Bilanol/iStock via Getty Images

One thing that I find disappointing about American stock market is lack of good farming stocks with high yield. We generate virtually all of our food from farms one way or another, yet there aren’t many options for investors to make money from this apart from a couple smaller companies such as Farmland Partners (FPI) and Gladstone Land Corporation (LAND). Both of these companies have rich valuations and low dividend yields. FPI enjoys a price to FFO ratio of 49 and a dividend yield of 2% while Gladstone enjoys a price to FFO ratio of 23 and a dividend yield of 3%.

On the other hand there are some foreign stocks that could get the job done with lower valuations and higher yields. BrasilAgro (NYSE:LND) is one of such stocks. While it is not risk-free (then again nothing ever is) it seems to be a decent way to boost your dividends. Below I will explain both pros and cons of this stock so that you can make an informed decision.

One thing that sets BrasilAgro apart from other similar farming stocks is that it doesn’t focus on any one type product or even one class of product. The company focuses on growing not only fruits and vegetables but also animal products. A good portion of the company’s income actually comes from livestock and husbandry. The company owns farms in 5 different states/provinces in Brazil but it also has partnerships in 2 other states as well as 2 countries that are neighbors of Brazil (Paraguay and Bolivia).

While the company produces many different types of products, its main products are soybeans, corn, ethanol, cotton, sugarcane and beef. Each product has a different planting and harvesting schedule which gives the company constant influx of revenues. Also keep in mind that Brazil’s warm, sunny and humid climate allows for longer periods of growth cycles. Much of Brazil is on the line of equator, practically enjoying summer all year long.

In recent years, the farming industry saw its challenges as well as its opportunities. On one side, there are issues with climate change, drought, declining quality of soil across the world but on the other hand there is more usage of technology, science and better land management techniques which allow for better productivity. For example, farms are now able to monitor their soil’s moisture levels 24/7 and employ targeted watering to areas that need most water when they need more water. Also with the help of genetic engineering we have access to seeds with more resiliency and more fertility.

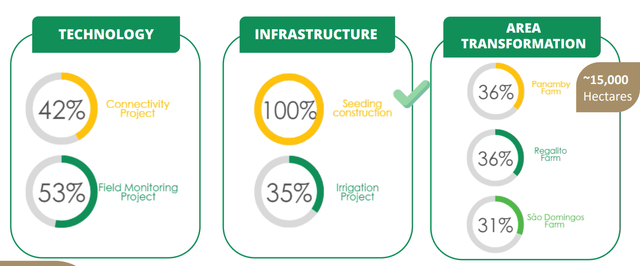

Farms that use technology and science to their advantage will continue to grow and prosper while others may be left behind. BrasilAgro’s management understands this very well and the company actually provides updates on its usage of newest technology in their earnings calls. For example, as of last quarter the company reached 42% in connectivity project (connecting different farms using cloud technology), 53% in field monitoring project, 100% in seeding construction and 35% in irrigation project. It also made progress in area transformation in some of its farms in terms of modernizing them and making them better producers. These specific numbers may not be particularly important for investors to know but knowing that the company is making improvements on its farms and using more technology is relevant. It at least tells me that this company won’t be left behind because its management is being proactive right now.

BrasilAgro

Since this company is dealing with commodities, it also has to deal with commodity prices. In 2022 prices skyrocketed after Russia’s invasion of Ukraine but they came down to earth since then partially as a response to tightening policies of central banks across the world. Commodity prices might continue fluctuating for the foreseeable future which will change this company’s ability to grow its profits and distribute those profits in dividends. Investors should approach this like how they approach oil companies and how you see better profits and better dividend growth when oil prices are higher as compared to when they are lower. This is a risk (as well as opportunity) investors must consider when making commodity-related plays.

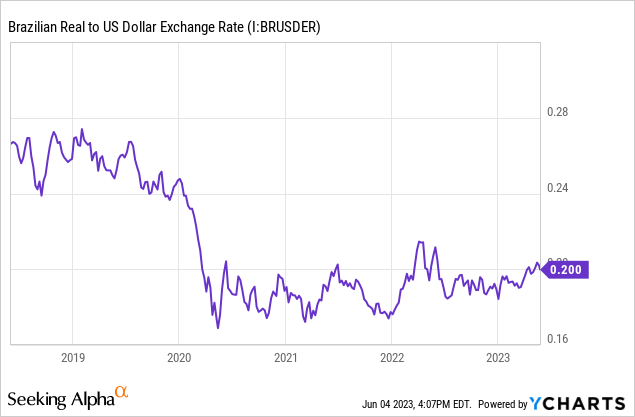

Speaking of risks, there is also the currency risk. Since the company reports its earnings and dividends in Brazilian Real, what you see in your bank account might be different when you receive dividends. Historically Brazilian Real has been weaker than the US dollar but this could also serve as an advantage when the company exports its products to countries with stronger currencies like the US, Canada and England. If you are reinvesting your dividends or adding more to your investments, cheaper Real can also be to your advantage in some situations.

When it comes to Brazil there are always political risks but ironically bigger companies are more exposed to those risks. This is one of those situations where a company being small might be to its advantage. In Brazil, the government has partial ownership in some of the largest corporations and there are always calls from certain political groups for the government to be more involved. This is especially true for large oil and mining companies because they are seen as sources of political capital. Since this is a rather small company with its market cap under $1 billion, I don’t see a lot of political pressure on it like we see in some larger Brazilian companies like Petrobras (PBR). Still, while the risk is small, it is still there. If an extremist government were to form in Brazil they could try to nationalize corporate farms or limit agricultural exports but I don’t see this as very likely at this moment.

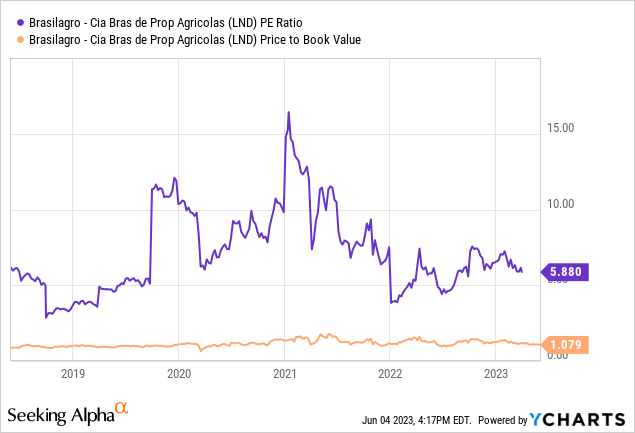

Now let’s talk valuation. The company currently trades for a P/E ratio of 5.8x and enjoys a dividend yield of 13%. It’s price to book value is 1.07x. The company’s current valuation is mostly in line with its historical average valuations. While you are not getting a deep discount versus the company’s long-term valuations, you are still getting a decent margin of safety when you invest to it with such low valuations (especially against its American counterparts that enjoy much higher valuations).

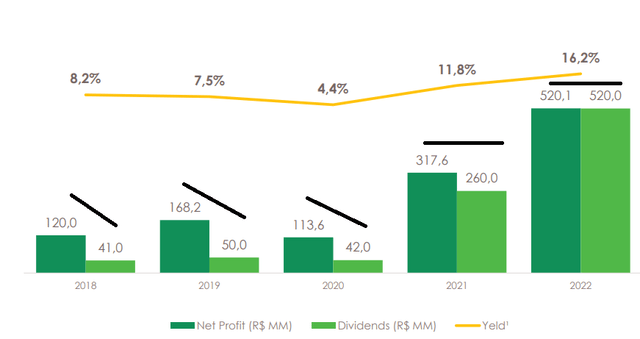

The company currently pays a rich dividend yield of 13% but there are no guarantees that this dividend payment will be sustained. The dividends fluctuate from year to year and depend on company’s profits in each year. The dividends also depend on commodity prices so they rise and fall along with commodity prices as would be expected. The company’s management is very transparent about how each of its farms are performing and how their performance is affected by commodity prices. Between 2017 and 2020, the company paid only 30% of its total earnings in dividends because it was focusing on developing more land and growing but in the last 2 years, it distributed close to all of its profits in dividends. Future dividends will also depend on how much of its profits the company wants to invest into growing.

BrasilAgro

I honestly wouldn’t complain either way. If the company cut its dividends by half and put that money into its business we would see a smaller paycheck initially but much bigger paychecks in the future. As you can see in the above chart, in 2020 the company paid a smaller dividend but its earnings tripled in the next year and its dividend payment grew 6 fold. While dividend payments fluctuated greatly from year to year, the company’s 5-year average yield is 9.5% and its 5-year dividend growth rate is 1200%.

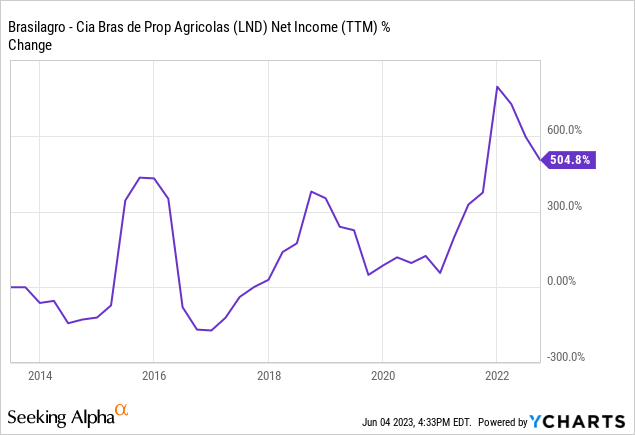

The company is still in its growth stage and its management was able to grow the company’s net income by 500% in the last decade. I expect them to continue to invest into growing their business which could hurt dividend payments in the short term but this should reward investors greatly in the long term.

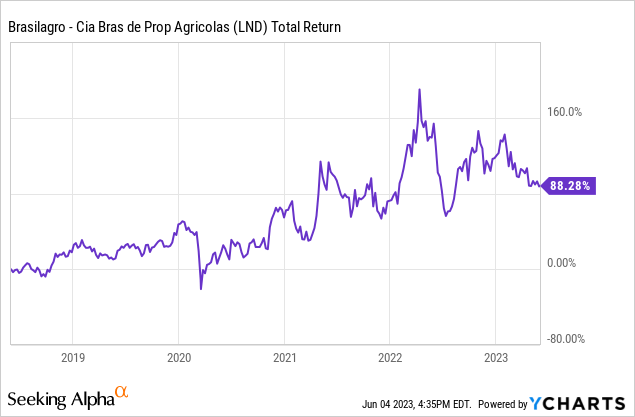

In the last 5 years the stock returned 88% in total returns including reinvestment of dividends. If the company can continue this performance, investors could be pleased in the next 5 years.

Now a word on taxes. When you invest in a Brazilian stock, your dividends get taxed by Brazilian government. Brazil currently withholds 15% from dividends made to foreign citizens. American investors can claim this when they are filing their taxes and get credited for this since its part of foreign tax credit. This extra paperwork is to ensure that you are not double-taxed on your dividends.

All in all, this is a good stock to get exposure to agriculture industry. From my view it enjoys low valuations, has a good management who is proactive and highly transparent, and comes with a nice dividend yield. Still it’s not free of risk (as nothing is) since the company’s profits and ability to pay dividends will rely on commodity prices, international markets and productivity of its farms. I would buy a small position in this stock and hold it for many years to come but I would advise against putting more than 1-2% of your total portfolio value into this stock for the sake of diversification.