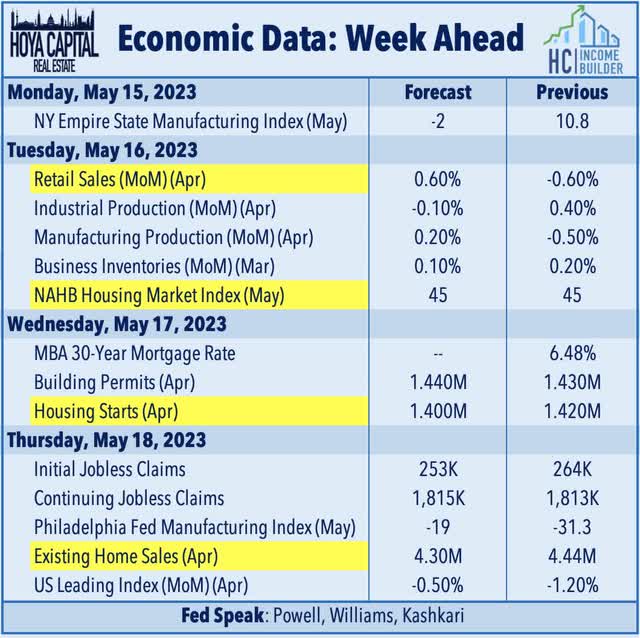

Economic Calendar In The Week Ahead

The state of the U.S. housing market will be in focus in the week ahead. The busy week starts on Tuesday with NAHB Homebuilder Sentiment data for May which looks to extend its streak of four-straight monthly increases after dipping to near-15-year lows late last year. On Wednesday, we’ll see Housing Starts and Building Permits data for April, which are expected to accelerate slightly after a stronger-than-expected March. On Wednesday, we’ll be watching mortgage-market data, specifically the MBA Purchase Index, which climbed to levels that were 22% above their February lows last week. We’ll see Existing Home Sales data on Thursday which is expected to decline slightly in April to a 4.30 million seasonally-adjusted annualized rate – up from the lows in January of 4.0 million, but well below the 2021 highs of over 6.5 million. We’ll also be watching Retail Sales data on Tuesday, weekly Jobless Claims data on Thursday, and a busy slate of PMI data throughout the week.

Hoya Capital

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.