Fahroni

Today I would like to look at Gladstone Commercial (NASDAQ:GOOD) which is a REIT owning industrial and office properties in the US and is listed on Nasdaq (NDAQ). They focus on single tenant and multi-tenant net lease long term (7+ years) assets. Currently, their focus is on industrial acquisitions to further increase their exposure to this promising sector within their portfolio. That is a logical move considering how the work from home trend is affecting office spaces right now and will make the portfolio more resistant towards it.

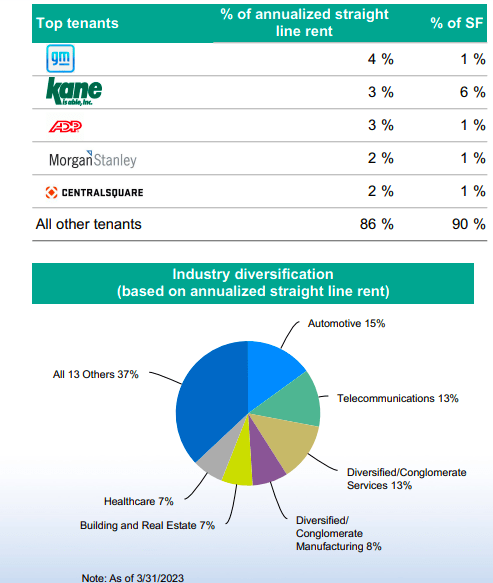

So let’s take a closer look at the company. GOOD owns 137 properties consisting of 59% industrial and 37% office spaces totaling 17.2 million square feet. They are distributed in 27 US states, mostly in Texas, Pennsylvania and Florida, which all account for over 10% each. The portfolio is very diversified in terms of tenants as they lease to 111 different ones and the biggest one, General Motors (GM), accounts for only 4%. The tenant industries are also well-diversified and the biggest one, Automotive, accounts for 15%. Their occupancy stands at 95.9% with a 6.9-year weighted average remaining lease term.

GOOD

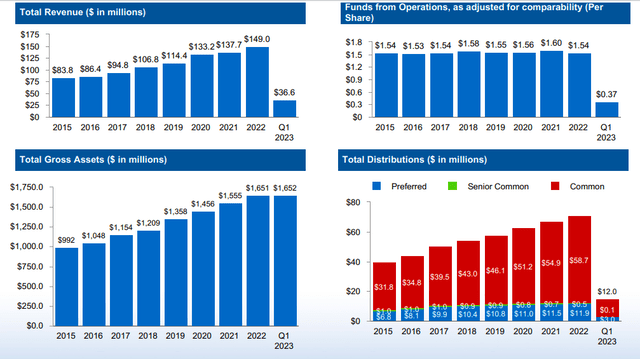

In terms of financials, the FFO is $14.7 million for the last quarter and $1.53 per share for the year. Historically, their revenues have been increasing but the same cannot be said for the FFO which has been basically flat for the last few years. This is mainly due to high incentive fees the company is paying to its advisors negotiating real estate transactions. However, management decided to cut these management fees for first two quarters of 2023 which has consequently raised the FFO. This is of course a short-term increase, considering they will bring the fees back.

GOOD

The outstanding debt stands at $733 million. 96.5% is fixed or hedged with a weighted average interest rate of 4.16%. They have $14 million in cash and $68.5 million available under a line of credit. The maturities for the next years might be problematic as $63 million matures this year, $19.8 million next year and $35.9 million in 2025. Since they have little cash and not a big credit line, they will probably have to refinance at a higher rate. Still, the maturities are not that bad so it might not affect the company too much.

The dividend has a history of increasing YoY even though the FFO has been increasing very slowly as a result the payout ratio increased well above sustainable levels. That is why the dividend was cut by 20% this year and is currently at $0.3 per share per quarter. This is still a really nice dividend yielding 9.4% with now a more sustainable payout ratio of 78%. However, it is definitely something to take into account as this was a very weak move, especially since they have 100% rent collections.

The P/FFO stands at 8.59x with a historical average of 15x. Peers trade at the following multiples – One Liberty Properties (OLP) at 10.43x, CTO Realty Growth (CTO) at 10.71x. Both are smaller companies, suggesting that GOOD is undervalued here. Moreover, the company trades way below Nasdaq’s PE (17.48x) but has a much higher dividend yield, which also says something. Because GOOD is essentially a combination of an industrial REIT such as STAG Industrial (STAG) and an office REIT such as Highwoods Properties (HIW), we can value it based on multiples of those companies, taking the respective weights of each sector into account. STAG trades at a P/FFO of 16x, while HIW trades at 6x FFO. Applying the weights, I get a “fair” multiple of 12x. Frankly, GOOD is of lower quality that the companies used for the calculation, so I will apply a further discount of 20% to get a fair multiple for GOOD of 10x. That’s somewhat above the current multiple.

But I am not sure that it is enough for the risk reward to make sense. The company is shifting towards an industrial portfolio which I see as a good move and they have a well diversified tenant portfolio. However, it did make some questionable choices in the past resulting in a 20% dividend cut which I assume won’t be the last one as they will need to preserve cash to deal with their maturities in the coming years and with the FFO staying flat for the time being this would be a logical choice. While the company is undervalued towards peers, there is a lot of unknown with where the company is going and I am not sure if they will be able to raise their FFO in the near future, leading me to a HOLD rating here.