The underlying reason for the ongoing increase in the east coast’s price for natural gas price is the supply. The Labor federal government has erroneously pushed the claim that price escalation has been caused by Russia’s invasion of Ukraine. This is a false narrative.

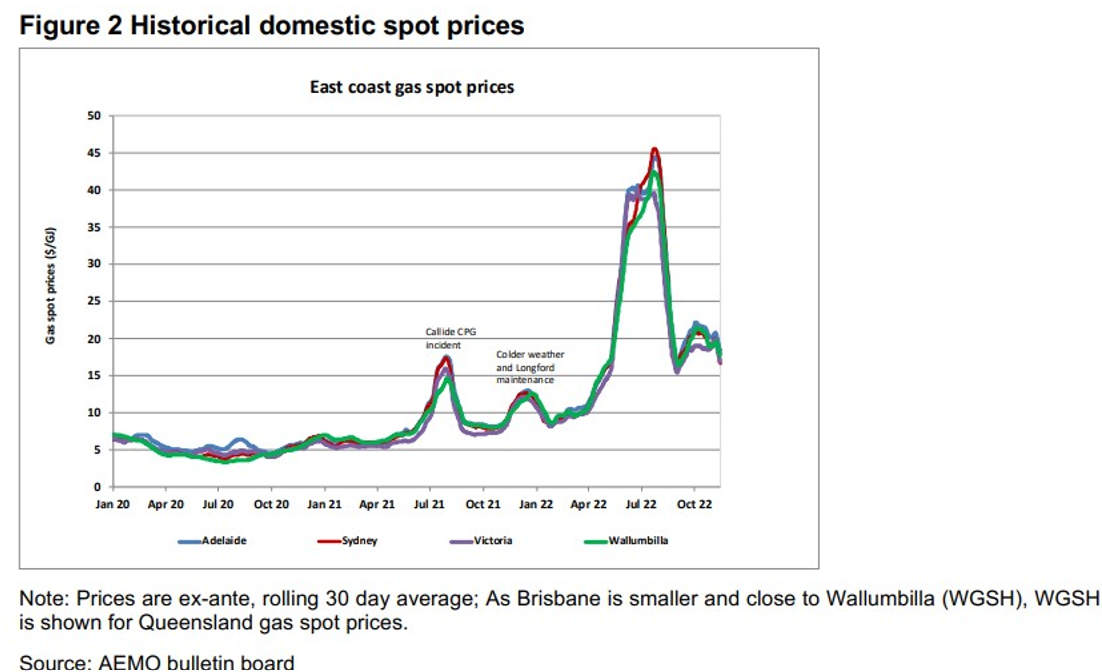

East coast gas prices began their increase in late 2020, well before the Russian invasion of Ukraine. The invasion of Ukraine did not cause the 2022 short-term gas-price spike experienced in the winter months. That was caused by local factors which will be examined in detail below. The winter of 2022 gas price spike lasted only five months (May-September) before prices dropped back to near previous levels. The war in Ukraine continues. (Figure 2).

This from Energy Minister Chris Bowen:

“The Albanese Government has today taken action to limit the worst impacts of gas price increases resulting from Russia’s illegal war in Ukraine by applying an emergency, temporary price cap to wholesale gas contracts.”

The Labor-Greens federal government then attempted to fill the east coast gas supply shortage by retrospectively introducing laws that forced LNG (liquid methane) exporters to sell uncontracted gas within Australia, rather than into the international LNG market.

In an attempt to moderate gas prices the Federal government then, for a second time, intervened and retrospectively enacted laws that placed a price cap of $12/GJ for domestic gas sales. The cap mainly applies to gas sold by producers to commercial and industrial users in Australia, such as manufacturers, gas-fired power plants and energy companies. The gas-sale caps applies to contracts entered into or varied after December 23, 2023, and does not affect international gas-sale contracts.

These two federal interventions retrospectively changed the legal and financial basis on which companies explore for and, if successful, develop oil and gas fields. These enforced impositions do not reflect business as normal in a democracy, which should promote a free market rather than enforcing a Socialist agenda.

The long term east coast gas price increase is mainly caused by a domestic gas supply shortage. This from the ACCC:

“The domestic gas contract prices offered to commercial and industrial users for supply in 2022 increased from $6-$8/GJ in late 2020 to about $7-$9.50 by mid-2021, and the supply outlook from 2022 onwards looks increasingly tight, the ACCC’s latest gas report reveals.”

And this from the 2022 AER Gas Markets in Eastern Australia:

“Since the last State of the Energy Market Report, east coast gas markets have entered a period of sustained high prices and tight supply. Over late 2021, and particularly since April 2022, gas prices in east coast gas markets have rose to and persisted at record highs.

Southern gas production is continuing to deplete reserves, increasing the risks of shortfalls, and the Iona storage facility dropped dangerously close to minimum reserves for its normal operation this winter.

Overlapping factors in the National Electricity Market from early May – including numerous coal baseload outages and peak gas generation units running for prolonged periods to fill the supply gap – have driven an unanticipated increase in gas demand from this sector despite the gas price increases. This interaction with electricity markets is putting further upwards pressure on gas prices at the same time as local gas markets are being used to cover short-term spot exposure over the higher demand winter period.

With higher gas market demand typical across winter, and the continuing requirement for additional gas generation to make up for supply constraints in baseload coal, gas and electricity prices are not expected to decrease until conditions ease in both local and international markets.

In combination, these market shocks have resulted in extraordinary interventions, including:

♦ the Australian Energy Market Operator (AEMO) activating the Gas Supply Guarantee twice, including its first ever usage

♦ AEMO directing two Victorian gas-powered generators not to generate

♦ suspension of a market participant

♦ extended periods with different gas hubs in administered pricing states”

On any evidential basis, blame for the east coast gas supply shortage can almost solely be sheeted home to past and present state governments in NSW, Victoria, SA and Queensland which, for more than a decade, have either banned petroleum exploration or severely limited access to new areas and latest technologies available for gas exploration through regulation and an unwillingness to expedite approvals.

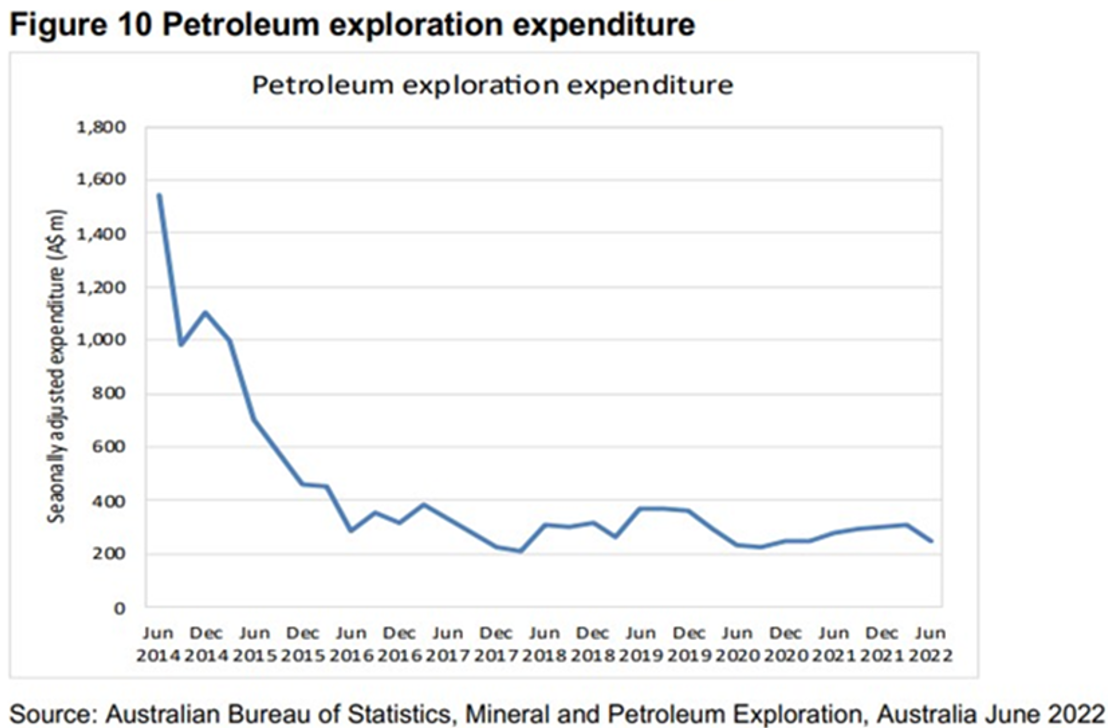

As a direct result of those state government bans, expenditure on petroleum exploration in Australia has declined significantly since 2014. Most of this reduction has been caused by the demonisation of fossil fuels, closure of large base-load coal-fired power stations combined with federal and state government’s promotion of heavily subsidised renewable energy projects. The Labor, Liberal/National and “green” political parties in each state all share that blame.

Past federal Labor and Coalition governments, in turn, failed to develop a national energy policy. Instead they promoted and heavily subsidised the introduction of renewable energy into the energy supply mix without any consideration as to how to supply large amounts of renewable energy into the market and, at the same time, maintain a reliable and low cost base-load power supply.

Domestic Gas Reservation Scheme

NSW and Victoria banned onshore petroleum exploration almost a decade ago. Both these states now claim they are open for business, but neither of those states has made available any new onshore exploration areas. The Queensland and South Australian governments, on the other hand, have restricted and greatly limited the supply of new areas available for petroleum exploration by way of their state-controlled “licence gazettal” process.

Western Australia, even with a legislated gas reservation law has allowed almost uninterrupted onshore petroleum exploration, in contrast to most of the other Australian States. Not surprisingly, WA is the only state to have significantly added new onshore gas reserves in the last decade. Huge gas discoveries have been made in the onshore Perth Basin, not far north of the City. In addition, a significant new gas field has also been discovered in Canning Basin, inland from Broome.

There has been no need to action the WA gas reservation policy because there is a gas surplus. In reality, the new gas fields recently discovered in the onshore Perth Basin have struggled to find markets to meet their gas production capabilities. The Canning Basin gas discovery remains undeveloped and with no immediate gas market capable of supporting field development.

Explore and you will find. Explore and there is no need for a gas reservation. Ban or restrict gas exploration and you will find nothing new and, as a consequence, fail to maintain a low cost, reliable supply. Enacting retrospective laws for “domestic gas reservation and gas price cap”, recently enforced by the Labor-Greens federal government, does not guarantee a long-term sustainable domestic gas supply nor low prices.

In the case of Australia it is merely a short term fix for poor government policy. The federal government enacted laws that reserve nominated gas volumes for domestic consumption are solely an attempt to fill a gas supply gap created by a domestic gas-supply shortage.

The domestic gas supply shortage in eastern Australia has been created by state laws banning or restricting petroleum exploration.

Governments are now attempting to retrospectively enforce solutions for their policy mistakes. There can be no enduring gas supply guarantee unless new discoveries are made. All producing gas fields eventually deplete and reach the end of their commercially productive life.

The most appropriate form of “gas reservation” is effected by entering into long term contracts where counterparties share the risk of development. Existing Australian export LNG projects were approved by federal and state governments and commercially developed for export markets only. There was no domestic gas supply shortage or gas reservation requirement at that time.

The federal government has, on behalf of the states, retrospectively demanded that the Queensland export LNG projects reserve for domestic consumption about 15 per cent of their gas production at prices lower than they could achieve if that gas was exported. In reality, private enterprise is being asked to rectify the East Coast gas shortfall which has solely been created by poor government policy. What happened to our free market??

Retrospectively enforced laws by the federal government have demanded Queensland’s LNG exporters sell a quantity of their gas in Australia and have imposed an additional penalty in the form of a gas-sale price cap. This is a text book example of sovereign risk. This new legislation has been enacted by the Labor/Greens in order to temporarily cover policy mistakes which include there being no federal or dtate energy policy combined with failure of the Victorian, SA, NSW, NT and Queensland Governments to allow gas exploration whilst those same governments have condemned coal-fired power generation.

In July 2017 the Australian Government entered an agreement with East Coast LNG Exporters to prevent a gas supply shortfall and secure competitively priced gas for the domestic market – Australian Domestic Gas Security Mechanism (ADGSM). That agreement was extended in 2022 and beyond.

“The negotiations ensure additional gas supply, improving security and affordability of domestic gas supplies in future years, while also introducing transparency measures to improve the information available to customers.

In July, the Australian Competition and Consumer Commission forecast a gas shortfall of 56 petajoules (PJ) for the domestic market in 2023.

The new commitments from LNG exporters will lead to an extra 157 PJ for the domestic market in 2023, with the gas to be supplied in line with seasonal demand.

The new Heads of Agreement includes:

♦ LNG exporters to first offer uncontracted gas to the domestic market, on competitive terms, with reasonable notice, before exporting;

♦ in respect of uncontracted gas, the principle that domestic gas customers will not pay more for the LNG exporters’ gas than international customers;

♦ commits LNG exporters to offering gas on terms consistent with a code of conduct;

♦ enhanced transparency and accountability, with quarterly compliance reporting to the Minister for Resources, with oversight by the competition regulator the ACCC.

Minister King will meet every quarter with each east coast LNG exporter to review whether they are meeting their individual commitments and ensure they are compliant with the Code.

The new Heads of Agreement was signed by Minister King and representatives from Australia Pacific LNG (APLNG), QGC Pty Ltd (operator of QCLNG), and Gladstone LNG (GLNG).”

The gas producers were not happy. In October, 2013 APPEA released a report they had commissioned from Deloitte Access Economics and following that in 2020 APPEA made a submission in response to the Federal Government’s Gas Reservation Issues Paper. APPEA concluded:

♦ These results are important reminders that the upstream oil and gas industry is in and of itself a major source of economic growth and employment – its contribution to the Australian economy is far more widespread, and important, than a narrow view of the role it plays in supplying natural gas to a subset of Australian manufacturing.

♦ Australia’s reputation as a reliable supplier of LNG is a vital component of the industry’s competitiveness and has been a key factor in the industry’s ability, across Australia, to establish stable long-term relationships with customers and to attract investment into the industry in a fiercely competitive global environment.

♦ Significant caution needs to be exercised when considering regulatory interventions that risk the attractiveness of Australia as a destination for upstream oil and gas industry investment and send worrying signals to both domestic and international investors and major trading partners. These include investors and trading partners with whom the Australian industry has spent a generation building relationships.

♦ A domestic gas reservation scheme acts as a simultaneous tax on the export of gas and subsidy to domestic gas users – both of which directly undermine the economy’s efficiency.

♦ The result is an unequivocal economic loss, with the economy forgoing the export income only to inefficiently subsidise domestic consumption. The longer-term consequences see reduced investment leading to lower levels of capacity and production, which in turn raises the risk that domestic supply is in fact compromised, rather than assured and upward rather than downward pressure is placed on prices.

♦ Arguments in favour of a domestic reservation scheme are often based on inappropriate input-output economic modelling which is partial in nature and does not account for the opportunity cost of the inputs used in domestic production. Previous analysis of domestic gas reservation systems in Australia

♦ Proposals for domestic gas reservation (or similar) schemes have featured sporadically in the energy debate nationally and in various jurisdictions since at least 2006. During that time, various analyses of the fundamental economics, the economic impacts and efficacy of these proposals have been the subject of extensive analysis. The consistent findings of this series of reports is that reservation schemes are likely to impose costs on the Australian economy and lead to distortions in the domestic gas market, endangering investment and future gas supply. Australian manufacturing: determinants of performance and appropriate policy responses – charting a way forward

♦ Much of the focus on domestic reservation appears to be motivated by concerns about the competitiveness of Australian manufacturing. While such concerns are understandable and genuinely held, a prospective national domestic gas reservation policy is not the way to respond to these concerns.

♦ Analysis by The Centre for International Economics in a new report, Australia’s manufacturing industry: determinants of performance, finds a variety of factors determine the fortunes of the manufacturing industry, all of which interact in various ways. It also finds that while gas is both an energy cost and an intermediate input cost (for some manufacturing industries), for both of these it makes a very small contribution to overall cost changes.

International experience is that government interventions to reduce domestic wholesale gas prices are often unsustainable, and have numerous negative side-effects in terms of economic, energy and environmental policy. Peru is the only country identified that exports gas and has domestic gas reservation. Investment in exploration has collapsed in recent years and raises doubts about the country’s ability to replace reserves in the medium to long-term.”

The retrospectively enacted laws create a significant financial burden whilst imposing an increased level of uncertainty for the application of risk capital to explore for gas in Australia. These new laws create increased Sovereign Risk and uncertainty for the foreign purchasers of Australian LNG – Japanese Government and company (eg. Inpex) officials have been most vocal in recent times pointing out this newly created uncertainty.

Gas Price Cap

The Australian Government’s Gas Market Emergency Price Order (2022) introduced a temporary price cap of $12 per gigajoule (GJ) which principally applied to gas sold by east coast and Northern Territory gas producers and their affiliates to wholesale customers in Australia. The government is making gas producers subsidise gas users by mandating that they supply low price gas for use in their business. Retrospectively enacted laws act as a deterrent for new risk capital being spent on gas exploration. Gas exploration, which is clearly years overdue, is necessary to increase gas reserves, guarantee supply reliability and lower prices.

APPEA commented:

However, the Interim Guidelines do little to resolve the short and long-term uncertainties in the market.

APPEA Chief Executive Samantha McCulloch said the interim nature of the Guidelines released this week reflected the complexity of implementing this policy and underscored its rushed nature.

The Interim Guidelines re-enforce the disconnect between the policy and the operations of the Australian gas market in practice, she said. It is clear that the new rules will make it extremely challenging for producers to continue to provide the flexibility of gas supply required by customers.

The Interim Guidelines also leave much of the interpretation of the rules to the discretion of the ACCC, on a case-by-case basis. This includes for simple questions such as when and where transport costs are included within the cap.

Ms McCulloch said the industry was committed to continuing to meet the needs of customers while adhering to the new laws.

With up to $50 million penalties, it is entirely reasonable for the industry to require certainty of the rules under which it is being asked to operate. But the government is still writing the rule book, she said.

To date, the government’s interventions have created uncertainty and confusion in the gas market, while delivering little or no benefit to consumers.

The government has acknowledged that over 90% of gas supply is already contracted for 2023.

We all need a gas market that can function. The industry will continue to engage with the ACCC and the Government to try and find a workable path out of the uncertainty that currently prevails.

As the Code of Conduct process advances, we hope that lessons will be learned from the price cap experience, where poorly conceived interventions are creating uncertainties and in turn damaging and immediate impacts on the functioning of the market to the detriment of consumers.

The government should be taking note of the unintended consequences of these measures as it seeks to permanently regulate gas prices.

APPEA engaged EnergyQuest to research the impact of a gas price cap. EnergyQuest reported:

As a result of the longer term upward trend in gas prices (following the global trend in oil pricing), recent extreme demand volatility for the winter of 2022, and the Australian Government Budget 2022-23 forecasting gas price increases of more than 40% over two financial years, there have been calls for a gas price cap to limit the exposure of high gas prices to gas users.

At the wholesale level, price caps have the effect of decreasing long term supply as capital investment is deferred or redeployed to higher priced markets or better economic opportunities.

At the retail level, the cost of subsidising gas prices can be enormous – EnergyQuest estimates this would be in the order of $1 billion per year for gas for just spot markets. The risk of getting caught in an energy price cap cycle can be challenging – The UK decreased its Energy Price Guarantee (applicable to gas and electricity) just six weeks after announcing it, and estimates it will now cost $55 billion over six months.

Price caps do not address the cause of high domestic prices – lack of new gas supply and volatility in demand from the electricity market with the transition to renewables.

The long term net effect of a price cap is to increase demand with lower prices, and decrease supply with lower economic returns – the opposite of what is required.

♦ Demand: Lower prices support more demand. Higher prices cause consumers to more actively seek alternatives or more efficient use of the resource – decreasing demand.

♦ Exploration: It is already at record low levels in Australia and a gas price cap can only decrease the economic drivers for exploring and adding gas resources.

♦ Development: There are discovered gas Contingent Resources of 38,986 PJ (equivalent to 19 years of domestic gas supply), which are currently uncommercial on the east coast and Northern Territory (NT). Higher gas prices improve the ability to commercialise these discovered resources, whereas lower gas price caps can only damage the prospects of development. EnergyQuest estimates that the loss of Contingent Resources would remove or delay the supply contribution of 586 PJ from these Resources to 2031 – more than one year’s east coast domestic demand (for 2021/22).

♦ Storage: The Victorian seasonal gas demand cannot be met efficiently without gas storage, and this dependency will increase with the decline of the Longford fields. In a price capped market, the ability to buy low priced gas in the off season to sell into the high priced peak winter season is reduced if not eliminated, because the highest price gas can be sold at would be the price cap, and this may even be the price at which the gas was sourced. Storage economics are driven by peak gas prices, which are reduced or eliminated with gas price caps.

♦ LNG Imports: There are five projects to develop LNG facilities on the east coast. EnergyQuest estimates that 50% of annual gas supply to the south-east region (NSW, ACT, Victoria, Tasmania and South Australia) will come from LNG imports by 2033. LNG imports are simply not viable with a domestic price cap at or below the suggested $10/GJ, when the average oil-indexed LNG price at Gladstone for 2022 to October was A$18.35/GJ.

♦ Government Revenue: Assuming conservatively that the price cap would only apply to wholesale spot sales (16% of total supply), then indicatively a price cap of $10/GJ would lower government revenue in the order of $87 million per year compared to actuals seen in 2021/22.

What other retrospective and commercially damaging laws might be enacted by the federal Labor government backed by The Greens in the Upper House and the Teals in the Lower House?

Recently enforced legal requirements have created new uncertainty and directly resulted in a huge reduction in risk funding available for petroleum exploration in Australia and as a consequence reduces the chance of discovering badly needed, new gas supplies. Funding for petroleum exploration had already fallen to new lows after the demonization of fossil fuels by the UN/IPCC and successive Australian Governments. It will now reduce even further.

Funding will flow offshore into jurisdictions that welcome petroleum exploration and production. The ASX listed company that I manage has already made a decision to invest overseas and it has commenced new exploration applications after the forced introduction of new laws and repeated knockbacks of exploration opportunities by the Queensland Government. It is just too difficult and far too risky to invest in petroleum exploration in Australia.

Petroleum Exploration and Production Industry Reactions

How did petroleum exploration and production companies operating in Australia react to these retrospectively applied and damaging laws forced upon them by the Labor/Greens Federal Government?

Business representative groups in Australia took two separate positions. Those positions were split along the lines as to whether the business sat in the explorer/producer group (eg. APPEA) or the gas user group (eg. BCA, Energy Users Association of Australia or AIG).

Rather than working together and lobbying the Federal and State Governments with evidence based recommendations that demanded continuance of petroleum exploration in order to guarantee addition of new, reasonably priced gas supplies, the two groups took opposing positions.

The gas buyers sided with the Government. They appear to have embraced this position with the view of taking advantage of a short term benefit of gas being sold at a capped price for a longer term loss. The gas buyers and their industry representative groups have embraced the UN/IPCC narrative and implemented Woke business practises demonising fossil fuels and promoting renewable energy, all at the cost to the consumer. In my opinion, the gas users have made a poor choice by going Woke and opting for a short term gain for what will be a long term loss.

APPEA has finally demonstrated some strength in its response, opposing the enforced Government laws that cap the price of gas and enforce a domestic gas reservation.

The Role of Fossil Fuel Companies and Industry Representative Organisations

APPEA, fossil fuel companies, industry representative organisations and fossil fuel professional representative groups (eg. American Association of Petroleum Geologists) have ironically contributed to the introduction of gas price caps and domestic gas reservation policy.

Let me explain.

The gas producers and their business representative organisations have created this situation by deciding not to oppose the false UN/IPCC narrative about the burning of fossil fuels as an energy source which in turn increases atmospheric carbon dioxide concentrations trapping excess solar energy, directly increasing Earth’s temperature and changing weather patterns.

The UN/IPCC claims of human causation are false and are not supported by scientific evidence. Earth’s temperature, weather pattern and natural responses (eg. shrinking glaciers) over the last 150 years sit within known normal limits.

APPEA, the major fossil fuel companies, industry representative groups and professional associations possess internal scientific expertise in climate science to refute these false claims made by the IPCC. Climate cycles fall within geologic time, not years or centuries.

Gas producers and business representative groups appear to have chosen to play the middle ground, sit on the fence, be WOKE, support the cancellation of opposing views and pander to illegitimate UN/IPCC claims whilst trying to stay in business and navigate the hand grenades being launched at them.

Unfortunately those tactics have been a massive failure – gas producers and business representative groups have kicked an own goal. The petroleum industry should have facilitated open, civil scientific debate about the false UN/IPCC claims and nipped the issue in the bud. They chose not to do that!

These businesses are responsible for their own demise. They are run by salary men and women making huge money and whose ownership in the company is solely shares given to them by shareholders under incentive programs – often being rewarded for just fulfilling their job description.

These same executive managers and boards of directors have chosen to appease politicians, avoid protests and demonstrators gluing their body parts to the floor in their office foyers in preference to facilitating an evidence based narrative around the false UN/IPCC claims.

It is a simple process to prove that UN/IPCC claims of the burning of fossil fuels changing Earth’s climate are false. These IPCC claims are not supported by scientific evidence.

The recent climate record falls within known natural extremes. Earth’s natural system, including the weather over the last 10 or 150 years, falls within known limits and this claim is backed by empirical data and scientific fact.

A little scientific research would quickly reveal that carbon dioxide emitted into the atmosphere by burning fossil fuels is not altering the Earth’s climate.

Humans are not capable of significantly altering Earth’s natural system and this includes the climate. One has to only assess the scientific evidence presented by the Socialist led UN/IPCC in their reports (AR1 – 6) to quickly determine that the claim of human causation an unproven hypothesis, without empirical or observational data to support it.

There has been an absence of any civil scientific debate with the mainstream scientific journals cancelling publication of scientific research highlighting the falsity of the UN/IPCC claims. The mainstream media has chosen to solely promote these false UN/IPCC claims and they are enthusiastically supported by Government rhetoric and actions.

The false claims are religious in nature and are presented as propaganda rather than evidence based reasoning.

Scientific evidence that disproves claims that humans are changing Earth’s climate has been very effectively cancelled by those same Governments and media – censorship. Politicians promote the false human cause narrative and they are ably supported by media, NGOs and rent seeking businesses in the renewable energy sector or the associated service industries (eg. chartered accountancy firms, solicitors, consultants etc.).

Industrial gas consumers and their industry representative groups have taken the view that a short term reduction in gas price is in their best interest – even if this gain comes at the expense of long term supply guarantee. In order to support their position, the gas consumers have cosied up to federal and state governments and supported retrospectively applied, Socialist legislation that both reserves gas for domestic supply and creates a price cap – “cognitive dissonance”. All this, while at the same time seeking Government subsidies or other financial benefits.

Industrial gas consumers and their lobby groups, in my opinion, should be working with the gas producers to convince the Federal and State Governments to expand the amount of land available for gas exploration. This would directly lead to new exploration activities and in turn guarantee the addition of new gas supplies for sale in the local market, which in turn would deliver lower gas prices.

The gas supply and price issue is exacerbated by those industrial/commercial gas users who failed to enter long term take or pay contracts, which would have provided them with price certainty. Gas consumers who failed to enter long term contracts are now forced to purchase gas in the spot market whilst at the same time complaining about the high gas price.

These same businesses actively support Government imposed, totalitarian gas supply guarantees and price caps in order to save them from their own bad business decisions. They demand gas producers provide them with a free financial subsidy!!

A financial subsidy funded by gas producers to support poorly managed businesses. Imagine if the Government were to impose price caps on items such as fertilisers, bricks, aluminium, concrete, building materials etc.?

In September, 2022 the Albanese Government announced the Climate Change Bills had passed into law ensuring an Australian emissions reduction target of 43 per cent and net zero emissions by 2050. Standing together in support of Albanese was the seemingly witless Energy Minister Chris Bowen and behind him, amongst others, were representatives from the Business Council of Australia and the Australian Chamber of Commerce and Industry – in my opinion a stupid decision by those industry representative groups to support this new Government law.

Business representative groups have implemented unhinged business practises under their ESG policies in response to claims of imagined damage being wrought by anthropogenic use of fossil fuels as a source of cheap, reliable energy. Business groups embrace the false narrative that humans, by burning fossil fuels, have created an increase in atmospheric carbon dioxide concentration which in turn is destroying the Earth’s climate and its natural system.

At the same time these groups promote the ever increasing introduction of Government subsidised wind, solar and hydrogen power into the energy system whilst demanding a low cost, reliable source of base load electricity and guaranteed, low cost gas supply. Alert – you can’t have both or either. Low emissions technologies result in high cost and low reliability!!

In my opinion, the board and management of almost all companies in the Western World (note: not China, India and Russia) involved in coal and petroleum exploration and production have been their own worst enemy by not supporting fossil fuel industries in order to guarantee a reliable, low cost energy supply.

Business decided not to publicly debate and disprove the false anthropogenic climate change narrative established and promoted as propaganda by the UN/IPCC. Like lambs to the slaughter, business has merely accepted criticism and contributed to their own demise. Alternatively, they took advantage of the false claims by establishing new rent seeking enterprises to milk the Government of renewable energy subsidies or provide associated services.

Business failing to act has resulted in oil, natural gas and coal being unnecessarily demonised as a source of low cost, reliable energy.

Humans are not capable of significantly altering Earth’s climate. Companies involved in the exploitation of coal and petroleum have in-house scientific expertise to prove that claim.

Climate cycles are measured in geological time and not years, decades or millenia. Atmospheric carbon dioxide concentration does not have a significant impact on Earth’s temperature. Solar radiation from the Sun varies in known cycles over time and so are Earth’s well documented climate cycle (about 130,000 years in length for the last 1 million years).

Gas and Energy Markets

Who pays for all the renewable energy-related subsidies and the often unnecessary cost to build renewable energy infrastructure? You, the taxpayer and consumer. Most importantly, those hardest hit are people who can least afford to pay the increased energy charges – the poor and those in the emerging countries desperately in need of cheap, reliable energy.

These unfortunates are being punished by the actions of inner city, “left-wing capitalists” – our “chardonnay socialists” and “captains of industry”, who without any valid scientific knowledge or evidence know better than anyone else. Emotion triumphs over evidence based reasoning!! Those elected in the inner city electorates are dominated by Teals and Greens, at Federal, State and Local Government levels. No candidates of those political groups succeed in any other electorates.

Conclusion

It is unfortunate that our business leaders have chosen to ignore in-house scientific expertise and refute false claims made by the UN/IPCC regarding the use of fossil fuels. In parallel, the industry professional representative groups have followed that same failed plan.

Most of these business leaders have sat on the fence. They have abandoned evidence based reasoning in support of continued use of fossil fuels, instead being weak and acting Woke by supporting the government’s false narrative of human induced climate change and promotion of highly subsidised renewal energy programs. At best they focus on ways to sequester carbon dioxide (food of life for plants). I consider business leaders have missed the main game!!

As a direct consequence of inaction in response to false claims about climate change, peddled by the UN/IPCC, the fossil fuel exploration and production companies in Australia have been demonised. This demonisation by federal and state governments and the lack of defence from the fossil fuel businesses has directly led to an east coast gas and electricity supply shortage and huge increase in energy prices.

Now add to that pain the federal Labor-Greens legislated gas reservation policy and gas price cap.

That action has now come back to haunt these business leaders. Despite having within their own ranks scientific experts capable of presenting climate history and evidence based facts to refute false claims made by the UN/IPCC, they elect not to so. They only have themselves to blame.

Dennis Morton is a sedimentary geologist with First Class Honours from Macquarie University and who has worked in the petroleum industry for 47 years. Sedimentary geologists generally possess detailed knowledge of climate and climate change because the physical effects of climate change are recorded in sedimentary rocks