Kateryna Mashkevych/iStock via Getty Images

Introduction

I like the risk/reward ratio offered by the preferred shares of Gladstone Land (NASDAQ:LAND). As they rank senior to the common shares, the preferred dividends are safer and although the potential for capital gains is lower (and will depend on the REIT’s creditworthiness and the interest rates on the financial markets), they are a good fit for the part of my portfolio focusing on a reliable income stream. In a previous article published in March I focused on the Series B preferred shares but recently my attention has shifted towards the D-Series which have a ‘soft mandatory’ call date in 2026. If Gladstone doesn’t call that specific series, the preferred dividend yield will increase to 8% on the principal.

Seeking Alpha

Following up on Gladstone Land’s Q1 performance

In this article I will mainly focus on the REIT’s performance in the first quarter of this year and what the somewhat soft results mean for the preferred shareholders. For a better understanding of Gladstone’s business model and operational details, I’d like to refer you to my older article.

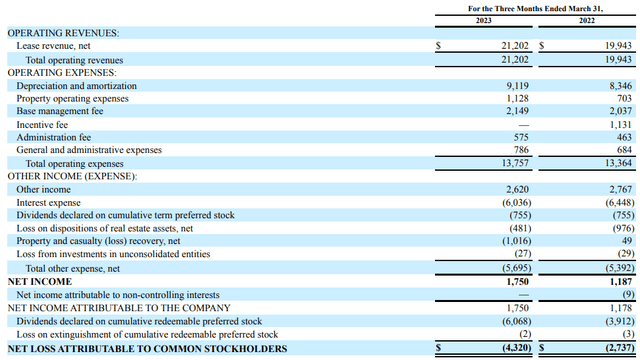

Although the FFO, Core FFO and Adjusted FFO are the most important metrics to look at, the starting point for those results is actually the net income so it makes sense to start with Gladstone Land’s income statement.

The REIT reported a total rental income (‘lease revenue’) of $21.2M and operating expenses of $13.8M. The majority of those expenses are depreciation and amortization expenses but let’s also not forget the base management fee increased to $2.15M. The operating income of Gladstone land thus came in at approximately $7.5M (an increase from $6.6M in Q1 2022 but during that quarter there was a non-recurring $1.1M incentive fee payable to the external manager of the REIT).

Gladstone Land Investor Relations

The net interest expenses decreased and this resulted in an increase of in excess of 50% of the net income, which jumped to $1.75M. From that amount we still have to deduct the $6.1M in preferred dividend payments on top of the $755,000 that’s included in the net finance expenses, and this means the REIT’s net income attributable to the common shareholders was a negative $4.3M.

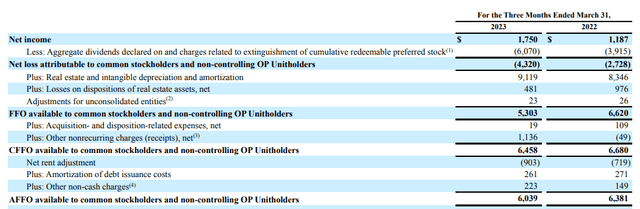

Sounds bad but keep in mind US REITs need to depreciate the real estate assets (which is not the case in most other jurisdictions) and that’s why it’s more important to have a look at the FFO and AFFO calculation.

As you can see below, the starting point is the $4.32M net loss and the $9.1M in depreciation expenses as well as the $0.5M loss on the sale of an asset are added back to the equation. This results in an FFO of $5.3M and after adding back the $1.15M in non-recurring items, the core FFO was $6.45M.

Gladstone Land Investor Relations

The AFFO was slightly lower at $6.04M which means the FFO, Core FFO and AFFO per share came in at respectively $0.15, $0.18 and $0.17. Sufficient to cover the $0.14 distribution that has been paid during the quarter but definitely lower than the results in the first quarter of last year. The company isn’t being coy and confirms it is still working through some issues with some of its tenants so hopefully it can improve its situation soon.

But based on the Q1 AFFO of $6.04M which includes about $6.8M in preferred dividends (including the $0.75M of preferred dividends that are included in the finance expenses) the coverage ratio is about 190%. That’s not spectacularly high, but it does the trick.

I focused on LANDO in the previous article, but now LANDM is getting interesting as well

In my March article I focused on (LANDO), one of the two series of preferred shares that are currently outstanding. The investment thesis was pretty simple: the preferred dividends were well-covered and as LANDO paid a monthly dividend of $0.125 per preferred share, the yield came in at 6.8% which was a pretty good risk/reward ratio. The share price has recovered a bit and the yield is currently approximately 6.6% which is obviously still fine, but at this point I’m also getting increasingly interested in the Series D preferred shares issued by Gladstone Land.

That series is trading with (NASDAQ:LANDM) as its ticker symbol and while the preferred dividend is lower ($1.25 per year for a preferred yield of 5% based on the principal), there is an interesting kicker here. This preferred share has to be redeemed by Gladstone Land by January 31, 2026, so just over 2.5 years from now. Should Gladstone Land fail to call these preferred shares, the preferred dividend will increase to $2/share per year.

This means we should really look at this series using the ‘yield to call’ calculation as we can assume the preferred shares will be called. LANDM last traded at $23.30 (May 19, 2023) which means the yield to maturity is almost 7.9% (consisting of the 5% preferred dividend yield as well as the 7.3% capital gain which will be realized over the next 32 months.

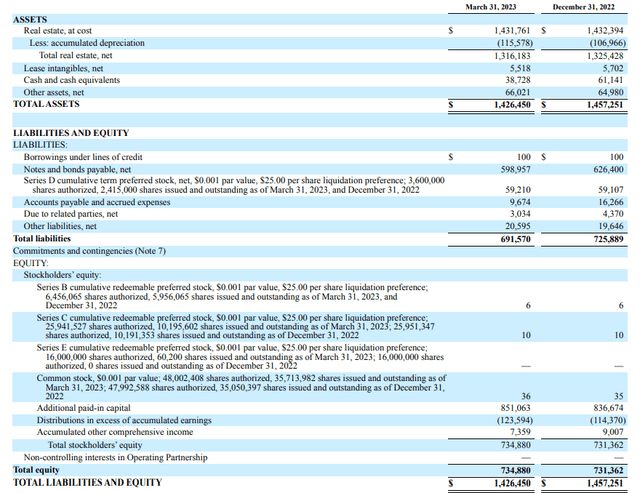

And because there is a mandatory redemption date, the LANDM securities are included in the liabilities and not in the equity portion of the balance sheet. This means that in theory, the entire $735M in equity ranks junior to the D-Series of the preferred shares making these mandatory callable preferred shares very interesting, especially considering the yield to call. There’s only $560M of net financial debt more senior to the LANDM securities (assuming a normal business scenario and not a liquidation scenario), which is offset bay about $1.32B in assets (including in excess of $115M in accumulated depreciation while the fair value has been estimated at $1.6B).

Gladstone Land Investor Relations

Investment thesis

I really like Gladstone Land’s preferred equity and I think the LANDM securities offer an interesting value proposition. Either Gladstone Land calls these securities in 2026 resulting in a yield to call of in excess of 7.5%, or the securities remain outstanding while the annual preferred dividend increases to $2 per preferred share. And based on the current share price of $23.30, the yield based on the current price would then increase to in excess of 8.5% while the risk hasn’t increased (other than Gladstone Land looking bad for not redeeming preferred equity with a mandatory redeem date).

I currently have no position in LANDM but I will likely initiate a long position soon. I may also consider going long on LANDO but at this moment I have a preference for LANDM thanks to the mandatory call feature in 2026.