naphtalina/iStock via Getty Images

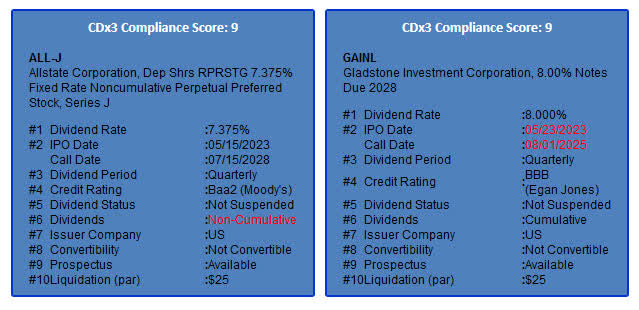

New offering summaries:

CDX3Investor.com

SEC filings for further information: ALL-J, GAINL

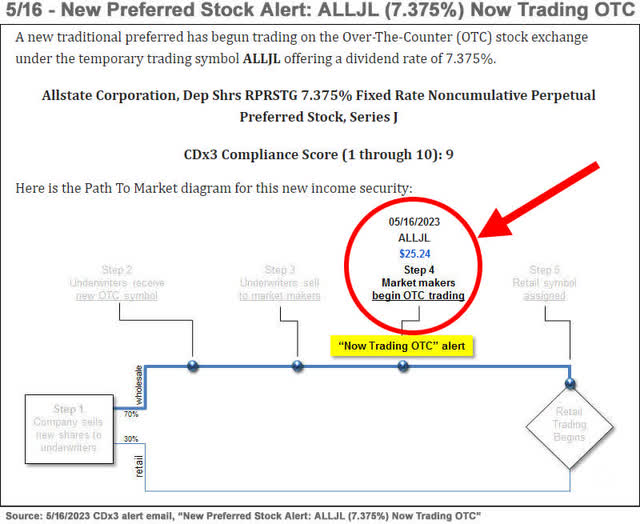

Allstate (ALL) marked the only preferred stock offering alert we sent out this month, but with the company offering a whopping $600 million worth of non-cumulative series J preferred shares at a fixed dividend rate of 7.375%. The shares were rated Baa2 and BBB by Moody’s and S&P respectively, but notably both credit ratings agencies have a “negative” outlook. The new shares traded temporarily on the OTC under symbol ALLJL, before moving the permanent symbol ALL-J on the New York Stock Exchange where they recently traded handily above par at a price near $26.50.

And externally managed Business Development Company (BDC) Gladstone Investment Corporation (GAIN) priced an offering of $65 million worth of new exchange traded notes due 2028. These notes are not yet trading as of this writing, but will eventually trade under symbol GAINL. Interestingly, last month we reported on fellow BDC, Saratoga Investment Corp (SAR), which had issued new exchange traded notes in April, also due 2028, pricing that offering at an 8.5% interest rate and raising $50 million. Saratoga’s new notes trade under symbol SAZ and received an Egan-Jones credit rating of BBB+. By contrast, Gladstone’s new notes received a BBB credit rating from Egan-Jones but managed to find buyers at a slightly lower 8% interest rate. GAINL received a lower credit rating versus SAZ, but found buyers at a better interest rate.

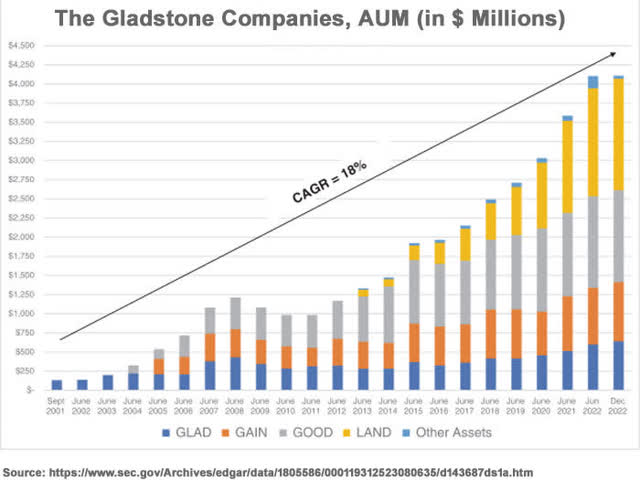

GAIN is one of two BDCs managed by The Gladstone Companies as external manager, with the other being Gladstone Capital Corporation (GLAD). The manager also runs two REITs: Gladstone Commercial Corporation (GOOD) and Gladstone Land Corporation (LAND). As a group, these funds are regular issuers of preferred stock and/or exchange traded debt securities.

The external manager, The Gladstone Companies, had filed an S-1 in February of 2022 hoping to come public itself under symbol “GC,” and then filed three subsequent amendments in April and May of last year; but no new SEC filing activity was observed for the rest of 2022, possibly because of worsening overall market conditions. Then in March of this year they filed a fourth amendment to their S-1 registration statement, revealing, among other things, updated AUM figures for their various funds:

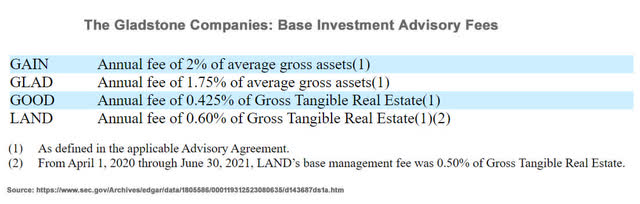

CDX3Investor.com

All four of the publicly traded externally managed funds shown in the above chart have management agreements spelling out both “base fees” and “incentive fees” (which are extra fees paid to the manager if returns on the fund’s investments exceed specified hurdle thresholds). The base fees for the four funds, as summarized in the S-1, include a 2% fee on average gross assets for GAIN – meaning that the proceeds from the offering of their $65 million of new 8% notes (GAINL) will be subject to that 2% fee, raising the bar (so to speak) on the returns GAIN will need to earn on this new capital to 10% before the interest rate plus the management fee are both covered.

CDX3Investor.com

The steady stream of asset management revenue that these fees provide to the asset manager in turn supports the notion that the asset management company itself could be valued highly in the IPO market (although perhaps under better overall market conditions than those seen in the past year).

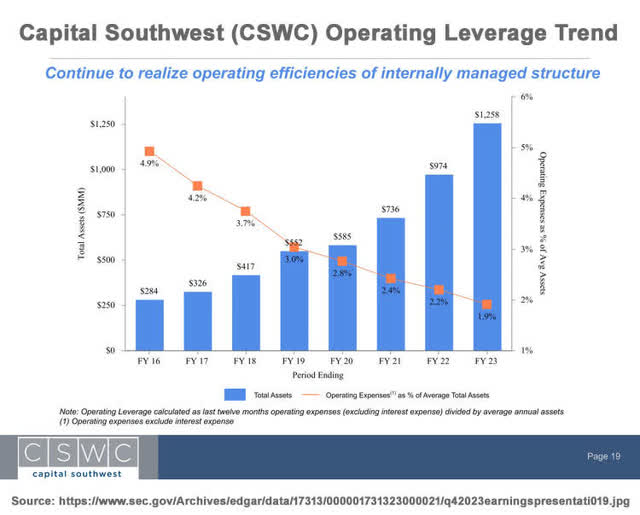

The vast majority of BDCs are externally managed according to BDCInvestor, with just a handful of the listed companies being indicated as internally managed – internal management meaning the company manages itself with its own employees rather than paying fees to an outside manager: Main Street Capital (MAIN) is the largest internally managed BDC by equity market cap (at approx. 3.2 billion), followed by Hercules Capital (HTGC) at approx. 2.1 billion, Capital Southwest (CSWC) at approx. 670 million, Trinity Capital (TRIN) at approx. 450 million, and PhenixFIN Capital (PFX) at approx. 73 million. In its recent earnings presentation filed with the SEC, Capital Southwest included a slide highlighting the economy of scale benefits that internal management has brought to its shareholders as the company and its investment portfolio have grown in size:

CDX3Investor.com

As regulated investment companies (“RICs”), Business Development Companies (“BDCs”) like those mentioned above have built-in investor protections including a limit on leverage, and investors in debt instruments issued by BDCs have pointed to favorable outcomes making it through the financial crisis (as far as BDCs meeting their debt obligations) as evidence for measuring the level of risk involved in investing in ETDs (and preferred stocks) issued by BDCs.

With a requirement to invest primarily in private companies in the United States, BDCs were created in 1980 by Congress to encourage the flow of public equity capital to private U.S. businesses. BDCs also have a structural requirement to distribute 90% of taxable income to shareholders, much like Real Estate Investment Trusts (REITs). Because of this earnings distribution requirement, BDCs generally cannot reinvest their regular earnings into portfolio growth and instead must rely on the equity and debt markets in order to raise new capital to fund growth in their portfolios. As a result, many BDCs routinely issue preferred stocks and exchange traded debt (ETD) securities (which are also known as “baby bonds”), such as GAINL discussed earlier.

Buying new shares for wholesale

Preferred stock IPOs often involve a temporary period during which OTC trading symbols are assigned until these securities move to their retail exchange, at which time they will receive their permanent symbols. But there is no need to wait. Individual investors, armed with a web browser and an online trading account, can often purchase newly introduced preferred stock shares at wholesale prices just like the big guys (see “Preferred Stock Buyers Change Tactics For Double-Digit Returns” for an explanation of how the OTC can be used to purchase shares for discounted prices).

For example the new Allstate preferred mentioned above, ALL-J, which now trades on the NYSE well above par in the $26.50 range, traded temporarily on the OTC as ALLJL, with a price of $25.24 at the time our “now trading alert” went out:

CDX3Investor.com

Those who have been following this strategy of using the wholesale OTC exchange to buy newly introduced shares for close to (and sometimes less than) $25 are more able to avoid a capital loss if prices drop (if they choose to sell).

Your broker will automatically update the trading symbols of any shares you purchase on the OTC, once they move to their permanent symbols. A special note regarding preferred stock trading symbols: Annoyingly, unlike common stock trading symbols, the format used by exchanges, brokers and other online quoting services for preferred stock symbols is not standardized.

For example, a given Series A preferred stock might have a symbol ending in “-A” at TDAmeritrade, Google Finance and several others but this same security may end in “PR.A” at E*Trade and “.PA” at Seeking Alpha. For a cross-reference table of how preferred stock symbols are denoted by sixteen popular brokers and other online quoting services, see “Preferred Stock Trading Symbol Cross-Reference Table.”

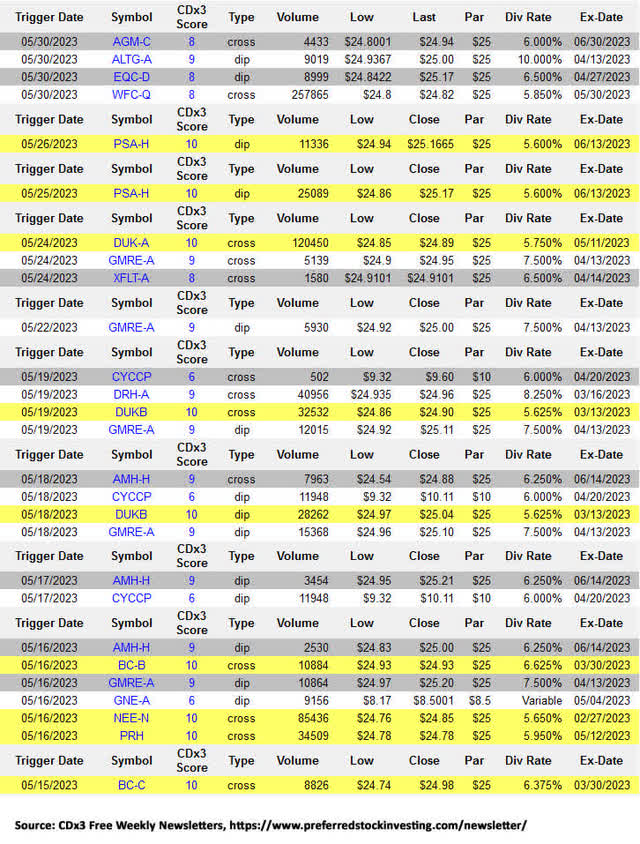

Past preferred stock IPOs below par

In addition to covering new preferred stock and ETD offerings, here at CDx3 Notification Service we also track past offerings, with alerts when securities fall below their par values. Here are some of the recent dips/crosses below par we observed:

CDX3Investor.com

Note: Any yellow highlighted entries indicate eligibility for the “CDx3 Bargain Table.”