Highlights

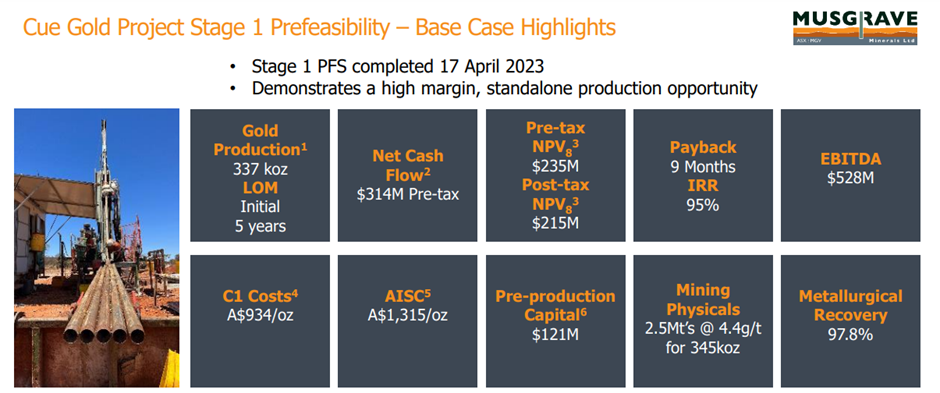

- Musgrave Minerals concluded the Stage 1 Prefeasibility Study (PFS) on its tenure at the Cue Project in April 2023.

- The Stage 1 PFS results reflect a high-margin standalone production opportunity for MGV.

- The company raised AU$2.1 million upon successful completion of a Share Purchase Plan in January this year.

- Thanks to constant efforts, new prospects and discoveries are being developed into resources by MGV.

One of the leading gold explorers and emerging developers in Australia, Musgrave Minerals Ltd (ASX: MGV) recently shared a round-up of the firm’s financial and operational activities at its resources based in Sydney. The company asserts that it is committed towards achieving exploration and development success so as to establish a sustainable and profitable gold mining business.

The Cue Project

The company considers the Cue Project to be a high-margin gold mine in the mining jurisdiction with excellent infrastructure.

The Cue Project has a strong strategic and project appeal as it is surrounded by huge gold producers, such as Westgold, Ramelius, Silver Lake, besides having great road connectivity. It holds in it high-grade, near surface, free milling gold.

Image source: Company presentation

Cue Gold Project Stage 1 Prefeasibility – Opportunities

With continued drilling and interpretation of the deposit geology, lot of information about high-grade trends & resource conversion has been gathered.

Thanks to constant efforts, new prospects and discoveries are developed into resources, like Waratah and Amarillo.

The company is conducting drilling campaign to change Inferred mineralisation into Indicated Resources. Also, further drilling is being done on present deposits for more CGP resources for underground mining.

MGV is also carrying out early-stage exploration at Mt Magnet south, drill campaigns at new prospects to expand its resource base.

Image source: Company presentation

Financial metrics of the company

Musgrave had AU$11.8M in cash at the end of the March 2023 quarter. Approximately 591,207,949 fully paid ordinary shares (ASX: MGV) and 25,170,000 unlisted options at different exercise prices and expiry dates are part of its capital structure.

The company could raise AU$2.1 million (before costs) upon successful completion of a Share Purchase Plan (SPP) in January 2023.

As part of its investment strategy, Musgrave has invested in 12.5 million shares worth AU$0.7 million in Legend Mining Ltd as per a legend share price of AU$0.046 per share. Musgrave also holds 1,308,750 ordinary shares in Cyprium Metals worth AU$0.14 million based on a Cyprium share price of AU$0.11 per share.