peeterv

This is another fresh activist campaign that has popped onto my radar recently. I think the pressure from an activist investor here has the potential to catalyze the sale of a lower-margin segment and help the remainCo re-rate to a significantly higher multiple. There is also the possibility of an outright company sale. The situation potentially offers significant upside if things pan out at least partially in line with the activist’s expectations.

Clear Channel Outdoor (NYSE:NYSE:CCO) is a $633m market cap outdoor advertising company that owns and operates billboards and posters primarily in the US (55% of revenues) and Europe (42%). Activist investor Legion Partners Asset Management (owns 5%) and has recently come out, criticizing the company’s share price performance in recent years due to its high leverage as well as suboptimal conglomerate structure. Legion has claimed that the company should accelerate the ongoing sale process of the lower-margin European segment. The move is expected to have a two-fold positive impact on the company:

- After a potential divestiture, CCO would be in a position to repay a portion (around $1bn) of its currently outstanding debt (net debt of $5.2bn).

- More importantly, the potential sale would shine a light on the company’s significantly higher-margin US business. After the potential disposal of the European assets, CCO is expected to re-rate from the current 10x EV/2022 adjusted EBITDA to the 11x-14x multiples of its largest US peers. Note that given CCO’s high leverage, even a small uptick in the valuation multiple might lead to a substantial share price increase.

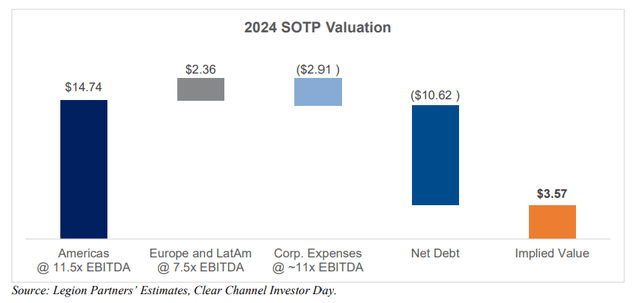

Legion Partners has also suggested other potential strategic moves, including the sale of certain US assets, disposal of the Latin American business and an outright company sale. The activist’s 2024E SOTP valuation suggests a price target of $3.57, implying a 170%+ upside (see chart below). My cross-checking of the activist’s valuation (see Valuation section below) suggests that while this price target might be overly optimistic, there is still substantial upside here as CCO might reasonably be worth $2.31/share or 76% above current share price levels.

Legion Partners’ Public Letter

CCO’s management has been running a strategic review for the European business since December ’21, with the intention of selling the segment. While the sale process has been prolonged so far and has failed to reach a conclusion, several arguments suggest a divestiture of the European business might potentially be on the horizon.

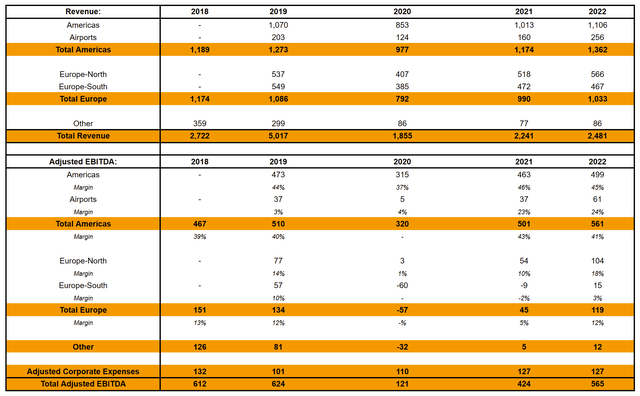

Firstly, timing of potential sales of European assets is favorable given the recovery of the segment from the negative impact of the pandemic. CCO’s European business generated $143m-$151m in adjusted EBITDA in 2018-2019 before a sharp drop to -$57m in 2020. During the launch of the ongoing strategic review, CCO’s European business was still heavily impacted by COVID as demonstrated by $43m in adjusted EBITDA generated in 2021. Having said that, the segment’s adjusted EBITDA has already recovered much closer to pre-pandemic levels, with $119m adjusted EBITDA in 2022. CCO’s management has highlighted these dynamics during the recent Q1’23 conference call:

And I mean I think as you think about Europe as a whole, when we announced that we were starting this process, we were still, frankly, in the COVID, I mean, Omicron came after we announced it. And COVID was very hard on a number of the European markets. And so if you think about where we were when we started, and when we pivoted to doing country level, we had basically 1 good quarter Q4 of ’21 in our pocket and a plan. And what has happened subsequent to that is that the business has actually performed quite well, and it’s been inconsistent country to country. But overall, now we have a half dozen quarters under our belt, not quite a half dozen yet, but it will be soon. And I do think that, that will help us when the time comes for us to market the part of Europe that we’ve articulated since the middle of last year, that’s going to be higher margin and cash generative and so forth.

Importantly, the sale process has already seen some progress recently as CCO’s Switzerland business was sold in December ’22. There is a strategic reason why CCO’s management is committed to completing the sale of the European business. The company’s leadership has recently reiterated its goal to convert to a REIT – potential divestiture and subsequent deleveraging are expected to be a significant part of the planned conversion. From a March ’23 investor conference:

You know that you still have a leverage issue that if you want to preserve the option to convert to a REIT over time because in the future, we do anticipate becoming a federal income taxpayer. We are not today, and we won’t be over the next few years. But if we continue to grow and execute on the European strategic plan, we envision that we will be. And so we at least want to be in a position to have the option to convert to a REIT over that time period.

Secondly, CCO’s largest competitor in Europe JCDecaux has recently hinted that it sees room for and is well-capitalized for further consolidation in the out-of-home advertising space in the continent – see quotes from JCDecaux’s Q4’22 conference call below.

On the first one, M&A bolt-on acquisition, as you know, it’s part of our strategy for quite some time now.

[…]

For example, I will start with the exception, I don’t think we will see anything in Africa or in the Middle East as we speak, but it is clear that you have some — you could see some further, I would say, consolidation in Europe, but you will see also — you could see some also in other regions. So that’s why we still believe that JCDecaux can continue to grow, and this is a clear moment where we could see and size some quite good acquisitions in that moment if things happen, nothing major in terms of size, but yes, good bolt-on acquisition as we did at some point in Asia as we did in Latin America, as we did also in some European countries in the past during tough times or after tough times.

[…]

I think we have currently a strong balance sheet enough for us to ensure our development in terms of organic growth, digitalization and bolt-on acquisition. So far, as you have seen over the last 2 years, despite we were in an unprecedented crisis, we continue to grab some opportunities, and we made some bolt-on acquisition of about €100 million per year, and this is not going to affect our net debt financial leverage.

There is also the possibility of an outright company sale given potential interest from the largest outdoor advertising providers in the US and Europe. Legion Partners has highlighted that consolidation in the out-of-home advertising industry would be accretive given significant strategic synergies. Interestingly, JCDecaux’s management previously noted that expansion into the US – the only large market where the company is not an industry leader – might be a strategic move. A potential outright company sale might receive support from CCO’s largest equity holder fixed income asset manager PIMCO (owns 22% and controls one board seat). The shareholder has held its position in the company since the bankruptcy reorganization of Clear Channel’s parent iHeartMedia. PIMCO is an unnatural equity holder and would potentially agree to a company sale coming at a reasonable valuation.

Another interesting aspect here is that Ares Management has been regularly buying CCO shares on the open market, raising its stake from 8.3% in March ’22 to 11.7% currently. Ares Management’s purchases came in September ’22, October ’22, January ’23 and February ’23. I am not exactly sure what to make of Ares’ quite aggressive shares purchases, however, the shareholder’s decision to go over the 10% ownership threshold (implying additional reporting requirements) is interesting.

Legion is an activist hedge fund with c. $300m in AUM running a concentrated portfolio. CCO is the activist’s seventh largest position. Legion, which has been described as a “behind-the-scenes” type of activist, has a history of pursuing activism in companies that were eventually partially/wholly sold, including Momentive Global (acquired by Symphony Technology in March ’23) and NN (Life Sciences Division sold in August ’20).

Below I provide an overview of CCO’s business and valuation as well as discuss the main risks involved.

Clear Channel Outdoor

A description of CCO’s business segments and their recent operational performance is provided below. Please refer to this well-written VIC write-up for a more extensive background on the company and the industry.

Clear Channel Outdoor Filings

Americas (55% of Revenues)

The segment comprises advertising displays located along major expressways in the US as well as airports in the US and the Caribbean. The majority of the segment’s sales come from billboards (91% of the segment’s revenues excluding airports sub-segment). CCO is among the three largest outdoor advertising companies in the US. The other large competitors in the market are Lamar Advertising (LAMR) and Outfront Media (OUT). Beyond the three largest outdoor advertising providers, the industry is highly fragmented, with a number of smaller players. The largest players have a significant moat given that new permits for billboards are severely restricted by regulations.

The segment has already exceeded pre-pandemic revenue and adjusted EBITDA levels (see table above) driven by a pick-up in travel/transit as well as increasing share of revenues generated by higher-margin digital displays (from 29% in 2020 to 34% in 2022 ex-airports and from 45% to 57% for the airports sub-segment). While the US business saw declines in revenues/adjusted EBITDA in Q1’23 due to weaknesses in several end-markets (including crypto and tech), management expects the company to continue on a growth path going forward driven by planned expansion into other verticals (CPG and pharma). It’s worth noting that CCO has a high visibility into its expected operational performance given that a significant portion of customer bookings are made in advance. The segment’s adjusted EBITDA margins of 41%-43% in 2021-2022 have exceeded pre-COVID levels (39%-40%), however, management has guided for margin contraction in 2023 given expected ramp in lower-margin airport revenues as well as contract renegotiations with a large landlord.

Europe (42% of Revenues)

The segment includes CCO’s operations in Southern Europe (France, Switzerland, Spain and Italy) and Northern Europe (UK, Sweden, Norway, Finland, Netherlands and other eastern/northern European countries). CCO’s European segment has displayed much lower adjusted EBITDA margins compared to the US business due to the revenue mix geared towards street furniture displays (50% and 52% in 2022 for Europe-North and Europe-South) as opposed to higher-margin billboards (11% and 12%). Digital displays have accounted for 53% and 23% of the revenues in 2022 at Europe-North and Europe-South sub-segments. The segment’s key competitor is the world’s largest outdoor advertising provider JCDecaux (OTCPK:JCDXF).

The European business has been significantly impacted by the pandemic as well as the subsequent war in Ukraine and the macroeconomic slowdown. The segment has already substantially recovered to pre-pandemic levels, with 2022 revenue only slightly below 2019 levels, led primarily by the recovery of the Northern European subsegment. The company expects the continuing pick up of the Europe-South business as well as new contracts in both sub-regions to drive further revenue growth. CCO’s guidance appears to imply a low-to-mid-single-digit growth rate for the segment in 2023.

Other (3% of Revenues)

The segment includes CCO’s operations in Latin America (Mexico, Brazil, Chile and Peru) as well as Singapore. The businesses have failed to significantly recover from the impact of COVID so far, with adjusted EBITDA of $5m-$12m in 2021-2022 vs $73m-$126m in 2018-2019.

Valuation

Legion Partners’ 2024E SOTP valuation implies a share price target of $3.57/share. Below is my attempt to verify the activist’s valuation assumptions. While Legion’s valuation is largely reasonable, the activist’s adjusted EBITDA estimates for the Americas and Europe/Latin American segments might be too high at $620m and $152m respectively. With seemingly more reasonable $590m and $120m adjusted EBITDA estimates, I arrive at a share price target of $2.31/share.

Americas

Legion Partners uses a 11.5x multiple on the estimated 2024E EBITDA. The segment’s closest peers LAMR and OUT are currently trading at 13.6x and 10.1x forward multiples and 12.7x/9.5x on 2024E EBITDA basis. I think the segment’s valuation is closer to the upper range of the peer multiple range is reasonable given its margin profile and revenue mix. The peers have boasted 46% and 27% 2022 adjusted EBITDA margins compared to 41% for CCO’s US business. Meanwhile, LAMR and OUT generated 90% and 78% of its 2022 revenues from higher-margin billboard displays (compared to 91% for CCO’s US segment excluding airports). LAMR and OUT’s share of revenues from higher-margin digital displays in 2022 stood at 26% and 30% respectively vs 34% for CCO (excluding airports).

The activist’s 2024 adjusted EBITDA estimate of $620m seems to be overly optimistic. CCO’s Americas segment generated $561m in 2022. The management’s outlook seems to imply a mid-single-digit revenue growth guidance for the segment in 2023, however, the management has guided for margin contraction in 2023. While the expected impact on margins has not been specified, to stay on the conservative side I estimate 2023E adjusted EBITDA to stay flat year-over-year at $561m. Assuming a 5% revenue growth (in line with the company’s long-term guidance put out during Sep’22) and stable adjusted EBITDA margins in 2024, I arrive at c. $590m in 2024E adjusted EBITDA.

Europe and Other

Legion Partners values the European and Latin American segments at 7.5x 2024E adjusted EBITDA. The segment’s closest peer JCDecaux is currently trading at 7.9x 2023E EBITDA and 6.9x on 2024E EBITDA (8.4x on TTM basis). CCO and JCDecaux are the two largest OOH advertising players in the European market and have boasted similar revenue mixes, with 53% of JCDecaux’s sales in 2022 coming from street furniture displays (vs 50-52% for CCO’s European business) and 15% generated from higher-margin billboards (vs 11-12% for CCO’s European segment). JCDecaux’s share of revenues generated from digital displays stood at 31% in 2022 compared to 23-53% for CCO’s Europe-South and Europe-North businesses. Worth noting that JCDecaux’s adjusted EBITDA margins have been slightly higher in 2022 at 18% vs 12% for CCO’s European business, with the difference coming from the yet-to-recover Europe-South sub-segment (3% margins) as opposed to Europe-North (18%).

Having said that, I think the activist’s valuation multiple is reasonable given that CCO’s Switzerland business was recently sold for a 9.5x EV/2022 EBITDA multiple (excluding corporate overheads). CCO’s management has noted that the Switzerland business has been an “average” business within the company’s European operations. Another reference point here is large acquisition of UK-focused OOH advertising provider Ocean Outdoor by its largest shareholder in May ’22. The transaction valued Ocean Outdoor at $580m or 11x 2019 adjusted EBITDA (which the company had guided to exceed in FY2022).

Legion’s 2024E adjusted EBITDA estimate of $152m generated by the European, Latin American and Singaporean businesses seems to be excessive. Assuming a 3% revenue growth in both 2023 and 2024 as well as stable adjusted EBITDA margins, I arrive at $110m in 2024E adjusted EBITDA for the European business. Note that this excludes the recently sold Switzerland segment which contributed c. $15m in adjusted EBITDA. As for CCO’s other operations in Latin America and Singapore, I do not assume a recovery in the segment and estimate $10m in 2024E adjusted EBITDA.

Net Debt

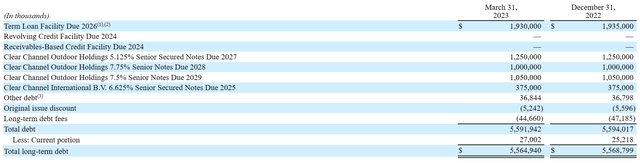

CCO’s net debt stood at $5.3bn as of Q1’23. This includes the company’s term loan due in 2026 ($1.9bn) and senior notes maturing throughout 2025-2029 ($3.7bn).

Corporate Overheads

The activist Legion Partners capitalizes $131m in 2024 estimated corporate expenses at an 11x multiple. The activist’s overhead estimate is in line with the $127m in adjusted corporate expenses that the company incurred in 2021 and 2022.

Risks

-

One of the primary uncertainties here is the fact CCO is a highly levered entity with a net debt-to-EBITDA ratio of over 10x. Having said that, the solvency risks appear to be limited as the earliest debt maturities come only in 2025 ($375m or 7% of total gross debt) and 2026 ($1.93bn or 35%). Another important aspect here is that $3.3bn out of CCO’s $5.6bn gross debt is fixed rate, somewhat mitigating the interest rate risk. Nonetheless, CCO’s large debt burden might cause significant share price volatility, meaning that there might be a sharp share price drop if things go south.

Clear Channel Outdoor Q1’23 10-Q

-

Another risk here is a tough M&A environment amid tight lending markets and the macroeconomic slowdown in Europe. This might potentially hinder CCO’s efforts to divest the European business. Having said that, the segment’s recovery closer to pre-pandemic levels and the company’s recent divestiture of Switzerland operations at a reasonable multiple give some confidence that the ongoing strategic review might reach a successful conclusion. Importantly, CCO’s management has highlighted that financing is unlikely to be an issue for European assets as they are expected to be sold piecemeal – from a March ’23 investor conference:

Question: Now that you’ve had 5 quarters of pretty solid performance, and you’ve proven out what you had in the memorandum as you put it or exceeded. I’m just trying to think of from a prospective buyer’s point of view, the numbers are there. The assets still look like they’re delivering, obviously, is there a financing issue? Is there anything along those lines that may be a hindrance to those buyers in those markets prospectively.

Answer: I think if we were working on the platform as a whole that, that would probably still be an issue. When you’re working on individual countries, you’re not talking about huge checks and you’re talking with entities that have their own financing mechanisms and other things available to them.

-

A noteworthy risk here is slowing broader advertising spend since late 2022 due to a number of verticals facing economic headwinds, including retailers. However, during a recent conference call CCO’s management hinted that advertising demand in the OOH industry has not been impacted by a broader macro pullback and remains healthy. During a March ’23 conference call, CCO has stated that outdoor advertising has held up better than other advertising channels, such as television and radio.

Conclusion

CCO currently presents an interesting value play with a potential medium-term catalyst. The pressure from an activist might very well catalyze the ongoing European business sale process. I expect the eventual divestiture of European operations to lead to a substantial share price re-rate. While the situation is nonetheless risky given CCO’s high debt burden, I think that the setup currently offers a positive risk-reward with a potential for huge upside.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.