iridi

Foreword

All but two equities and all but one of the funds listed in this May batch of monthly-paying dividend dogs live up to the ideal of paying annual dividends from a $1K investment exceeding their single share price. Here, in the MoPay collection, lie affordable (yet volatile and risky) bargains. The dogcatcher rule of thumb is: one metric ($1k invested income>1 share price) fits all!

Now, over three years past the 2020 Ides of March market dip, and before other pull-backs yet to come, the time to buy top yield MoPay dogs may be now.

To learn which of these 83 MoPay equities pay “safer” dividends, go to my dividend dogcatcher investing group lists after May 30th. Simply click on the last bullet point in the Summary section above.

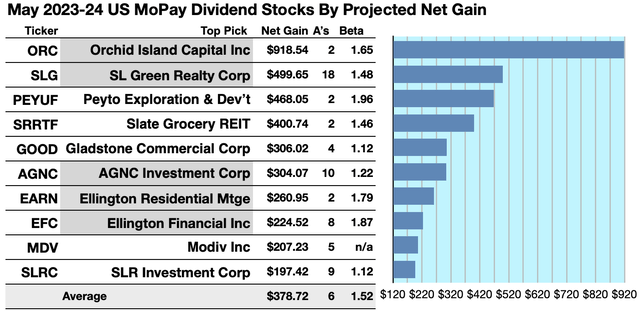

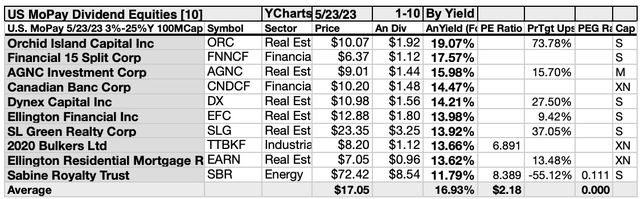

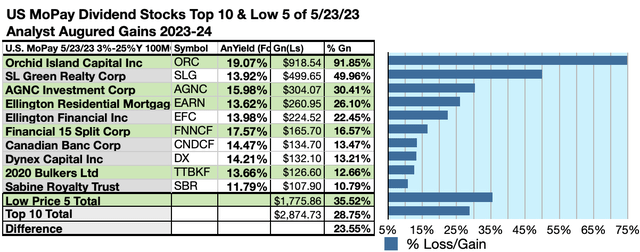

Actionable Conclusions (1-10): Brokers Estimated Top Ten MoPay Equities Could Net 19.74% to 91.85% Gains By May 2024

Five of ten top-yield MoPay stocks (shaded in the chart below) were verified as being among the top-ten gainers for the coming year based on analyst one-year target prices. Thus, the Dogcatcher yield-based strategy for this MoPay group, as graded by broker estimates this month, proved 50% accurate.

Estimated dividend payouts from $1000 invested in each of the ten highest-yielding stocks, plus analysts median 1yr target prices for those stocks, as reported by YCharts, produced the data points for the gains estimates below. (Note: target prices from lone analysts were not counted.) Ten probable profit-generating trades so identified to May, 2024 were:

source: YCharts

Orchid Island Capital, Inc. (ORC) netted $918.54 based on the median of target estimates from 2 analysts, plus estimated annual dividends less broker fees. The Beta number showed this estimate subject to risk/volatility 65% greater than the market as a whole.

SL Green Realty Corp. (SLG) netted $499.65 based on the median of target estimates from 18 analysts, plus estimated annual dividends less broker fees. The Beta number showed this estimate subject to risk/volatility 48% over the market as a whole.

Peyto Exploration & Development Corp. (OTCPK:PEYUF) was forecast to net $468.05 based on the median of target price estimates from 2 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 96% greater than the market as a whole.

Slate Grocery REIT (OTC:SRRTF) netted $400.74 based on the median of target price estimates from 2 analysts, plus Dividends less broker fees. The Beta number showed this estimate subject to risk/volatility 46% greater than the market as a whole.

Gladstone Commercial Corp (GOOD) netted $306.02 based on the median of target price estimates from 4 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 12% greater than the market as a whole.

AGNC Investment Corp. (AGNC) netted $304.07, based on the median of target price estimates from 10 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 22% greater than the market as a whole.

Ellington Residential Mortgage REIT (EARN) netted $260.95 based on the median of annual price estimates from 2 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 79% greater than the market as a whole.

Ellington Financial Inc. (EFC) netted $224.52 based on the median of target price estimates from 8 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 87% greater than the market as a whole.

Modiv Inc. (MDV) netted $207.23 based on the median of target price estimates from 5 analysts, plus dividends, less broker fees. A Beta number was not available for MDV.

SLR Investment Corp. (SLRC) netted $197.42 based on the median of target price estimates from 9 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 12% over the market as a whole.

Average net gain in dividend and price was 37.87% on $1k invested in each of these ten MoPay stocks. This gain estimate was subject to average risk/volatility 52% greater than the market as a whole.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More specifically, these are, in fact, best called “underdogs.”

May’s Monthly Pay Dividend Data

Three lists produce numerous actionable conclusions and several more un-numbered results. To draw these conclusions and results, May 23 closing prices and estimated annual dividends were referenced from YCharts. In the process, monthly pay equity (1) yield and (2) upside potential lists were compared and contrasted against (3) the high yield (and higher risk) MoPay CEICs/ETFs/ETNs list.

Monthly Pay Dividend Qualities

Quarterly, Semi-Annual and Annual dividend investors anxiously await announcements from a firm, fund, or brokerage to learn if their next dividend will be higher, lower, or paid at all.

Monthly pay stocks, funds, trusts, and partnerships inform the holder every four and one third weeks by check and/or statement. If the entity reduces or suspends a payment, the holder can sell out of the investment immediately to cut future losses.

This advantage has been curtailed when companies suddenly cut monthly dividends to save cash. Numerous prominent MoPay firms declared dividend cuts between May and June, 2020, including: Oxford Square Capital Corp; Partners Real Estate Investment Trust; Orchid Island Capital Inc; Cross Timbers Royalty Trust; H&R Real Estate Investment Trust; BTB Real Estate Investment Trust; American Finance Trust Inc; Mesa Royalty Trust; Solar Senior Capital Ltd; Ellington Financial Inc; Dividend Select 15 Corp; Chesswood Group Ltd; Sabine Royalty Trust; TORC Oil & Gas Ltd; Freehold Royalties Ltd; ARC Resources Ltd; Inter Pipeline Ltd; San Juan Basin Royalty Trust; Ag Growth International Inc.

Former MoPay top ten regular by yield Bluerock Residential Growth REIT, Inc. announced December 2019 it was retreating to quarterly dividend payments “in keeping with industry tradition.” That tradition continued with Armour Residential REIT and Stellus Capital Investment Corp both transitioned to QPay in June, 2020. Within three months, however, both SCM and ARR returned to MoPay mode.

Top yield stock for July, 2018, June 2021, and September 2021, Orchid Island Capital, released this cautionary note with its monthly dividend announcements back in 2018: “The Company has not established a minimum distribution payment level and is not assured of its ability to make distributions to stockholders in the future.” ORC directors proceeded to back-up their words with actions cutting the dividend from $0.14 to $0.11 in February, to $0.09 in March, to $0.08 in September, 2018, and to $0.055 for May, 2020. However in August. 2020 ORC monthly dividend increased from $0.06 to $0.065 for September, October, and into 2021. ORC currently pays a $0.16 monthly dividend and is again listed here.

The U.S. exchange MoPay segment is volatile, transitive, recovering, and has achieved and minnow recovering from full strength. More trades in monthly pay equities are available from Canadian firms, many of which are also listed on U.S. OTC (Pink Sheet) exchanges. Active listed MoPays priced over $2 were up from 71 in October to 73 in February 2021, and since October 2021 at the full strength of over 100 active, not seen for years. This list found itself pared to 83 by keeping the share price limit to $5 and not listing dividends yielding over 20% or under 3%.

List One:

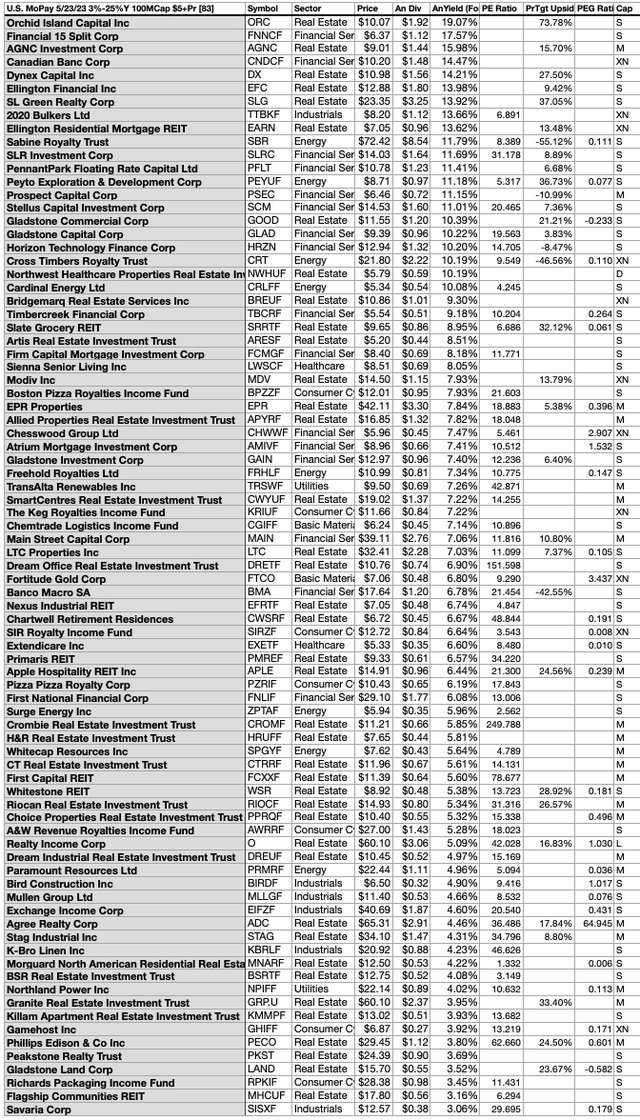

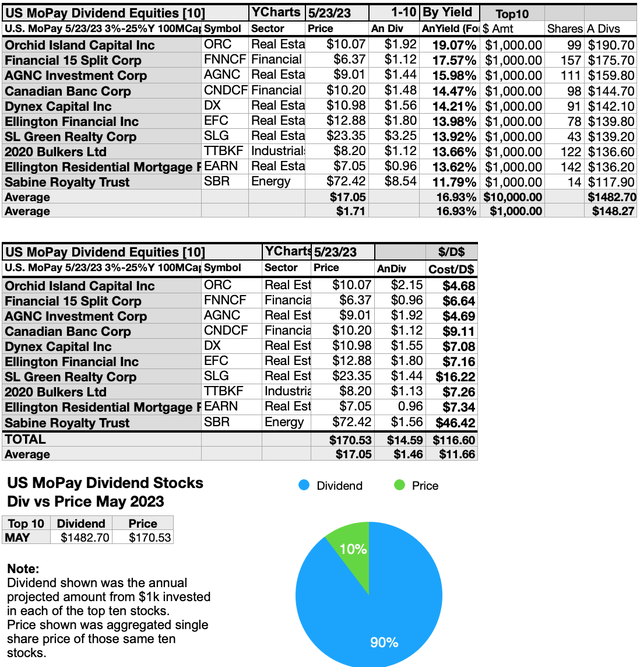

US Exchange Traded MoPay Dividend Equities by Yield

source: YCharts

Top ten of these US exchange listed monthly pay dividend equities showing the best yields for May, represented just four of the eleven Morningstar market sectors. Representative firms split 6, 2, 1, and 1 between the real estate, financial services, industrial, and energy, sectors.

First place went to the first of six real estate representatives: Orchid Island Capital [1]. The others placed third, fifth seventh, and eighth: AGNC Investment Corp [3]; Dynex Capital, Inc. (DX) [5]; Ellington Financial Inc [6]; SL Green Realty Corp [7]; Ellington Residential Mortgage REIT [8].

Second place went to the first of three financial services sector members, Financial 15 Split Corp (OTCPK:FNNCF) [2], and Canadian Bank Corp (OTCPK:CNDCF) [4] and SLR Investment Corp [10].

Finally, in seventh place, was the lone industrial, sector member, 2020 Bulkers Ltd. (OTCPK:TTBKF) [7], and ninth place went to lone energy missionary, Sabine Royalty Trust (SBR) [9], which completed the May MoPay top ten equities list by yield.

List Two:

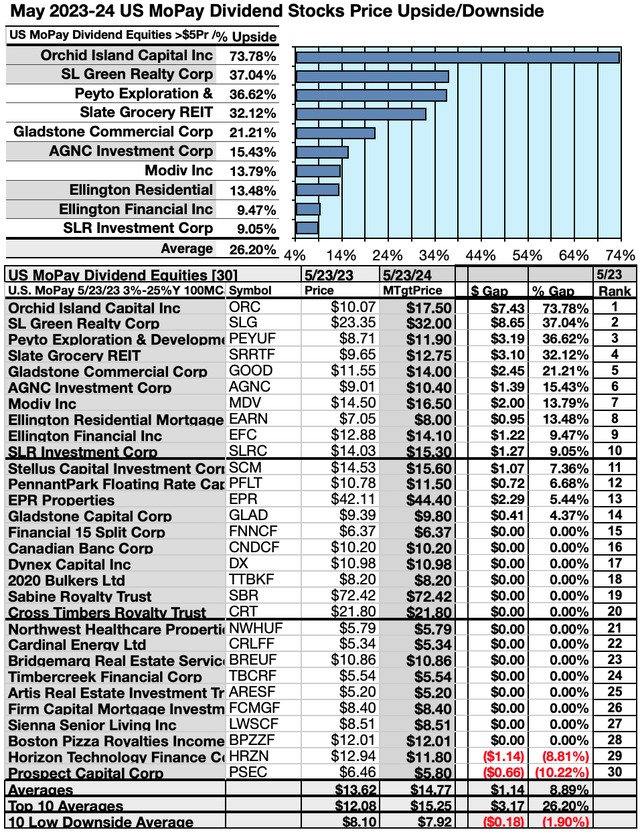

Monthly Pay Dividend Equities by Price Upsides (and Downsides)

Results from YCharts, shown below, show 30 MoPay dividend stocks (as of market closing price May 23) compared with the median of analyst target prices one year-out. The ten top-stocks displayed 9.05% to 73.78% price upsides for the next year based on analyst estimates.

source: YCharts

Four (tinted) of ten on this top ten price upside list were also members of the top ten list by yield. The first five places on this upside list went to: Orchid Island Capital Inc [1], SL Green Corp [2], Peyto Exploration & Development Corp [3], Slate Grocery REIT [4], and Gladstone Commercial Corp [5].

The lower level (by yield) five were, AGNC Investment Corp [6], Modiv Inc [7], Ellington Residential Mortgage REIT [8], Ellington Financial Inc [9], and SLR Investment Corp [10].

Price upside, of course, was defined as the difference between the current price and analyst target one-year median price targets for each stock.

Ten MoPay stocks showing the May 2024 were gleaned from 30 selected by yield. Three to nine analysts have historically provided the most accurate median target price estimates.

List Three:

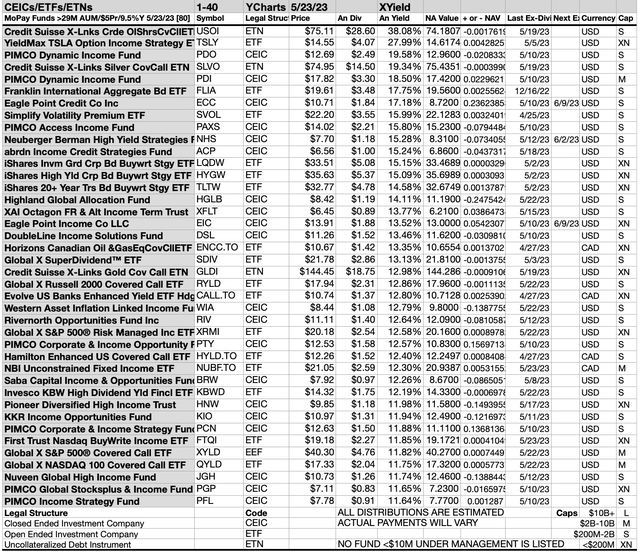

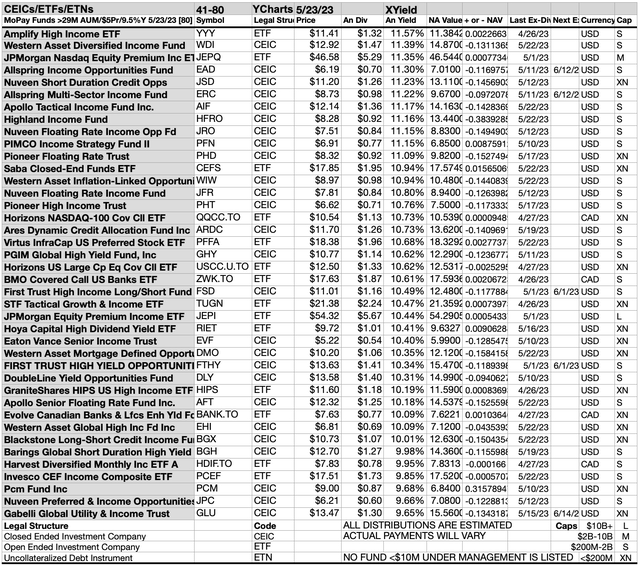

MoPay Dividend Closed End Investment Companies, Exchange Traded Funds, and Notes, by Yield

Eighty top monthly dividend paying Closed End Funds, Exchange Traded Funds and Notes listed below were culled from nearly 800 candidates. Yields of 15.28% or greater, calculated as of May 23, determined the top ten. All 80 show assets under management (AUM) greater than $10M and are priced above $5 per share.

source: YCharts source: YCharts

The top-ten monthly-paying dividend investment companies, funds, & notes. showing the biggest yields for per YChart & YahooFinance data, featured two uncollateralized debt instruments [ETNs], and three open-ended investment companies [ETFs], and five closed-ended investment company [CEICs].

source: YCharts

The two uncollateralized debt instrument companies (ETNs) placed first, and fourth: Credit Suisse X-Links Crude Oil Shares Covered Call ETN (USOI) [1], and Credit Suisse X-Links Silver Covered Call ETN (SLVO) [4].

Then three open ended investment companies [ETFs] placed second, sixth and eighth, YieldMax TSLA Option Income Strategy ETF (TSLY) [2], Franklin International Aggregate Bond Fund ETF (FLIA) [6], and Simplify Volatility Premium ETF (SVOL).

Finally, fiver closed end investment companies (CEICs) placed third, fifth, seventh, ninth, and tenth. They were: Eagle Point Credit Company Inc. (ECC) [7], PIMCO Dynamic Income Opportunities Fund (PDO) [3], PIMCO Dynamic Income Fund (PDI) [5], PIMCO Access Income Fund (PAXS)[9], and Neuberger Berman High Yield Strategies Fund (NHS) [10], to complete the top-ten Exchange Traded Notes, Exchange Traded Funds, and Closed End Investment Companies list for May, 2023-24.

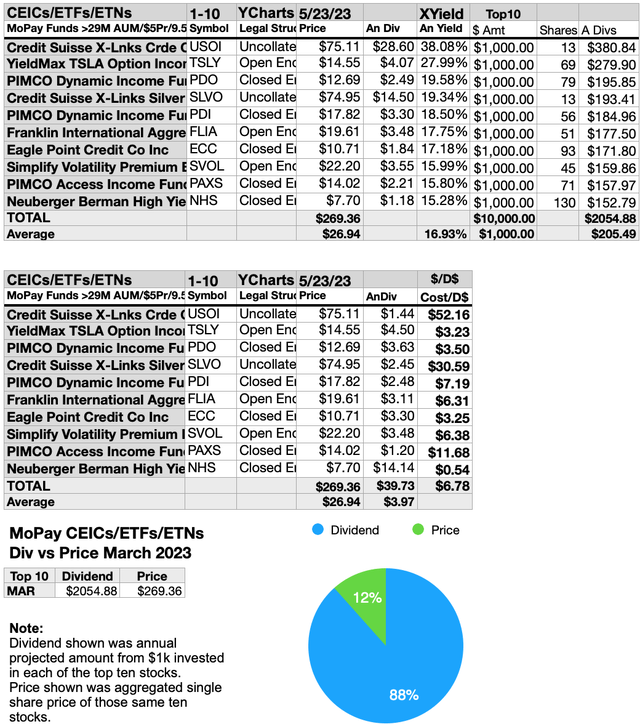

Compare Equity To Fund Performance

source: YCharts

Note that May 2023-24 top ten equity dividends are currently priced 2% under those of the top ten funds. Last September they were 2% higher. Last June they were 1% higher. The price differences were found in the outlandishly high dividends attributed to the top equities or funds. Without those odd aberrations, funds are generally priced higher than the equities due to the higher overhead costs of fund management.

Background and Actionable Conclusions

In June 2012 readers suggested the author include these funds, trusts, and partnerships in the MoPay article. A list of MoPay equities to buy and hold in September 2012 resulted from those reader suggestions supplemented with a high yield collection from here. That list was supplemented by an upside potential article in October and a upside vs. buy & hold in November. Another list factored December 2012 reader comments.

Now we have a new decade of 2020 that began in January, and continued to February, March, April, early May, and mid May, June, July, August, September, October, November, December. The progression continued in 2021 in January, February, March, April, May, June, July, August, September, October, November, and December. And carried-on in 2022, January, February, March, April, May, June/July, August, September, October, November, December, and again, in 2023, January, February, March, April and, now May, we compare and contrast MoPay equity upside potential to the yield (and higher risk/volatility) should one be tempted to buy and hold Closed End Investments or Exchange Traded Funds and Notes.

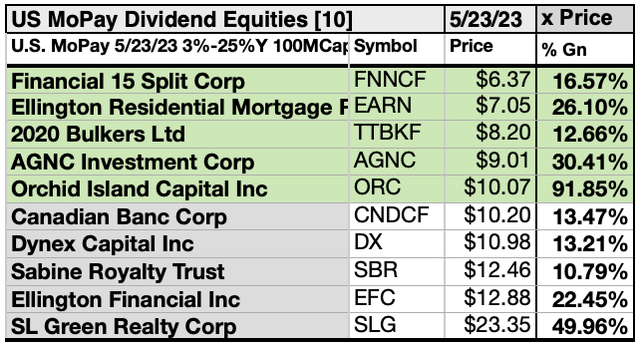

Yield Metrics Found A 23.55% Advantage For The Five Lowest-Priced Of Ten High-Yield MoPay Equities In May

source: YCharts

Ten monthly pay stock equities were ranked by yield. Those results, verified by YCharts and YahooFinance, produced the following charts.

Actionable Conclusions: Analysts Estimated 5 Lowest Priced of Top Ten High Yield MoPay Dividend Stocks (11) Would Produce 35.52% VS. (12) 28.75% Net Gains from All Ten by May, 2024

source: YCharts

$5000 invested as $1k in each of the five Lowest priced stocks in the top ten MoPay dividend dog kennel by yield were predicted by analyst 1 year targets to deliver 34.03% LESS net gain than $5,000 invested as $.5k in all ten. The eighth lowest-priced MoPay dividend dog, Orchid Island Capital, was predicted to deliver the best net gain of 75.07%.

source: YCharts

Lowest priced five MoPay dividend stocks estimated as of May 23 were: Financial 15 Split Corp; Ellington Residential Mortgage REIT; 2020 Bulkers Ltd; AGNC Investment Corp; Orchid Island Capital Inc, with prices ranging from $6.37 to $10.07.

Higher priced five MoPay dividend equities, estimated as of May 23, were: Canadian Banc Corp; Dynex Capital Inc; Sabine Royalty Trust; Ellington Financial Inc; SL Green Realty Corp, whose prices ranged from $10.20 to $23.35.

This distinction between five low-priced dividend dogs and the general field of ten reflects the “basic method” Michael B. O’Higgins employed for beating the Dow. The same technique, you now see, is today useful to find rewarding dogs in the MoPay kennel.

The added scale of projected gains, based on analyst targets, contributed a unique element of “market sentiment” gauging upside potential. It provided a here and now equivalent of waiting a year to find out what might happen in the market. It is also the work analysts got paid big bucks to do.

Caution is advised, however, as analysts are historically 15% to 85% accurate on the direction of change and about 0% to 15% accurate on the degree of the change.

Gains/declines as reported do not factor-in any tax problems resulting from dividend, profit, or return of capital distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Afterword

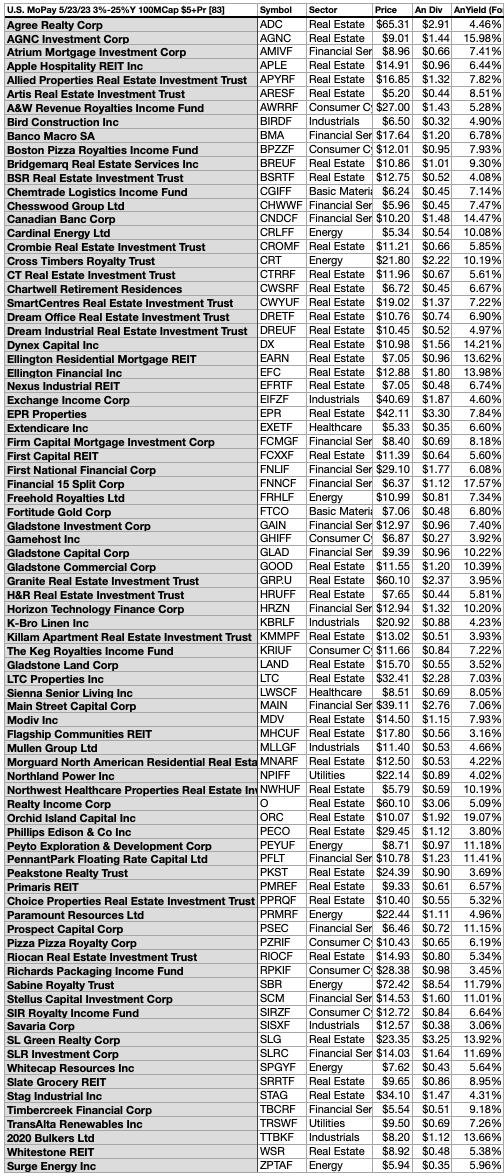

If somehow you missed the suggestion of the stocks ripe for picking at the start of this article, here is a reprise of the list at the end:

May MoPay Equities List

(Alphabetical by Ticker Symbol)

source: YCharts

All but two equities and all but one of the funds listed in this May collection of monthly-paying dividend dogs live up to the ideal of annual dividends from $1K invested exceeding their single share price. Here in the MoPay collection lie affordable yet volatile and risky bargains.

Well over three years beyond the 2020 Ides of March dip, and before other pull-backs yet to come, the time to buy top yield MoPay dogs may be now. There have been more to choose from. This month’s list of 83 held the maximum yield to under 26% , setting the minimum price per share for selection at $5, and holding the minimum yields to 3%, nevertheless May was down six from April. When bulls are back, bargains disappear.

Stocks listed above were suggested only as decent starting points for your MoPay dividend stock purchase or sale research process. These were not recommendations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.