CoreLogic’s weekend auction clearance rates were the strongest since October 2021.

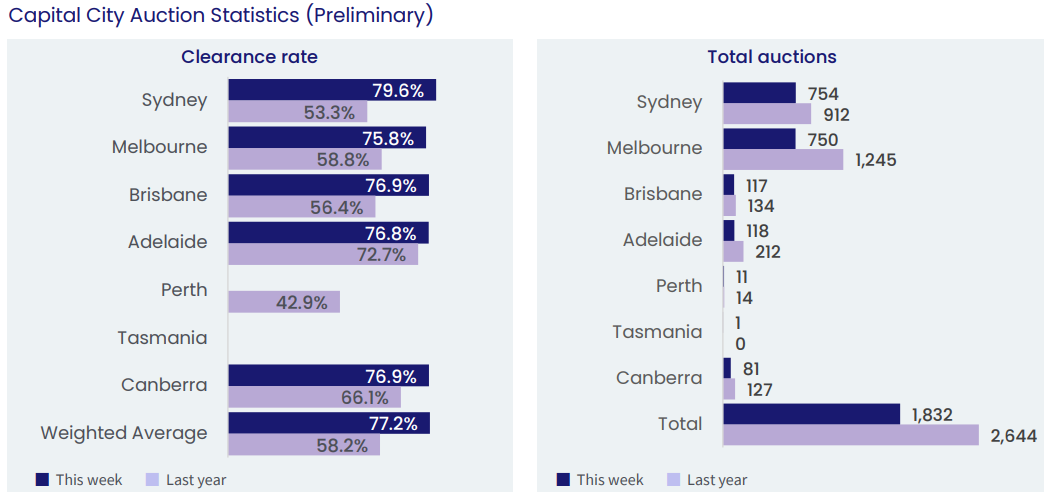

The national preliminary auction clearance rate lifted for the third consecutive week to 77.2%.

Sydney led the way, recording a preliminary clearance rate of 79.6%, the city’s strongest since mid-October 2021.

Melbourne recorded a preliminary clearance rate of 75.8%, which was the eighth consecutive week above 70%.

Advertisement

Low auction volumes have clearly created FOMO (‘fear of missing out’) in the market, with the number of homes auctioned (1,832) down 31% from the same weekend last year (2,644).

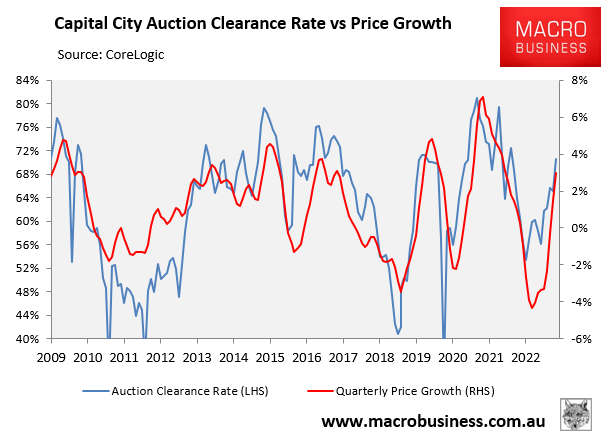

As illustrated in the next chart, auction clearance rates have historically been a strong leading indicator for house price growth:

Advertisement

Thus, this weekend’s strong auction results should ensure that dwelling values continue rising at a solid rate, especially across Sydney.

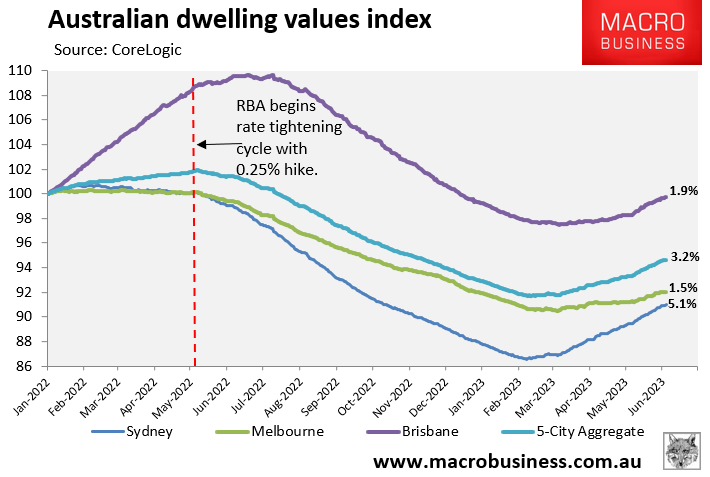

The next chart plots the rebound in CoreLogic’s daily dwelling values index across the major markets since values bottomed on 7 February:

Advertisement

Values at the 5 city aggregate level have rebounded 3.2%, overwhelmingly driven by Sydney (+5.1%).

Melbourne (+1.5%) and Brisbane (+1.9%) have experienced smaller rebounds.

Advertisement

These rebounds have come despite further official interest rate rises in February, March and May, with further monetary tightening expected.

Record immigration, soaring construction costs and rents, and a general lack of supply on market has generated FOMO, which is driving values higher.

It is a highly unusual house price rebound, given recoveries typically only emerge once the RBA is actively cutting interest rates or is very clearly poised to do so, and borrowing capacity increases.

Price rises also tend to follow a sustained lift in turnover, not vice-versa.

Advertisement