When Clive Drew decided to semi-retire in 2016, he thought it would be an opportune moment to reassess his finances and open investment and pension accounts with low fees.

After extensive research on a range of execution-only platforms, he opted for Fidelity for its charges, service and fund range.

“It was not just the fees for holding money, but the charges for drawing down a pension, taking money out of Isas, among others,” he says.

However, after a few years Drew felt the level of service had declined and the platform’s charges were no longer as competitive.

“Midway through last year I thought I’m spending a lot of time doing this but I wanted to go out and play tennis, rather than sweat over which funds to buy and the costs of trading, the cost of stamp duty — [which] are gradually creeping up.”

Drew, who is in his early 60s and lives in Warwickshire, decided to move his money to Netwealth, a low-fee discretionary wealth manager that launched in 2016. The site charges a fee of up to 0.7 per cent to manage customers’ money. With fund fees and trading costs, Netwealth estimates the total annual charge is about 1 per cent.

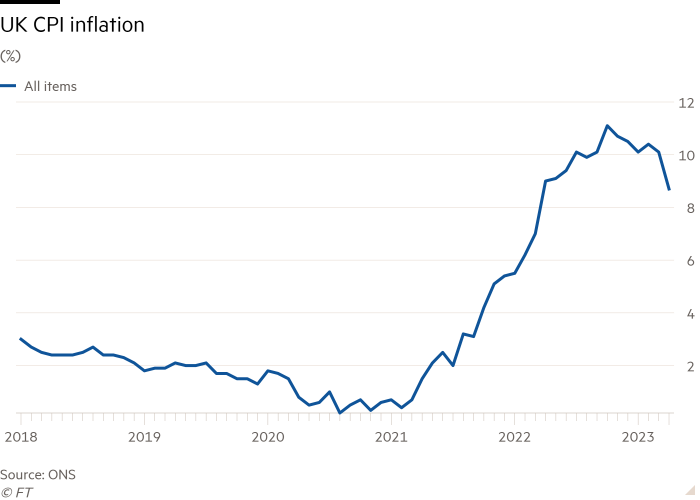

The issue of charges has come under the spotlight as inflation and the high cost of living continue to bite, spurring customers to seek better value for money. The established platforms for “do-it-yourself” investors are being challenged by a throng of new digitally focused entrants, while incoming regulations will shortly oblige all providers to show they are putting their customers’ needs first, including on fees.

As cost pressures bear down on investors, the complexity of platform charges, which range from flat fees to percentages of a portfolio, and from trading costs to fund manager expenses, is leading many to reappraise their choices. But the best option for one type of investor may be punishingly expensive for another. FT Money explores the options for do-it-yourself investors as well as those looking for hands-on help at a low cost.

Scrutiny on fees

Drew, a former engineer, is not alone in moving providers after becoming dissatisfied with fees and service. One investor who contacted the FT said they felt it was expensive to buy and sell shares on Hargreaves Lansdown’s platform, where it costs up to £11.95 per deal, while another said their fees generally were “too high”.

Others said they had moved to new digital apps such as Plum, which offer a faster service along with low fees. A large range of sites offer investment and pension products, from banks such as Halifax to mobile apps that also provide “robo” advice, such as Moneyfarm.

New regulation called consumer duty that comes into force at the end of July will intensify the focus on platform costs and services, as financial companies will have to prove to the Financial Conduct Authority they provide a good outcome for their customers. A swath of new app-based accounts has also put pressure on costs, with some such as Freetrade and eToro offering commission-free trading. US firm Vanguard, which entered the UK in 2017, bypasses the platforms by allowing individuals to purchase its low-cost funds directly from its site. It has now amassed more than 500,000 UK customers.

“The view we generally take when it comes to investing is that the only certainty is charges, so you want to keep a close eye on this,” says James Daley, founder of consumer site Fairer Finance. “So which platform is best for you? It depends on size of the portfolio, what assets you want to be invested in, and how frequently you trade.”

Chris Bredin, consultant at the Lang Cat, says: “Every platform will be feeling some sort of fee pressure given the wider market conditions. Customer acquisition costs are high so one of the levers platforms can pull to encourage potential customers is to tweak pricing and make it more compelling.”

Fractional differences between annual portfolio charges might seem trivial but the compounding effect can mean substantial amounts of money handed over to a provider over the long term. Not all differences are tiny: according to the Lang Cat, the annual cost of investing £5,000 in an Isa — including initial and ongoing platform fees, Isa charges and 12 monthly fund investments — range from £8 with Vanguard to £160 with iWeb. With a £500,000 investment, they are £60 with Halifax Share Dealing and £1,750 with Hargreaves Lansdown.

Making like-for-like comparisons between platforms is difficult due to their widely varying charging structures. Hargreaves Lansdown and AJ Bell, two of the largest execution-only sites, levy a percentage fee on a customer’s total assets for using their platforms. For Hargreaves, this fee is up to 0.45 per cent a year. For AJ Bell, it is 0.25 per cent. Hargreaves recently reduced this charge for certain products: its Lifetime Isa now incurs a 0.25 per cent fee and Junior Isas are free. AJ Bell also removed its platform charge for customers with more than £500,000.

Interactive Investor, the second-largest platform by assets under management, charges a fixed account fee instead, which varies according to the level of service a customer requires. The basic “Investor Essentials” package, for example, charges £4.99 a month, whereas the “Super Investor” option, which includes additional services such as lower-cost trading and junior Isas, charges £19.99 a month.

“We see more fixed-fee providers now,” says Holly Mackay, founder of consumer site BoringMoney. “Interactive Investor is the most notable, with many of the smaller disruptors having at least an element of a fixed fee. But this is of course horses for courses — for smaller accounts these fixed fees can be super expensive.”

Costs of trading

Trading fees in particular have come under pressure. The rise of app-based accounts and a surge in trading during the pandemic, as many people accumulated savings through lockdown, brought these charges into focus.

Hargreaves Lansdown, for example, recently removed the charge to invest in shares, investment trusts and ETFs on a regular basis through direct debit. “Over time, the cost of investing has fallen and will continue to fall, not least as scale and technology work to improve pricing efficiency,” says Danny Cox at Hargreaves Lansdown.

Lower flat fees

Richard from Chichester opted to shift his investments from Barclays Smart Investor and the stockbroker Thesis to iWeb, a low-cost share dealing platform owned by Lloyds Banking Group. This was ultimately because of iWeb’s low, flat fees, which are much more cost-effective for larger pots.

“Barclays charges 0.1 per cent a year for holding shares, which is not much if you have a small investment, but for £500,000 it’s a lot — you’re paying £500 for nothing,” he says. “Paying out £500 a year for something which is of no value irks me more than insuring my car. My wife is with Hargreaves Lansdown and her fees [for holding shares] are capped at £45 a year.”

Richard, who is retired and asked for his full name to be withheld, invests in shares for the dividend payouts. “I just wanted to hold stocks for the income. I’m not trading much. I didn’t need investment advice. I hold big FTSE stocks paying 3 or 4 per cent a year. I didn’t need advice on whether to invest in Japan or Korea.”

After researching the execution-only platform market, Richard felt iWeb was one of the best options in terms of fees and service. “There is no annual charge. Buying and selling shares is quick and cheap, and they remit dividends promptly,” he said.

He added that there was a £100 account opening fee, although noted the absence of an annual platform charge made iWeb very attractive.

“Although I rarely buy and sell, fees per trade are only £5 compared with £9.95 at AJ Bell and £11.95 for Hargreaves Lansdown. They remit dividends within a few days, unlike Hargreaves Lansdown and AJ Bell which only remit them monthly. And the process to transfer my money worked fine for me.”

Unlike many other sites, iWeb also provides access to exchanges across the US and Europe, allowing customers to buy overseas stocks.

AJ Bell has cut several charges, including those relating to trading in international shares and foreign currency funds. For example, the foreign exchange charge on a £6,000 investment has come down from £60 to £45.

Interactive Investor removed fees for regular investing in funds, ETFs, investment trusts and UK FTSE 350 shares in early 2020. “Since introducing free regular investing, we have seen the number of people investing monthly double,” says Jemma Jackson at Interactive Investor. The site cut dealing charges by 25 per cent for UK and US trades, although it also reduced the number of free trades to one a month.

Certain fees, such as those applied for leaving a site or for inactivity, will probably come under pressure when consumer duty rules kick in, Daley says. AJ Bell removed its exit fees last year, but a number of other platforms, such as HSBC, Charles Stanley, Share Active, and Pilling & Co, still levy them. Pilling, for instance, charges £24 for each stock or fund to be transferred out.

“With consumer duty coming in July, every financial services firm has to prove they are delivering good customer outcomes, which includes proving they offer fair value,” says Daley. “So it’s going to be hard to justify charging a large amount of money on a bigger portfolio through a percentage fee. Those firms charging a percentage will have to think carefully how they justify that and where their thresholds are.”

Charges come down

Some of the largest sites have tweaked their charges in recent months ahead of the new rules taking effect.

“The principles of treating customers fairly sits comfortably with our fair, transparent, monthly service plan, in pounds and pence,” says Jackson at Interactive Investor.”

According to a recent survey it carried out, involving 1,000 UK investors, more than two-thirds preferred a flat subscription fee over a percentage fee, citing reasons such as fairness and transparency. Jackson says flat charges “are perfect for people who want to have a greater degree of predictability about the fees they will pay and transparency around their monthly costs”.

The advent of low-cost discretionary wealth managers, who invest and handle customers’ money on their behalf, has also raised questions of value for DIY execution-only platforms.

The bulk of Hargreaves Lansdown’s business is execution-only, although it provides guidance to customers in the form of research and a list of recommended funds. Hargreaves also has a small number of “restricted” financial advisers, meaning they can only recommend certain products.

However, potential regulatory changes could make it easier for financial advice to become more accessible. For example, the Financial Conduct Authority is consulting on making it easier for companies to advise on simple investments within Isas. This comes after it found that about 4.2mn people have more than £10,000 just sitting in cash.

Hargreaves aims to provide low-cost financial advice to savers who do not have enough money for full-blown advice. The new advice service will result in a individual recommendation, while its “augmented guidance” includes “nudges” or notifications to customers’ phones which prompt them to invest, or hold more cash in a rainy-day fund, for example.

The development, though, prompted a backlash from the site’s largest investor and co-founder Peter Hargreaves, who told the FT in January that automated advice did not take proper account of how much risk customers wanted and could lead them into the wrong investments.

He also criticised the expense of the development, which is part of a broader revamp of Hargreaves’ technology systems. Hargreaves says most of its £175mn expenditure is aimed at upgrading its technology, with a small portion used to develop its advice proposition.

AJ Bell says it has no plans to offer a similar type of advice service. Interactive Investor says it is looking to work with parent company Abrdn’s financial planning and research team for its customers at some point.

New advice services are likely to face the same type of fee pressure as self-directed platforms, as more new entrants enter the market and consumer duty rules come into effect. With more low-fee discretionary fund managers also entering the fray, execution-only platforms will have to work harder to justify the price of their services.

Otherwise, more customers like Clive Drew may swap their execution-only accounts for cheap digital wealth managers, saving them money and leaving more time to spend on the tennis court.

A wider choice of investments

Vishal Natekar decided to move to Interactive Investor, a UK investment platform, on the basis of its transparent and low-cost flat fees.

He held a pension with Legal & General as well as Vanguard, but opted to transfer most of these savings pots a few weeks ago.

“Interactive Investor charges a flat fee but were also offering a bonus payment to join, so I thought, why not?” Natekar says.

Natekar, who works in the finance and technology sector, says another reason for shifting to Interactive Investor was its broader range of investments on offer, including a large choice of funds and passive trackers.

“I liked that Interactive Investor offers a global Vanguard index tracker, for example, which wasn’t available at L&G. I also wanted a [certain] bond index tracker. Again, L&G didn’t have the product I wanted; they were offering exposure to mid and longer-term bonds, but I wanted a short-term bond fund.”

For stocks and shares trading outside the tax-efficient wrapper of a self-invested personal pension (Sipp), Natekar has opted for US firm Interactive Brokers. “It gives access to a lot of markets, it’s very cheap, but it doesn’t offer a Sipp wrapper,” he says.

Natekar, who lives in London, says he does not tend to rely on investment guidance offered by various platforms, largely because he believes there is not enough data on the funds’ performance.

“I’d like to see past performance on active funds. I’d prefer something that backs a whole market, like index trackers. There are a few stocks I like, but the trading charges are quite high for Interactive Investor,” he added.

An experienced investor, Natekar says he had searched the market for other sites, but preferred the flat-fee model offered by Interactive Investor. “Based on my portfolio size, it works out cheaper,” he says.

He prefers tracker funds to individual stocks and shares, as this way he is able to gain exposure to a wider market and is less exposed to any individual company performance.

“Tracker funds are cheap and diversified,” he says. “And most active funds can’t beat the index.”