fotokostic

Gladstone Land Corp is one of the few public vehicles that allow retail investors to access the farmland asset class. Historically, farmlands protect investors against inflation due to scarcity value. After a post-COVID boom and bust, valuation on LAND shares are now back to attractive levels. Investors should take advantage of the near term discount to accumulate shares in this uncorrelated asset class.

Company Overview

Gladstone Land Corp (NASDAQ:LAND) is a publicly traded REIT specializing in acquiring and owning farmland across the United States. The company’s primary focus is on acquiring annual fresh produce (i.e. fruits and vegetables) and permanent crop (i.e. blueberries and nuts) farms, as these tend to be superior investments compared to commodity crops (i.e. corn and wheat). Fresh produce and permanent crops typically enjoy higher profitability and rental incomes and lower price volatility. In addition, these crops have lower storage costs and are typically closer to major urban centers, which give these farmlands higher development potential.

Figure 1 – LAND overview (LAND investor presentation )

Gladstone currently owns 169 farms with 116,000 total acres of farmland, in addition to 45,000 acre-feet of banked water in California. LAND typically leases its farms to farmers on a triple-net basis, meaning the farmer pays rent, insurance, maintenance, and taxes.

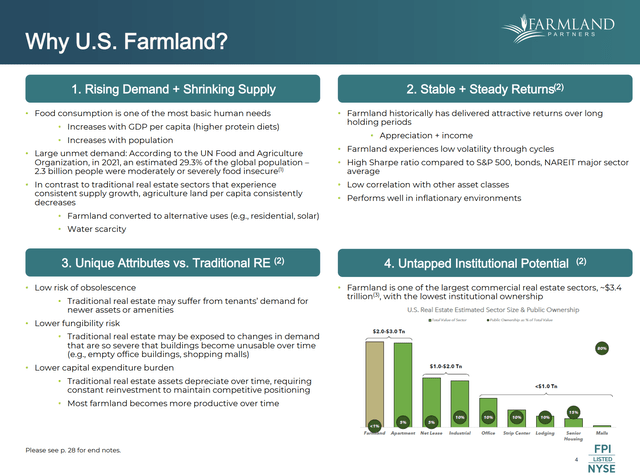

Farmland, for those not aware, is one of the largest commercial real estate sectors, on par with apartments and ahead of industrial properties in terms of sector size (Figure 2). However, ownership is very fragmented, with Gladstone estimating that 86% of farms are owned by small farmers with a lot of consolidation potential as the average farmer is 58 years old.

Figure 2 – Farmland is a huge asset class (FPI investor presentation )

Strong Growth Supports Financial Returns

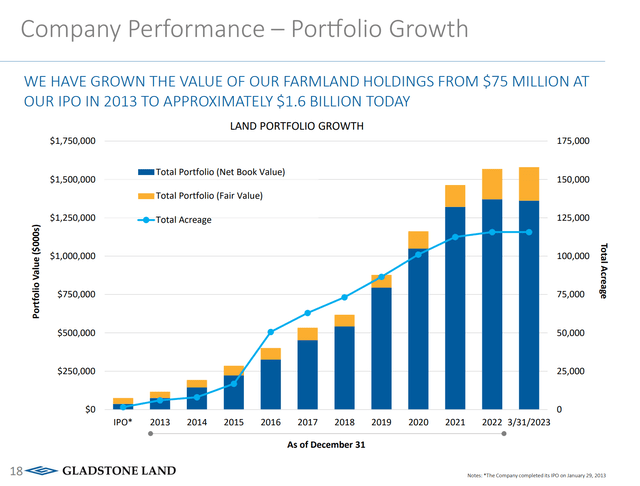

Gladstone Land Corp. is one of the few public vehicles allowing retail investors access to the farmland asset class. LAND has grown its portfolio 20x through acquisitions from $75 million at IPO in 2011 to approximately $1.6 billion currently (Figure 3).

Figure 3 – LAND has grown assets 20x since IPO (LAND investor presentation )

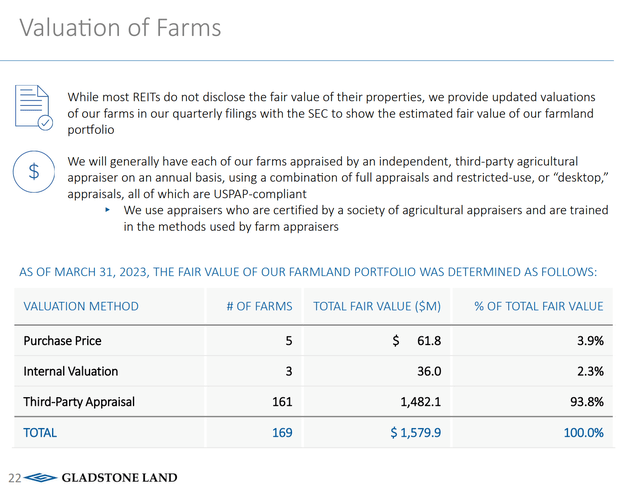

Unlike other REITs that do not disclose the fair value of their properties, Gladstone prides itself on transparency and provides updated valuations (93.8% third-party appraisal) at least on an annual basis (Figure 4).

Figure 4 – LAND valuation (LAND investor presentation )

As of March 31, 2023, LAND’s portfolio had an estimated $1.6 billion value, with 93.8% of valuation supported by third-party appraisals and 3.9% supported by recent purchase prices.

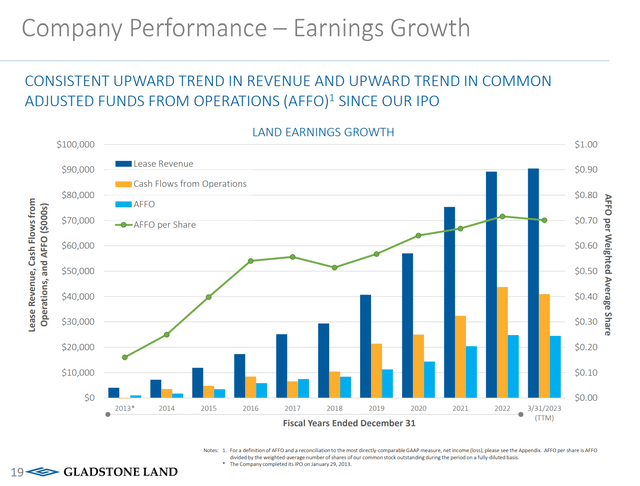

As Gladstone’s portfolio has grown, its revenues and cash flows have also scaled higher, with lease revenues reaching $90 million on a trailing 12 month basis and AFFO / share almost quadrupling from $0.19 in 2013 to $0.72 in 2022 (Figure 5).

Figure 5 – LAND financials have scaled with growth (LAND investor presentation )

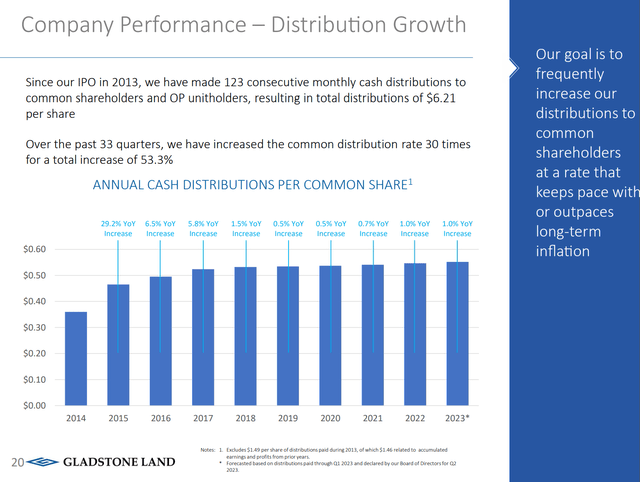

Similarly, LAND’s distribution to unitholders have increased from $0.36 / share in 2014 to $0.55 / share in 2022 (Figure 6).

Figure 6 – LAND dividends have grown every year (LAND investor presentation )

Near-Term Performance Marred By Tenant Issues

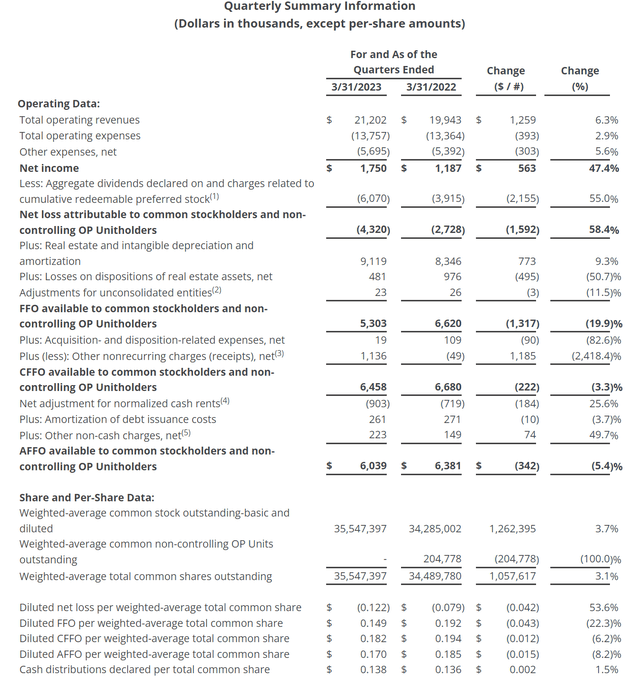

For the quarter ended March 31, 2023, LAND reported $21.2 million in operating revenues (+6.3% YoY) and $1.8 million in net income (+47.4% YoY). However, after preferred stock dividends and charges-offs of redemption expenses, net loss to common stockholders increased 58.4% YoY to $4.3 million (Figure 7).

Figure 7 – LAND Q1/23 financials (LAND investor presentation )

In the near-term, LAND’s operating performance has been marred by tenant issues as the company reported that LAND had to take over operations of one farm as the tenant had run into financial issues. In addition, LAND had two tenants that were late in paying their rents, partly due to “excess supply” of almonds in the markets. The company have placed these late paying properties into non-accrual, meaning revenues are only recorded on a ‘cash basis’ when they are received.

The YoY impact to LAND’s operations as a result of these self-operated and non-accrual properties was a decrease in net operating income of approximately $300,000 in the first quarter.

But Land Value Remains

Although some tenants have run into financial trouble, the underlying land value of Gladstone’s farms remain. In fact, management commented that they expect to sign a new lease on the self-operated farm sometime in Q2/2023. Furthermore, on one of the late paying farms, while the existing tenant is only making partial payments to Gladstone, a prospective grower is interested in leasing the farm, so Gladstone expects to sign a new lease on this property in the next few months.

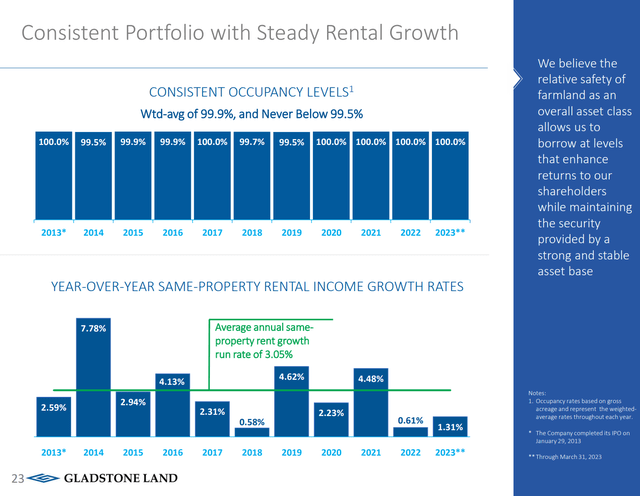

Overall, Gladstone’s farms consistently enjoy near full occupancy and have seen positive YoY same property rental income growth rates for the past decade, which suggest demand for renting the farms remain robust (Figure 8).

Figure 8 – LAND enjoys high occupancy (LAND investor presentation )

Cheap On NAV Valuation

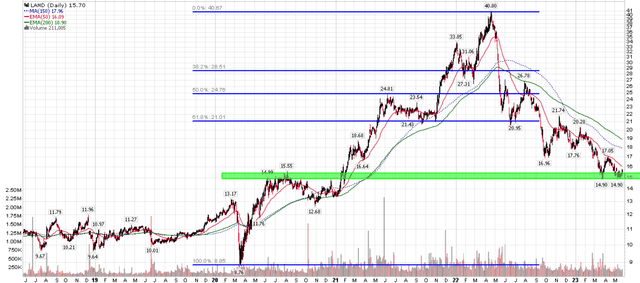

According to Benjamin Graham, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” This is certainly true for Gladstone’s stock valuation, as it has gone through an enormous run-up in valuation in the aftermath of the COVID-pandemic. At the time, there was a perceived shortage of food supplies, so investors were happy to bid over 2x NAV for shares of Gladstone (Figure 9).

Figure 9 – LAND price to NAV valuation (Author created with price chart from stockcharts.com and data from company reports)

However, less than 18 months since valuations peaked at 2.3x in December 2021, Gladstone’s shares are currently trading hands at 0.9x of its latest NAV of $17.12, as stock prices have plummeted by 60%.

On the Price-to-NAV metric, I believe Gladstone’s shares are now attractively priced. However, investors are cautioned that Gladstone’s historic Price-to-NAV valuation have fluctuated, from a high of 2.3x in December 2021 to a low of 0.5x in December 2015. So while the current multiple of 0.9x is “cheap”, it can certainly get cheaper.

Moreover, Gladstone’s NAV / share can also decline, as it did in 2018 and 2019. Going through the company’s historical reports, the decline in NAV in 2019 was a result of stock dilution as the company acquired $253 million in farms financed by $170 million in new debt, $90 million in preferred shares, and 2.5 million common shares. Notably, the appraised value of LAND’s farms continued to increase steadily during this time.

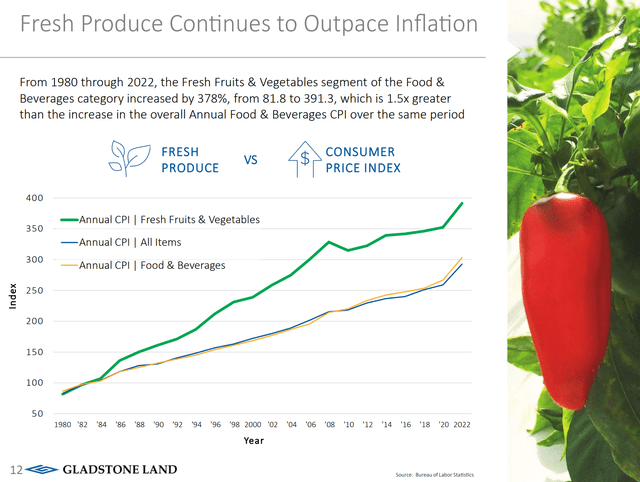

Farmland Protects Against Inflation

One reason I like the farmland asset class is because, historically, they protect investors against inflation. Prices for fresh produce have outpaced CPI food inflation (Figure 10).

Figure 10 – Farmlands protect against inflation (LAND investor presentation )

Higher prices for crops means higher income for farmers and higher rents for Gladstone. The main driver for crop and farmland prices is scarcity. The amount of available farmland in the U.S. continues to decline yearly as large amounts of prime farmland are converted to suburban uses.

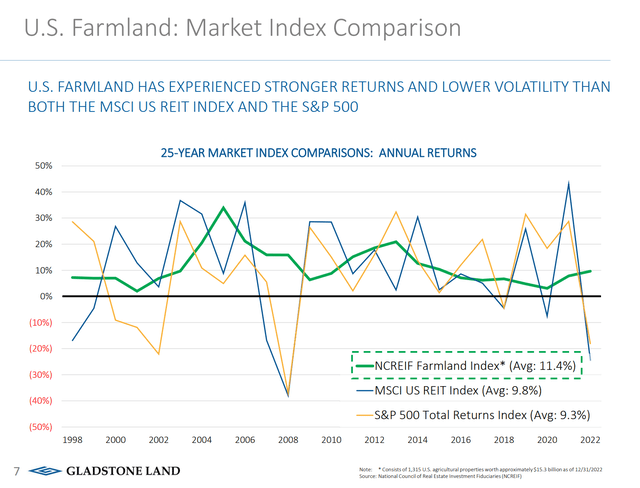

Historically, farmland, as measured by the NCREIF Farmland Index, has delivered stronger returns with less volatility than the MSCI US REIT Index and the S&P 500 Index (Figure 11).

Figure 11 – Farmland has outperformed REITs and stocks (LAND investor presentation )

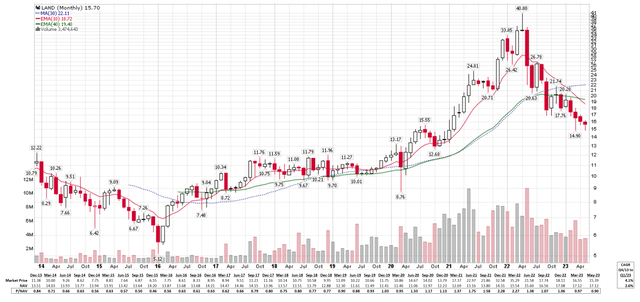

Technicals Back To Support

Technically, most, if not all, of Gladstone’s post-COVID froth has been wrung out of the stock price, as Gladstone has retraced more than 80% of the entire post-COVID rally and is trading back to breakout levels around $15 per share (Figure 12).

Figure 12 – LAND back to major support (Author created with price chart from stockchart.com)

Risks Of Owning Gladstone

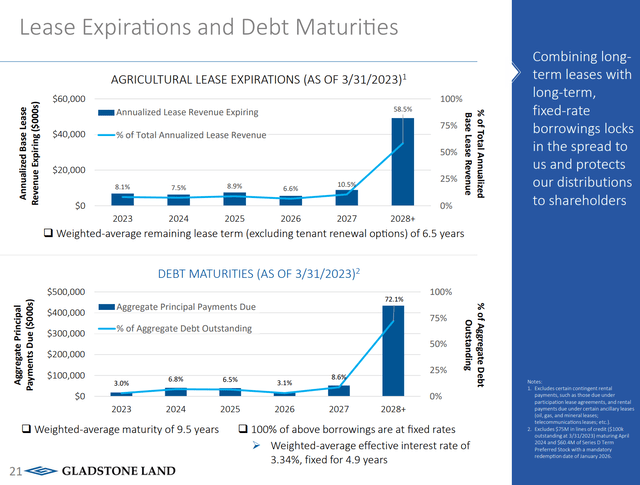

Investing in Gladstone Land is not without risks. First, LAND is heavily indebted, with over $560 million of fixed-rate debt. However, LAND’s debts are structured such that they generally match the maturity profile of its leases (Figure 13).

Figure 13 – LAND’s debts match lease terms (LAND Investor presentation )

As leases and debts mature, LAND is able to renegotiate lease rates based on prevailing interest rates and required returns. Furthermore, the bulk of LAND’s debts mature far in the future, alleviating some of the debt reset risks.

Another risk to LAND is climate change. Worsening climate change may negatively affect the productivity of LAND’s farms. For example, in the last few years, California has faced massive droughts that have affected crop yields. Although California currently has sufficient water, especially with a recent wet winter, there is no guarantee this situation will continue.

Conclusion

Gladstone Land Corp. gives retail investors access to the farmland asset class. After a post-COVID boom and bust, valuation on LAND shares are now back to attractive levels currently trading at 0.9x price-to-NAV. I believe investors should take advantage of near term tenant issues and debt worries to accumulate shares in this uncorrelated asset class.