JamesBrey

Today, almost everything we eat comes from farms one way or another, yet investors have very few ways of investing into farms for income. Sure there are some companies that sell goods and services to farmers, such as Deere (DE) which sells farmers tractors, machinery, and heavy equipment or CF Industries (CF) which sells farmers fertilizers but there are very few stocks that actually generate income directly from farms themselves.

Often times people bring up Farmland Partners (FPI) which is a nice choice but its yield is only about 2% which won’t satisfy most income investors.

There is actually one stock which generates income from farms and has a high yield and I will talk about this particular stock for the rest of this article. I am talking about Gladstone Land Corporation’s preferred shares (NASDAQ:LANDO). This stock currently has a nice yield approaching 7% which will satisfy many investors so let us take a deeper dive.

Gladstone Land Corporation’s regular shares (LAND) have been around since 2013 and they have a dividend yield of 3.6% and the preferred shares with a yield of (almost) 7% have been around for 3 years so it’s a relatively new stock. It was originally launched at $25 per share with a yield of 6% but the yield is now closer to 7% because the share price dropped last year as a result of the bear market we had last year and never fully recovered. The fund pays $1.50 per year (monthly payments of 12.5 cents) and never missed a payment so far.

The company doesn’t actually operate farms though. It buys farmland and leases them out to farmers who pay them a monthly rent. The company currently owns 169 farms in 15 states totaling 116k acres and 45k acre-feet of banked water in California. Currently, all of the company’s farmland is leased with an occupancy rate of 100% and zero delinquencies so far which is a very impressive metric for a REIT to have. Also, it’s important to note that the average remaining rent period for its farms is currently 6.2 years which will provide the company with reliable income for years to come.

The company doesn’t focus on any single farming product. Its main focus is divided into fresh annual produce, permanent crops (nuts and berries) and grains so it covers almost all produce types (except of course animal products) that farms offer in America.

Not only is the world population growing rapidly but also people are eating more on average than they ever did in human history. In developed countries, the average calorie intake kept rising over the years and we are seeing the same trend in developing nations as well. Food production is also a great hedge against inflation since food prices are one of the first items to increase during an inflationary period as we’ve seen in the last 2 years. Add to this the fact that they are is only a finite amount of farm land available in the world which makes each available land more and more valuable over time.

Another advantage of investing into farmlands (especially through preferred shares) is lack of volatility. Historically, farm lands and farm associated investments tend to have less volatility than the average stock because people have to eat regardless of whether we are in a recession or not. People don’t stop eating and farms don’t stop growing food when the economy gets tough, which means the farm business is one of the least cyclical business types in the world.

One thing I especially like about Gladstone is that they have a dedicated team of experts who are good at identifying valuable lands. They spend hours, days, weeks, months studying and analyzing different farm lands and only buy those that offer the most value for investors. These experts look at not only the location, weather, and other characteristics of each land but also availability of water, long-term sustainability, local government policies, availability of agricultural labor in the area, and many other factors. The company is actually very conservative with acquiring new lands and takes its time to make sure that each additional farm they buy will add to profits right away. The company is expected to add only a handful of new farms to its portfolio per year for the foreseeable future in order to make sure that every farm being bought is highly productive and profitable.

One caveat with this stock is that since it’s a preferred share, don’t expect a lot of upside in the share price. The stock’s share price could rise back to its original issue price of $25 but not much more than that. The appeal of this stock is the constant, reliable, and safe dividend yield of (close to) 7% and this play is purely for dividend investors. Those looking more for price appreciation and less for dividends should buy the same company’s regular shares which offer more upside but roughly half the yield (about 3.5%). It all depends on your investment goals and priorities. Some investors may also choose to buy a half position of each so that they are getting both upside potential as well as a high yield. Buying half-half would give you a yield of about 5% which is not too bad.

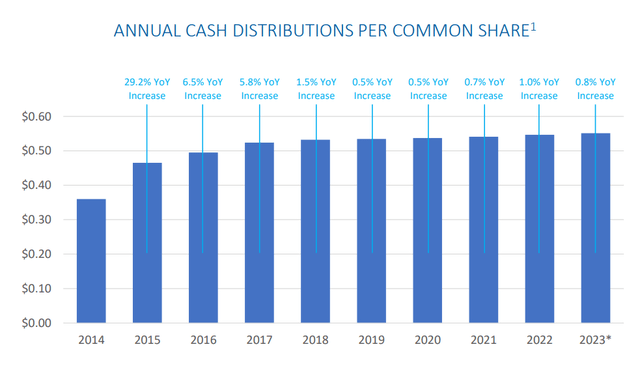

Another thing to note is that preferred dividends will stay the same for the life of the stock ($1.50 per year) but common stock may actually see dividend hikes along the way. As a matter of fact, the company’s common stock has raised dividends 29 times in the last 32 quarters for a total raise of 52% so even though preferred shares have a higher yield right now, we could see common shares have a higher yield sometime in the future if this trend continues.

Gladstone Investor Relations

Conclusion

These days it’s very difficult to find a farming stock with a nice yield even though we get virtually all of our food from farms and they are an excellent source of income. LANDO seems to fill this gap where it offers a reliable, safe, and monthly dividend with annual yields close to 7%. I like the company’s regular shares as well and investors can mix and match these two stocks in any percentage they want in order to get the right mix of growth and income they desire that meets their personal long-term goals.